Small Business Loan Options for Equipment & Vehicles: What to Know

November 03, 2025 | Last Updated on: November 03, 2025

In this article:

- Explore small business loan options for equipment and machinery.

- Understand eligibility requirements for different small business financing options, from credit approval and annual revenue to time in business requirements.

- Learn the advantages and disadvantages of different financing options for small business.

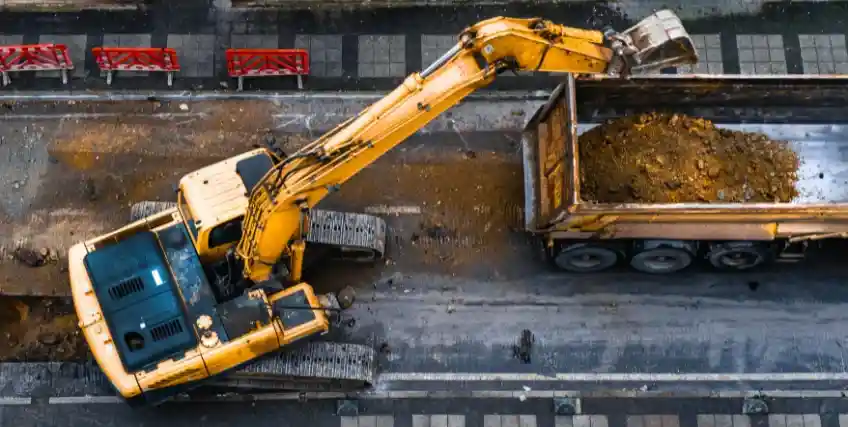

For many small businesses, assets like machinery, specialized tools, commercial ovens, or vehicles are essential to business operations. But heavy-duty equipment tends to be expensive, and purchasing it outright can put a serious strain on your cash flow. That’s where business lending comes in.

The right financing solutions are essential for business funding, and there are a variety of small business loan options specifically tailored for equipment and machinery acquisition. This guide breaks down key small business financing options, including equipment financing and SBA loans, to help you compare the advantages and disadvantages of each.

1. Equipment Financing

Equipment financing is typically the most direct and common way to buy or lease hard assets. These loans are offered by banks, credit unions, and online lenders and are usually structured around the asset itself.

With an equipment loan, the lender provides capital to purchase a specific piece of tool, which serves as collateral for the loan. If you default on the loan, the lender can repossess the equipment and resell it, thereby minimizing their risk. The self-securing nature makes equipment financing one of the most accessible small business loan options for asset purchase.

You can use equipment financing on a variety of assets, including:

- Vehicles: Trucks, delivery vans, and specialized vehicles like catering trucks or mobile grooming vans.

- Machinery: Manufacturing tools, construction equipment, and specialized industry machinery.

- Technology: Commercial-grade servers, printing presses, and medical equipment.

You repay an equipment loan with monthly payments that are determined by your interest rate and loan terms. These will vary depending on a small business owner’s personal credit score, business creditworthiness (if applicable), annual revenue, and other financial information. Equipment loans often require a down payment, although 100% financing is sometimes available for strong borrowers.

Pros:

- Fast funding decisions

- High approval rate and simple application process Requires less upfront capital than other types of loans due to the collateralized nature

- Preserves working capital

Cons:

- Shorter repayment terms than some other small business loan options

- Higher monthly payments due to the shorter terms

2. SBA Loans

The U.S. Small Business Administration (SBA) works with partner lenders to partially guarantee loan amounts. That guarantee helps reduce the risk to lenders. SBA loans are often considered strong small business financing options because they can offer competitive rates and longer repayment terms to qualified applicants.

Two SBA loan programs in particular, are suitable for equipment and machinery purchases:

- SBA 7(a) loan: The SBA’s most versatile program, it can be used for many business purposes, including buying equipment, certain commercial vehicles, and covering working capital needs.

- SBA 504 loan: Specifically designed for major assets, including heavy machinery and long-term equipment, as well as commercial real estate, the 504 program provides fixed-rate, long-term financing.

For businesses that do not qualify for traditional bank loans, SBA loans can offer competitive rates and lower down payment requirements. However, they can be harder to qualify for if you have bad credit or if you’re looking to get funds quickly. The competitive rates come at the cost of a long and rigorous application process, that will vet your business plan, assets, financial profile, and require a personal guarantee.

Pros:

- Usually, the lowest borrowing cost of small business loan options

- SBA loan options tend to have the longest terms, even for smaller loans like microloans

- Versatile enough to use on both equipment and other business needs

Cons:

- Very slow approval process that can take weeks or even months

- Stringent eligibility requirements, including a high credit score, low existing debt, and strong financials

3. Business Lines of Credit

A business line of credit can be a cost-effective funding source for smaller, recurring equipment needs. With a revolving credit line, you’re approved up to a maximum loan amount that you can withdraw from as needed, repay, and draw again. You only pay interest on the amount you withdraw, making a line of credit one of the most flexible small business loan options.

