Biz2Credit Small Business Earnings Report™

About the Report

Biz2Credit Small Business Earnings Report examines the financial performance of businesses that applied for credit from Biz2Credit.

The study looks at the performance of small to mid-sized firms -- from early stage to established companies in the U.S. that applied for funding. It’s intended to provide a snapshot of the financial health of businesses nationwide across a wide range of industries.

Key Findings

were $547,600.

average revenues are up by $25,200

($547,600-$522,400).

average expenses are up by $23,600

($498,300-$474,700).

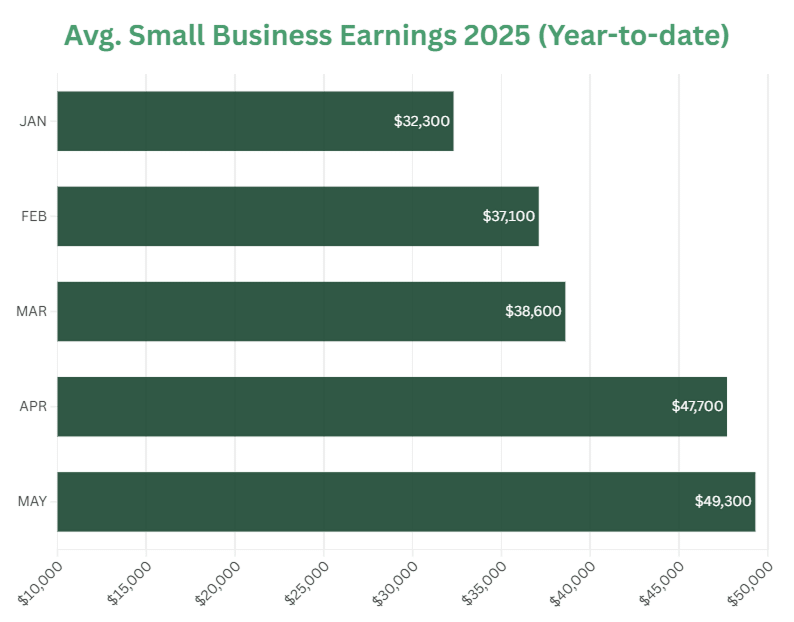

average earnings are down by $42,700

($49,300-$92,000).

compared to April’s rate at 2.3%.

2025 Small Business Performance & Key Takeaways

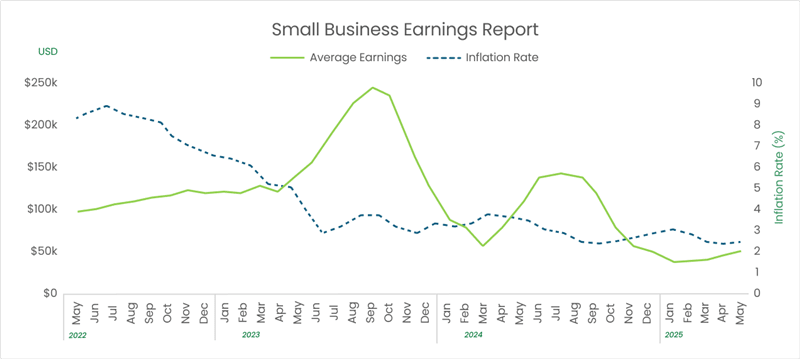

Small business earnings continue to grow as inflation is reigned in and consumer confidence recovers. Since the beginning of the year, earnings have jumped 53%. Expenses ticked up slightly from April, but remain unchanged compared to January.

Small business operators remain in a positive spot. Small business optimism remains higher than recent year, inflation is on a five-month streak under 3%, and consumer confidence is on the rise as summer approaches. However, uncertainty remains elevated due to tariff negotiations.

Methodology

Biz2Credit pulled over 100,000 complete financing applications submitted between January 2022 and May 2025. This report examines a number of variables including annual revenue, operating expenses, age of business, credit score, approval rate, and funding rate.

Term Loans are made by Itria Ventures LLC or Cross River Bank, Member FDIC. This is not a deposit product. California residents: Itria Ventures LLC is licensed by the Department of Financial Protection and Innovation. Loans are made or arranged pursuant to California Financing Law License # 60DBO-35839