End of Year Recap

Biz2Credit Small Business Earnings Report™

About the Report

Biz2Credit Small Business Earnings Report examines the financial performance of businesses that applied for

credit from Biz2Credit.

The study looks at the performance of small to mid-sized firms -- from early

stage to established companies in the U.S. that applied for funding. It's intended to provide a snapshot of

the financial health of businesses nationwide across a wide range of industries.

Small Business Earnings Report

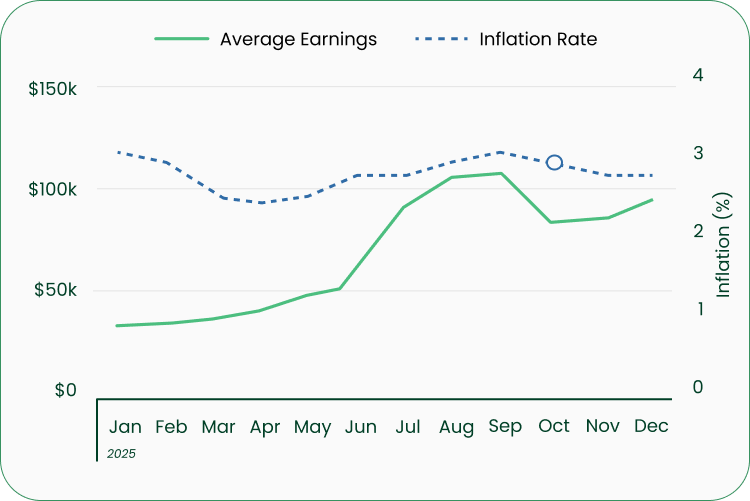

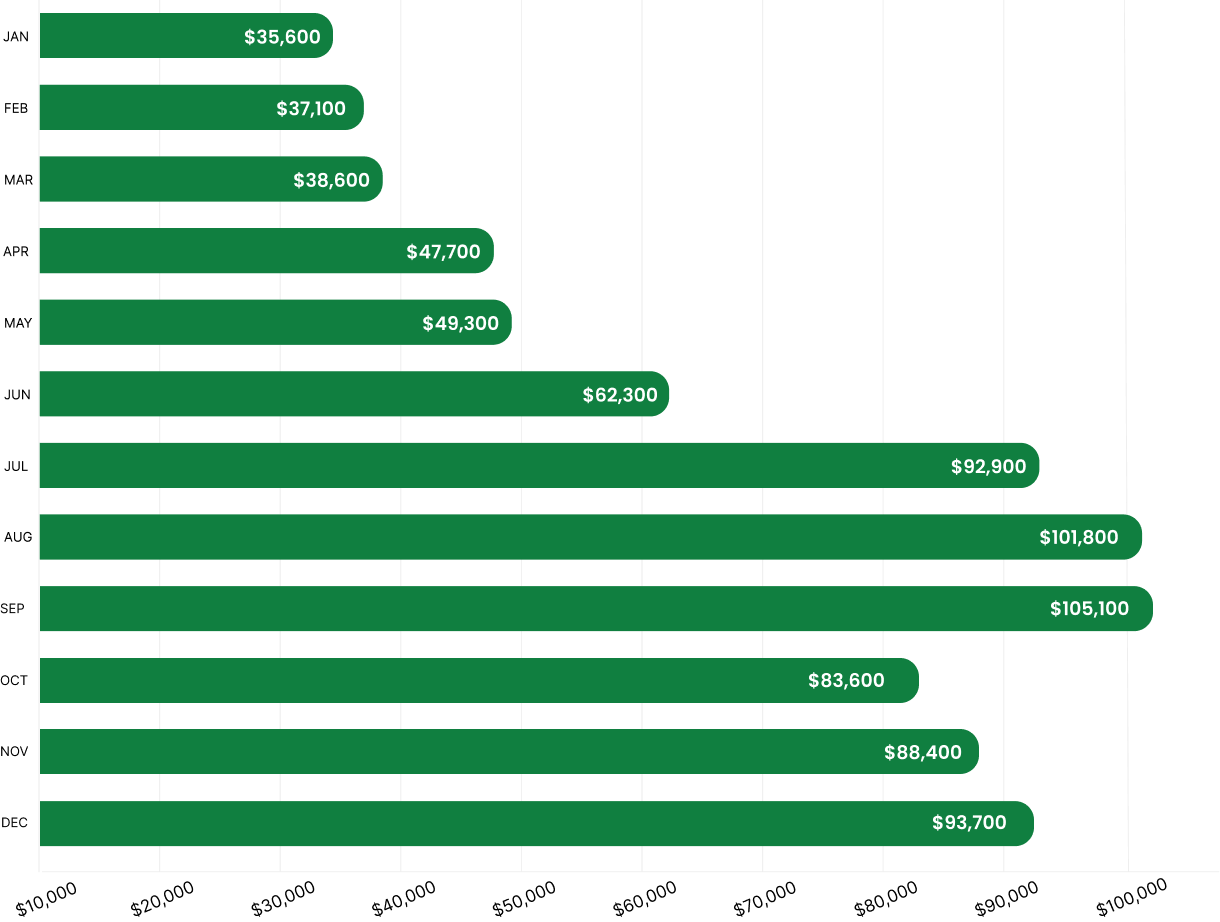

The average earnings for small businesses was $69,675 in 2025, down 16% from 2024. In December it was up by $5,300 to $93,700 compared to November 2025, due in part to holiday shopping.