You can use a line of credit for:

- Minor upgrades: Purchasing computers, small tools, or accessories.

- Vehicle maintenance: Unexpected major repairs on existing commercial vehicles.

- Down payments: Covering the required down payment for a larger SBA or equipment loan.

- Bridging finance: Covering a necessary expense while waiting for a large loan to finalize.

Lines of credit are very flexible and cost-effective if you use them sparingly, but interest rates tend to be high, even compared to short-term loans. They may be subject to draw fees or annual maintenance fees that add to the total cost of borrowing, but you can usually qualify quickly with an online application, making them useful for startup businesses or business owners with bad credit.

Pros:

- Funds can be accessed in your business banking account quickly after the credit line is established

- Only pay interest on what you use

- Easier to qualify for than other small business loan options

Cons:

- High interest rates, in line with business credit cards

- Limits are too low for major equipment purchases

- Can become expensive if you carry the debt for a long time

Online Lenders

For businesses that can’t wait the months required for an SBA loan or lack the strong credit profile needed by traditional banks, online lenders offer small business loan options that prioritize speed and accessibility.

Online lenders offer a variety of small business loan options that can be used for equipment, including specialized equipment loans, term loans, and lines of credit. These lenders often have a faster underwriting process that takes a company’s business plan, cash flow, and financial projections into account more than past performance. As such, they can often move capital into your bank account or process equipment loans faster than traditional financial institutions. That typically comes at the cost of shorter repayment terms, higher interest rates, and potentially higher origination fees or prepayment fees than traditional short business loan options.

Pros:

- Fast credit decision times

- More relaxed credit and collateral requirements

- Flexible small business loan options to suit your business needs

Cons:

- Higher borrowing cost

- Short repayment terms

How to Choose the Right Small Business Loan Option for Equipment

Choosing the right small business loan option for equipment comes down to three factors: time, cost, and term.

If you don’t need the equipment or machinery for a few months and you have excellent credit, an SBA loan is a good option among all small business loan options. The lower interest rate and long repayment term could yield the lowest monthly payment and the least amount of total interest paid, maximizing your long-term profitability and return on investment on your equipment purchase.

If you need a new asset within a few weeks and the item is easily collateralized, equipment financing is a viable option. The interest rate will likely be higher than an SBA loan, but the speed and security of a collateralized loan can make the higher interest worth it, especially if you can start using the equipment to generate revenue quickly.

In either instance, traditional term loans or lines of credit can be a good small business loan option if you have strong credit, annual revenue, and a few years in business. Online lenders may offer viable funding solutions if your application isn’t as strong.

Final Thoughts

Ultimately, any decision regarding small business loan options for equipment and vehicle purchases must align the repayment schedule with the asset’s ability to generate revenue. The low-cost, long-term stability of government-backed financing will generally be your best option, but more flexible and accessible solutions like equipment financing and lines of credit can also be very useful. Just make sure that any loan you get doesn’t leave you still paying for the asset after it has outlived its use to your business. Any piece of equipment should drive growth, not restrict it.

FAQs About Small Business Loan Options

1. What is the difference between an equipment loan and an equipment lease?

An equipment loan means you own the asset from day one, and the lender holds a lien against it. An equipment lease is essentially a long-term rental. You make payments and may have the option to buy the asset at the end of the term for its residual value.

2. Can I get 100% financing for a commercial vehicle?

Some lenders may offer 100% financing for qualified borrowers with strong credit and financials.. However, to secure the lowest interest rate, you’ll usually have to provide a down payment.

3. Does the age of the equipment affect financing options?

Lenders may prefer to finance new or lightly used equipment because it maintains a higher resale value, making it better collateral. Financing for used or older equipment is available through specific small business loan options, but the interest rates will be significantly higher due to the increased risk of breakdown and rapid depreciation.

4. What is the biggest advantage of using an SBA loan for equipment?

One of the biggest advantage is the long repayment term coupled with low interest rates. With SBA loans, you’ll likely have the smallest monthly payment of any small business loan option, freeing up more cash flow for other parts of your business.

5. What collateral is needed for equipment financing?

Usually, the equipment or vehicle being purchased serves as the collateral for the loan. The lender places a lien on the asset and can repossess it if you fail to repay the loan.

Frequent searches leading to this page

Term Loans are made by Itria Ventures LLC or Cross River Bank, Member FDIC. This is not a deposit product. California residents: Itria Ventures LLC is licensed by the Department of Financial Protection and Innovation. Loans are made or arranged pursuant to California Financing Law License # 60DBO-35839