Biz2Credit Small Business Earnings Report™

About the Report

Biz2Credit Small Business Earnings Report examines the financial performance of businesses that applied for

credit from Biz2Credit.

The study looks at the performance of small to mid-sized firms -- from early

stage to established companies in the U.S. that applied for funding. It's intended to provide a snapshot of

the financial health of businesses nationwide across a wide range of industries.

Key Findings

Small Business Earnings Report

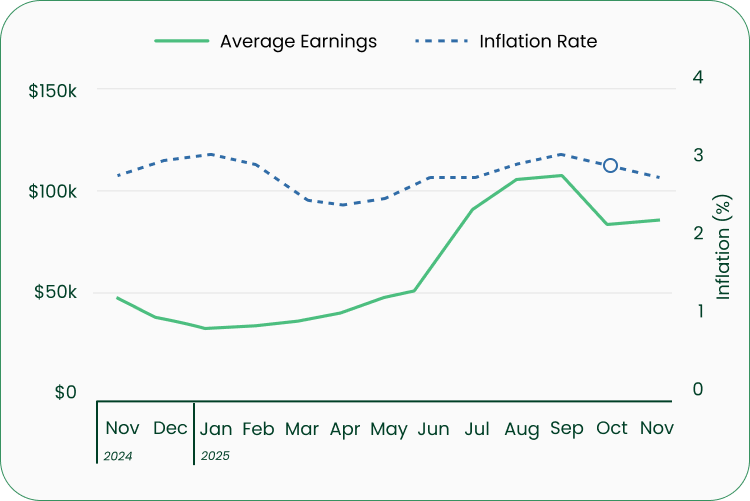

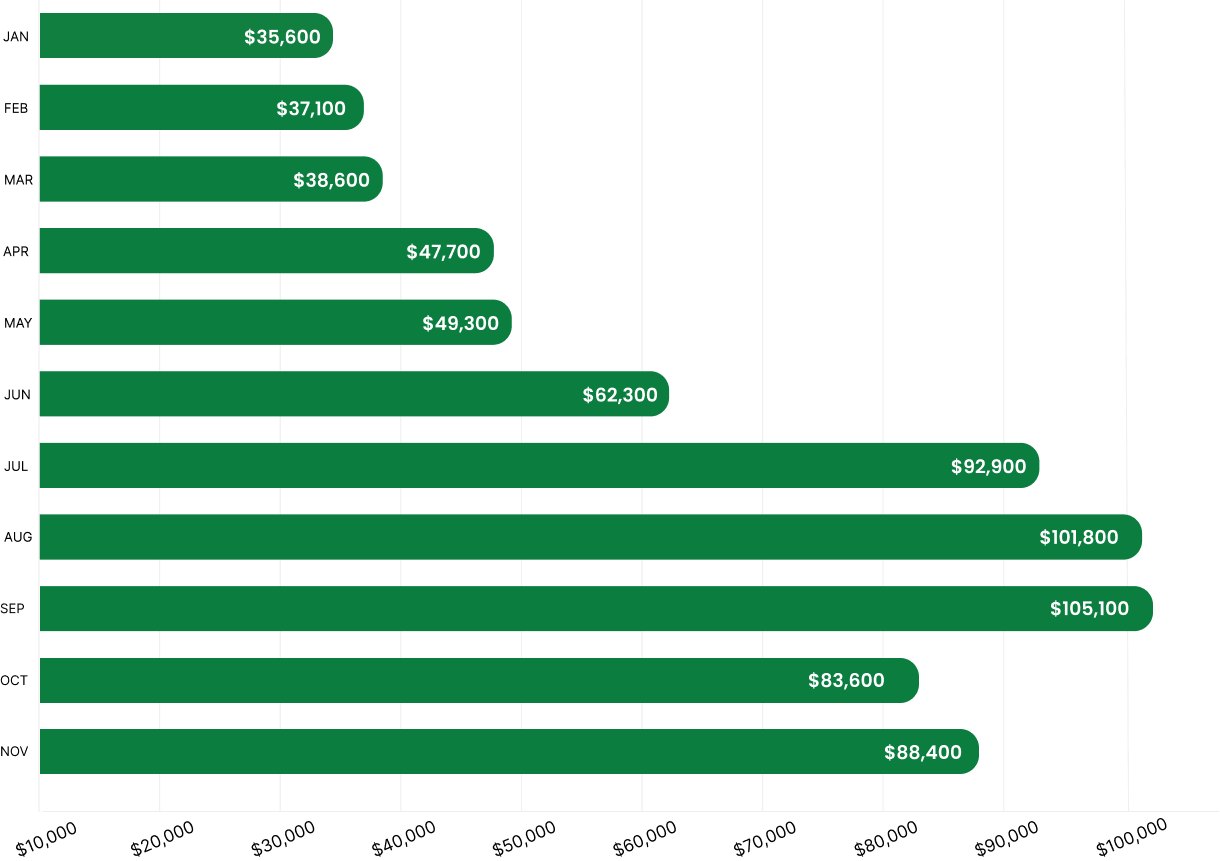

Small business in the U.S., driven by the start of the holiday shopping season, saw their average earnings tick up $4,800 to $88,400, after a slight dip in October.

The average earnings of small businesses jumped 80% from November 2024 and 148% since the beginning of the year, showing the resilience of consumer spending despite rising prices, continuous bumps to inflation and a persistently high interest rate environment.

Avg. Small Business Earnings 2025

(Year-to-date)

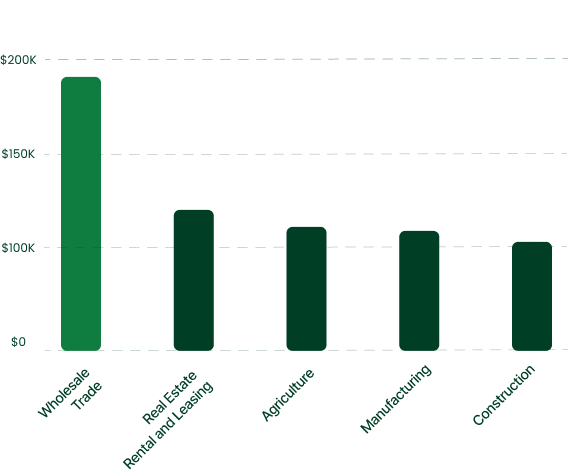

Top 5 Industries by Average Earnings

The average earnings in the wholesale trade sector continues to be propelled by consumers’ continued preference for e-commerce transactions.

The real estate rental and leasing sector also saw strong earnings, as average rental prices continued to decrease and demand grew.

The agriculture industry showed strong earnings attributed mainly to a U.S.-China trade pact in November that lowered or eliminated some tariffs on crops and a sharp rise in crop prices.

Small manufacturing businesses showed strong average earnings in November, despite the fact that the manufacturing industry as a whole slightly contracted .

Takeaways

