Biz2Credit Small Business Earnings Report™

About the Report

Biz2Credit Small Business Earnings Report examines the financial performance of businesses that applied for

credit from Biz2Credit.

The study looks at the performance of small to mid-sized firms -- from early

stage to established companies in the U.S. that applied for funding. It's intended to provide a snapshot of

the financial health of businesses nationwide across a wide range of industries.

Key Findings

Small Business Earnings Report

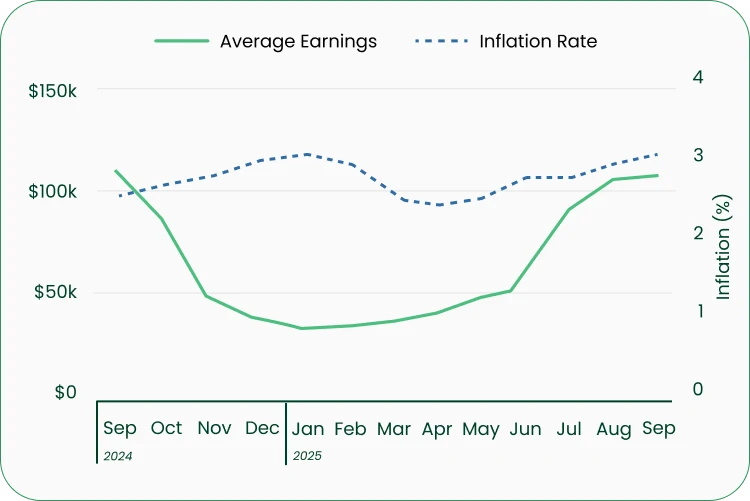

Small businesses continue their collective upward progress, now back to earnings numbers from 2024.

The U.S. Chamber notes that small business confidence hit a record high in Q3.

However, businesses are preparing for the holiday season with mixed revenue projections as consumers grapple with higher prices.

