Biz2Credit Small Business Earnings Report™

About the Report

Biz2Credit Small Business Earnings Report examines the financial performance of businesses that applied for credit from Biz2Credit.

The study looks at the performance of small to mid-sized firms -- from early stage to established companies in the U.S. that applied for funding. It’s intended to provide a snapshot of the financial health of businesses nationwide across a wide range of industries.

Key Findings

were $522,400.

average revenues are down by $9,500

($522,400-$531,900).

average expenses are down by $18,600

($474,700-$493,300).

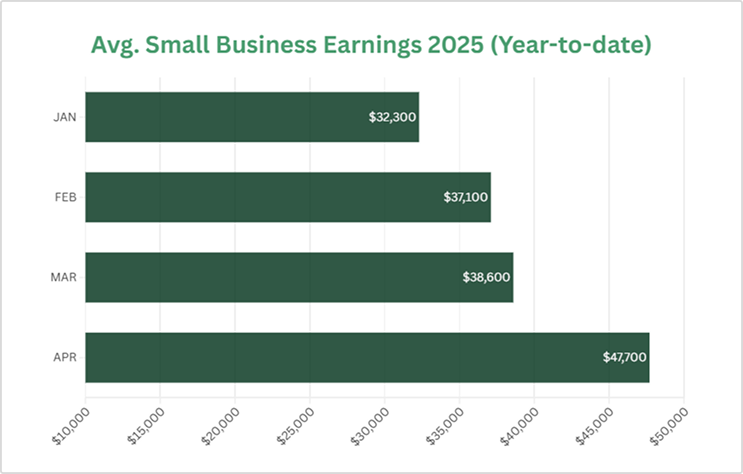

average earnings are down by $13,700

($47,700-$61,400).

compared to March’s rate at 2.4%.

2025 Small Business Performance & Key Takeaways

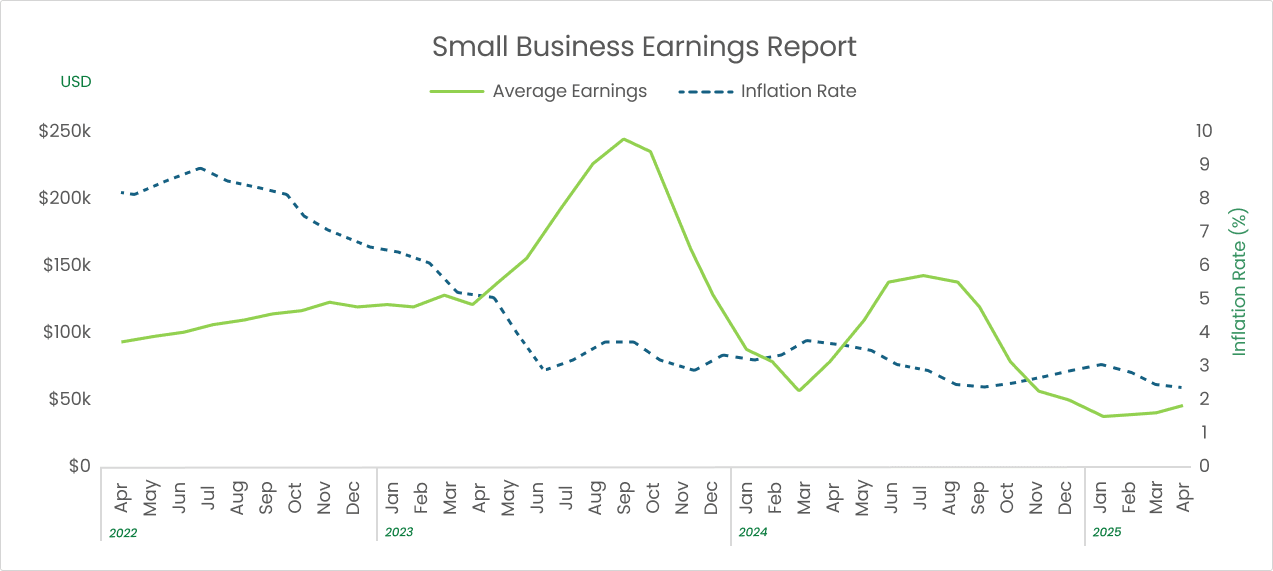

Small business earnings have risen notably in 2025, with a 48% increase in earnings from January to April, according to the Biz2Credit Small Business Earnings Report. This underscores a collective effort from small business operators to cut back on costs in response to rising economic uncertainty. At the same time, economic policy is beginning to stabilize, and inflation has inched closer to the Fed’s 2% goal.

It’s not all good news for business owners, however. We’ve seen small businesses that do trade internationally front-load imports to dodge potential tariffs, and there are reports of slowing goods trade coming into the country that could slow sales in the months ahead. Simultaneously, tariffs may cause business owners to raise prices, and potentially shrink demand.

The findings on SMB earnings mirrors recent survey data from the U.S. Chamber of Commerce that cites inflation costs and revenue as the top two current challenges, respectively.

Methodology

Biz2Credit pulled over 100,000 complete financing applications submitted between January 2022 and April 2025. This report examines a number of variables including annual revenue, operating expenses, age of business, credit score, approval rate, and funding rate.

Term Loans are made by Itria Ventures LLC or Cross River Bank, Member FDIC. This is not a deposit product. California residents: Itria Ventures LLC is licensed by the Department of Financial Protection and Innovation. Loans are made or arranged pursuant to California Financing Law License # 60DBO-35839