Any way you slice it, the health of many small businesses in the U.S. hinges upon how much consumers are willing to shell out during the holiday season. Meanwhile, ongoing economic uncertainty will follow small businesses into the new year. Anxiety still looms regarding inflation and the ever-changing tariff policies of the U.S. Economists are also awaiting a decision by the U.S. Supreme Court on whether many of the Trump Administration’s tariffs are legal. They are also hopeful that the Federal Reserve board will continue cutting the overnight rate after pausing last month due to the government shutdown. 2026 should be interesting.

Methodology

Biz2Credit pulled over 100,000 complete financing applications submitted between November 2022 and November 2025. This report examines a number of variables including annual revenue, operating expenses, age of business, credit score, approval rate, and funding rate.

Other Reports

Top 25 Cities for Small Business Annual Report

Biz2Credit's Top 25 Cities for Small Business Study is an annual review of the financial performance of small businesses in the United States. The study reviews tens of thousands of credit inquiries and applications from small to mid-sized businesses across the country for the full prior year (2024). Results from the study deliver insight on the performance of small businesses over the past 12 months.

Annual Women-Owned Business Study 2025

Building strong business credit is essential for the growth and stability of any small business. Good business credit can help secure better...

Annual Latino-Owned Business Study 2025

Biz2Credit, a leading online funding provider to small businesses, analyzed the financial performance of over 138,000 companies, including more than 18,000 Latino-owned firms, that submitted funding requests through the company's online funding platform. The report covered small businesses across the country, from start-ups to established companies, from July 1, 2024 to June 30, 2025.

Term Loans are made by Itria Ventures LLC or Cross River Bank, Member FDIC. This is not a deposit product. California residents: Itria Ventures LLC is licensed by the Department of Financial Protection and Innovation. Loans are made or arranged pursuant to California Financing Law License # 60DBO-35839