Biz2Credit Small Business Earnings Report™

About the Report

Biz2Credit Small Business Earnings Report examines the financial performance of businesses that applied for credit from Biz2Credit.

The study looks at the performance of small to mid-sized firms -- from early stage to established companies in the U.S. that applied for funding. It's intended to provide a snapshot of the financial health of businesses nationwide across a wide range of industries.

Key Findings

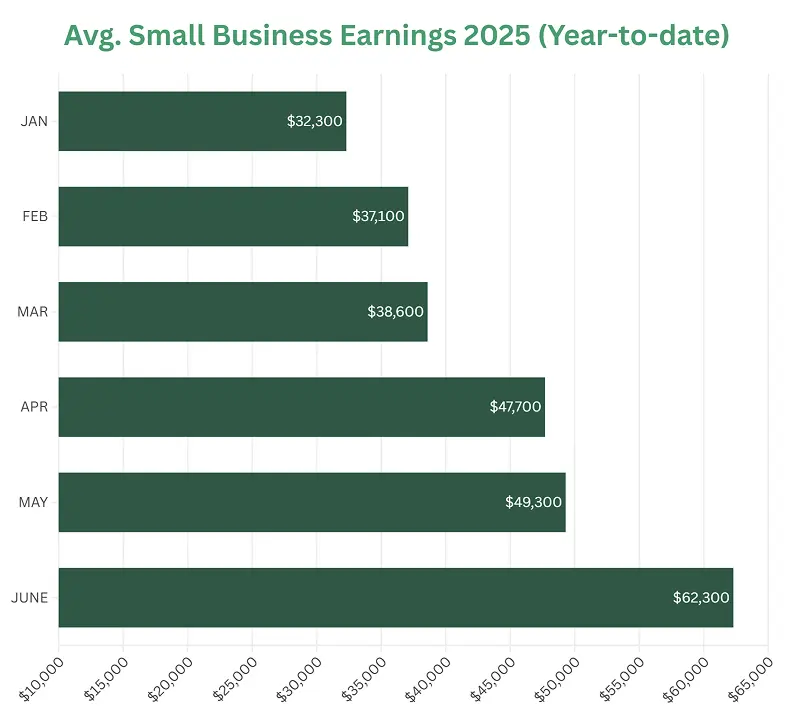

June 2025 were $62,300

(up by 26.4% from May).

June 2025 was $614,200

(up by 12.2% from May).

June 2025 were $551,000

(up by 10.8% from May).

compared to May's rate at 2.4%.

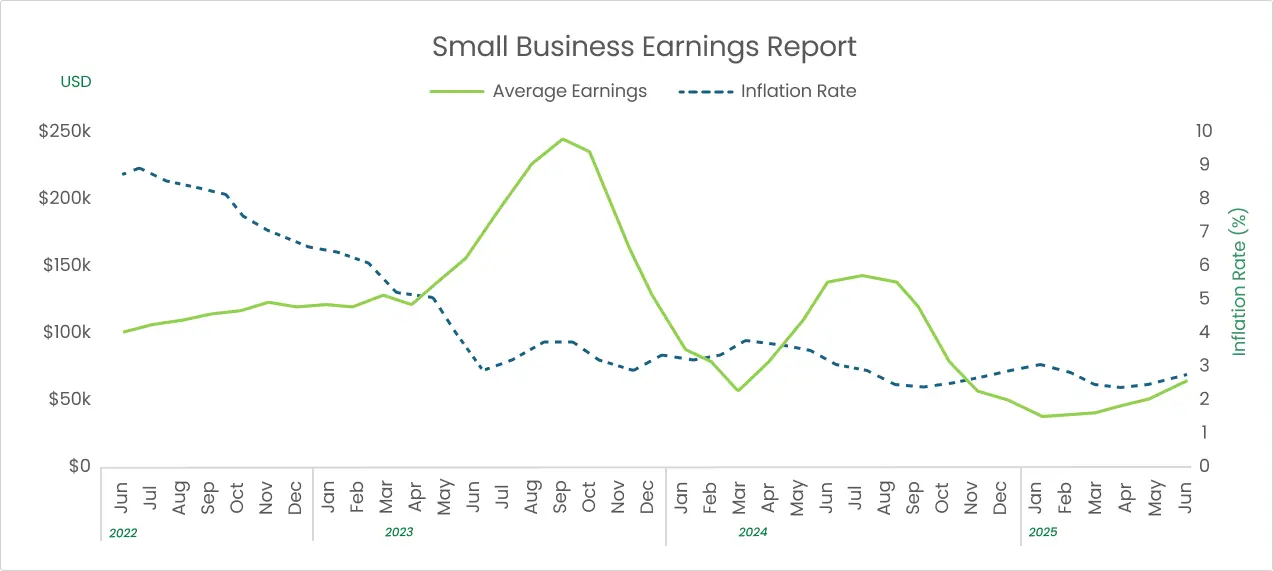

average earnings are up by 75%

($62,300-$35,600).

average earnings are down by 52%

($62,300-$128,900).

2025 Small Business Performance & Key Takeaways

Small businesses continue to pedal forward into the warmer months, growing bottom line earnings as inflation remains controlled and consumer spending remains resilient. Earnings for small businesses have nearly doubled since the beginning of 2025.

Small business optimism and confidence are rising cautiously as the second half of the year approaches. Top issues for small enterprises include inflation, tariff policy in limbo, and adjusting to new policy brought by the Big Beautiful Bill.

Methodology

Biz2Credit pulled over 100,000 complete financing applications submitted between January 2022 and June 2025. This report examines a number of variables including annual revenue, operating expenses, age of business, credit score, approval rate, and funding rate.

Term Loans are made by Itria Ventures LLC or Cross River Bank, Member FDIC. This is not a deposit product. California residents: Itria Ventures LLC is licensed by the Department of Financial Protection and Innovation. Loans are made or arranged pursuant to California Financing Law License # 60DBO-35839