Despite strong earnings in the summer months, rising inflation, general wage stagnation and increasing jobless numbers caught up to small businesses in the second half of the year. Consumers were driven to concentrate their spending on essential items rather than luxury goods and services that many small businesses specialize in.

December 2025

2025 Insights

(down by 16% from 2024).

(down by 15% from 2024).

(down by 15% from 2024).

Avg. Small Business Earnings 2025

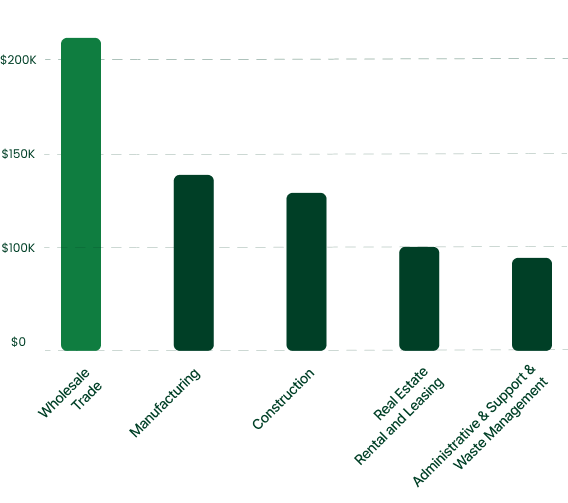

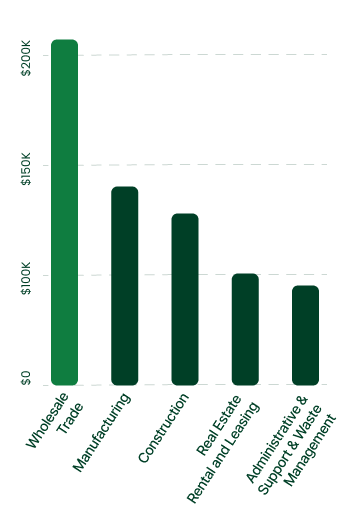

Top 5 Industries by Average Earnings

The wholesale trade continued to lead all sectors in growth. The movement of goods in bulk was driven in large part by the rising popularity of eCommerce and consumers seeking to buy products in bulk discounts.

Manufacturing was second, driven by manufacturers continued adaptation to AI to modernize inventory management and interest rate cuts that encouraged growth.

Construction continued to be a strong sector, as the need for new infrastructure overcame rising costs and a persistent shortage of skilled workers.

Takeaways

Research from Visa and Mastercard showed that consumers were still willing to shell out money during the season, as holiday spending in the U.S. rose 4% in 2025 compared to 2024. However, a separate report from McKinsey & Co. revealed that U.S. consumers approached the holiday season with a more pragmatic attitude than in years past, searching for sales and discounts more easily offered by large retailers. This could have hurt small businesses who simply can’t compete with large competitors on pricing.

Small businesses may want to view 2026 with cautious optimism. While the average year-over-year earnings decreased in 2025, lowered interest rates, strong GDP growth and strengthening labor conditions could present appealing growth opportunities and loosening lending requirements.

Methodology

Biz2Credit pulled over 100,000 complete financing applications submitted between January 2023 and December 2025. This report examines a number of variables including annual revenue, operating expenses, age of business, credit score, approval rate, and funding rate.

Other Reports

Top 25 Cities for Small Business Annual Report

Biz2Credit's Top 25 Cities for Small Business Study is an annual review of the financial performance of small businesses in the United States. The study reviews tens of thousands of credit inquiries and applications from small to mid-sized businesses across the country for the full prior year (2024). Results from the study deliver insight on the performance of small businesses over the past 12 months.

Annual Women-Owned Business Study 2025

Building strong business credit is essential for the growth and stability of any small business. Good business credit can help secure better...

Annual Latino-Owned Business Study 2025

Biz2Credit, a leading online funding provider to small businesses, analyzed the financial performance of over 138,000 companies, including more than 18,000 Latino-owned firms, that submitted funding requests through the company's online funding platform. The report covered small businesses across the country, from start-ups to established companies, from July 1, 2024 to June 30, 2025.

Term Loans are made by Itria Ventures LLC or Cross River Bank, Member FDIC. This is not a deposit product. California residents: Itria Ventures LLC is licensed by the Department of Financial Protection and Innovation. Loans are made or arranged pursuant to California Financing Law License # 60DBO-35839