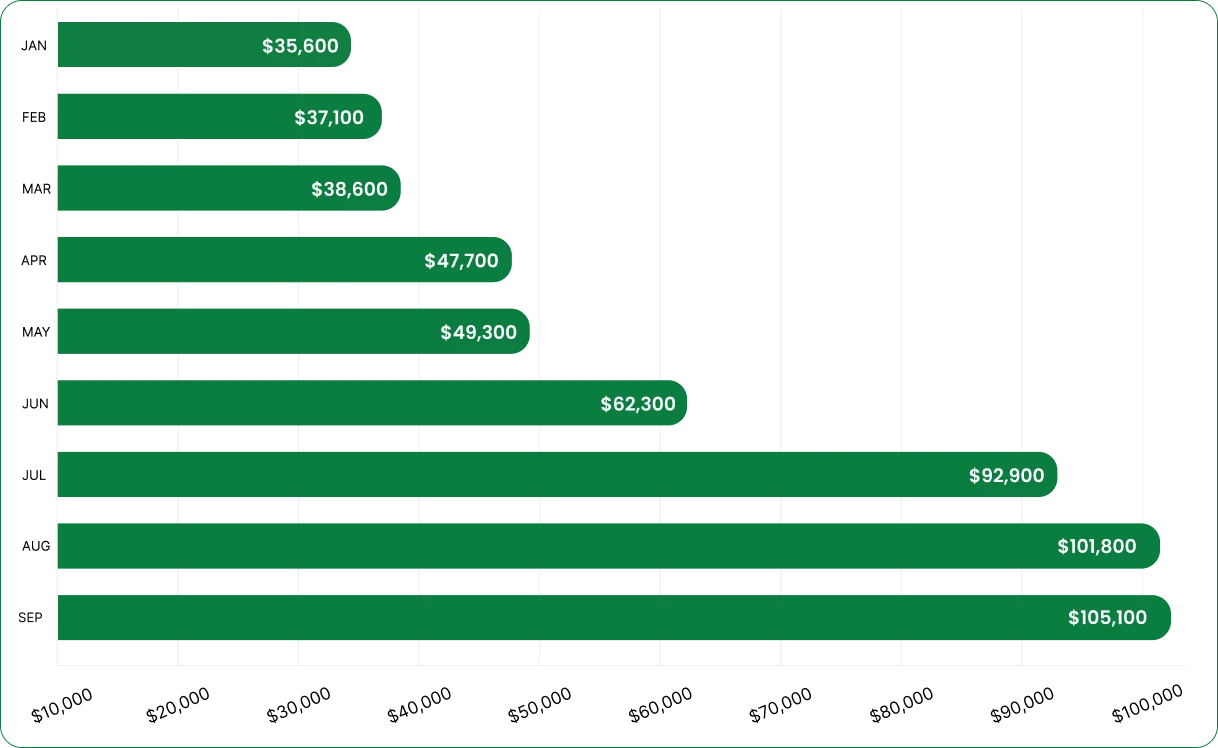

Avg. Small Business Earnings 2025 (Year-to-date)

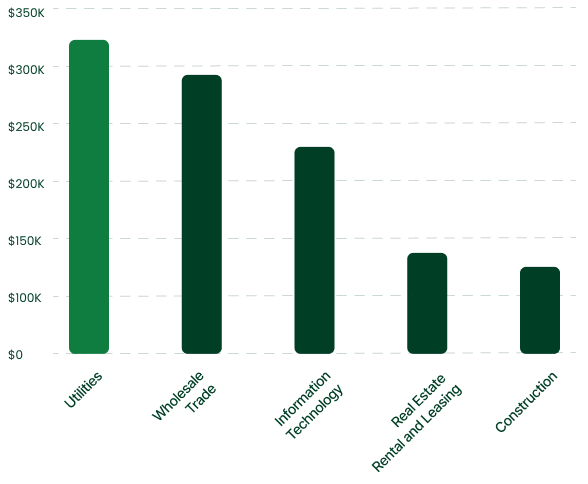

Top 5 Industries by Average Earnings

The utilities sector is performing well, due to a combination of rising demand and easing input costs. As energy prices have moderated from recent highs, utilities are benefiting from improved margins while maintaining consistent revenue from essential services.

The sector’s resilience also makes it attractive in a period of economic uncertainty, as consumers continue to prioritize essential spending.

Takeaways

The 36 million small and medium-sized businesses across the U.S. continue to make steady financial progress from the lows experienced at the start of 2024. Many have benefited from stronger consumer spending, easing supply chain pressures, and improved access to credit.

However, a stubborn challenge remains: labor quality. Despite a modest uptick in the national unemployment rate, many business owners still report difficulty finding and retaining skilled workers who meet their needs.

With the Federal Reserve’s rate cut in September and additional reductions anticipated in the final two meetings of 2025, optimism is building. Lower borrowing costs could free up capital for hiring, expansion, and investment, setting the stage for stronger growth across the small and medium business sector heading into 2026.

Methodology

Biz2Credit pulled over 100,000 complete financing applications submitted between September 2022 and September 2025. This report examines a number of variables including annual revenue, operating expenses, age of business, credit score, approval rate, and funding rate.

Other Reports

Top 25 Cities for Small Business Annual Report

Biz2Credit's Top 25 Cities for Small Business Study is an annual review of the financial performance of small businesses in the United States. The study reviews tens of thousands of credit inquiries and applications from small to mid-sized businesses across the country for the full prior year (2024). Results from the study deliver insight on the performance of small businesses over the past 12 months.

Annual Women-Owned Business Study 2025

Building strong business credit is essential for the growth and stability of any small business. Good business credit can help secure better...

Annual Latino-Owned Business Study 2025

Biz2Credit, a leading online funding provider to small businesses, analyzed the financial performance of over 138,000 companies, including more than 18,000 Latino-owned firms, that submitted funding requests through the company's online funding platform. The report covered small businesses across the country, from start-ups to established companies, from July 1, 2024 to June 30, 2025.

Term Loans are made by Itria Ventures LLC or Cross River Bank, Member FDIC. This is not a deposit product. California residents: Itria Ventures LLC is licensed by the Department of Financial Protection and Innovation. Loans are made or arranged pursuant to California Financing Law License # 60DBO-35839