Biz2Credit Small Business Earnings Report™

About the Report

Biz2Credit Small Business Earnings Report examines the financial performance of businesses that applied for credit from Biz2Credit.

The study looks at the performance of small to mid-sized firms -- from early stage to established companies in the U.S. that applied for funding. It's intended to provide a snapshot of the financial health of businesses nationwide across a wide range of industries.

Key Findings

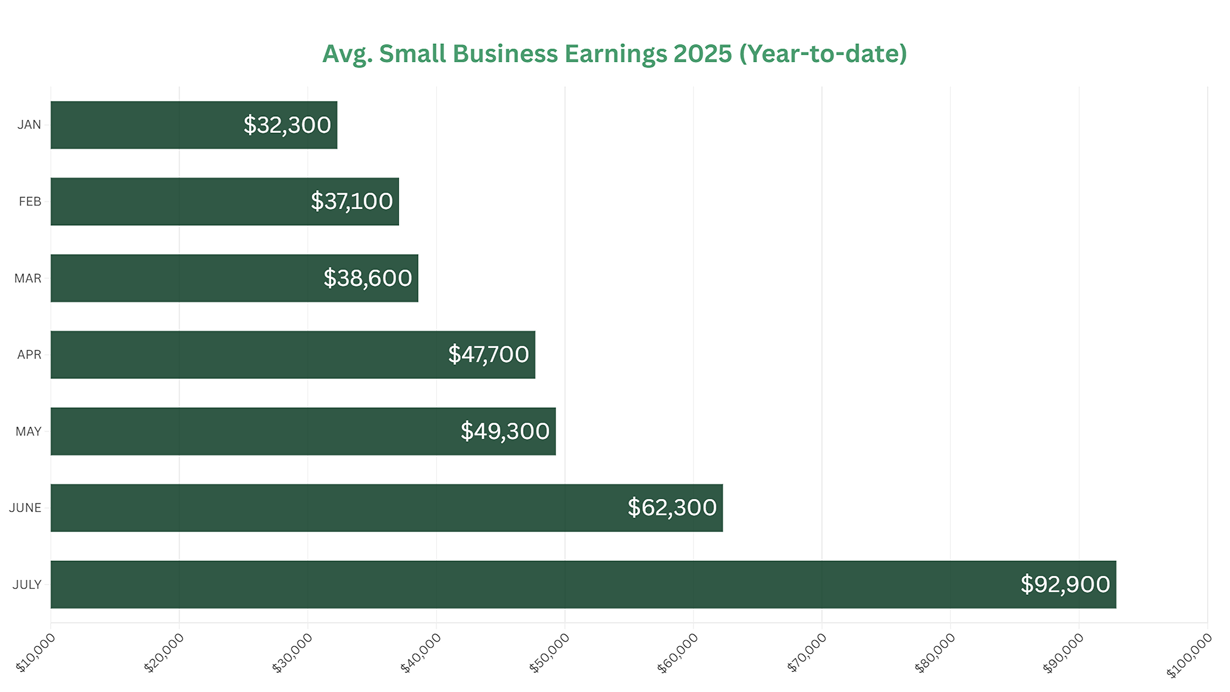

July 2025 were $92,900

(up by 49% from June).

July 2025 was $643,300

(up by 4.7% from June).

July 2025 were $550,400

(Down <1% from June).

Inflation ticked upward to 2.7% in July, an increase of 0.2%.

average earnings are up by 188%.

average earnings are down by 32%.

2025 Small Business Performance & Key Takeaways

Small businesses continue to navigate economic uncertainty with precision. Revenues climb upward, and expenses have flattened month-over-month (could be attributed to previous imports to avoid tariff-related duties), leading to climbing profits for operators. Since the beginning of the year, earnings are up a whopping 188%. However, compared to July 2024, earnings remain down 32%.

In the remaining four months of 2025, tariff concerns continue to loom, along with adjusting to new tax policy from the Big Beautiful Bill signed into law last month, and finding quality job applicants.

Methodology

Biz2Credit pulled over 100,000 complete financing applications submitted between January 2022 and July 2025. This report examines a number of variables including annual revenue, operating expenses, age of business, credit score, approval rate, and funding rate.

Term Loans are made by Itria Ventures LLC or Cross River Bank, Member FDIC. This is not a deposit product. California residents: Itria Ventures LLC is licensed by the Department of Financial Protection and Innovation. Loans are made or arranged pursuant to California Financing Law License # 60DBO-35839