Biz2Credit Small Business Earnings Report™

About the Report

Biz2Credit Small Business Earnings Report examines the financial performance of businesses that applied for credit from Biz2Credit.

The study looks at the performance of small to mid-sized firms -- from early stage to established companies in the U.S. that applied for funding. It's intended to provide a snapshot of the financial health of businesses nationwide across a wide range of industries.

Key Findings

Small Business Earnings Report

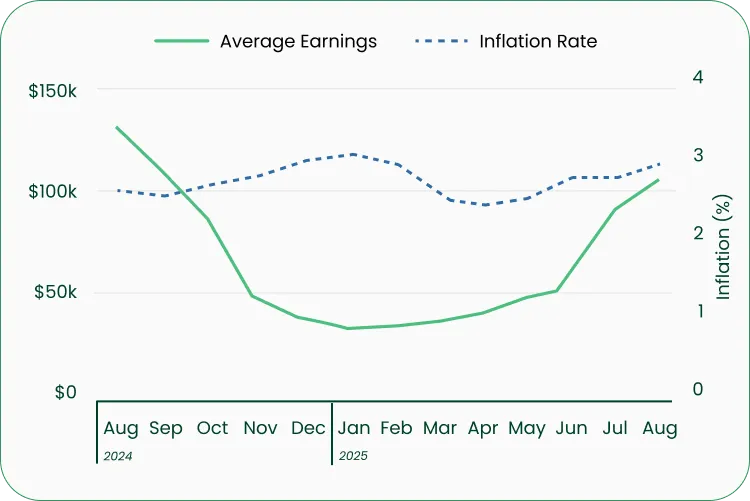

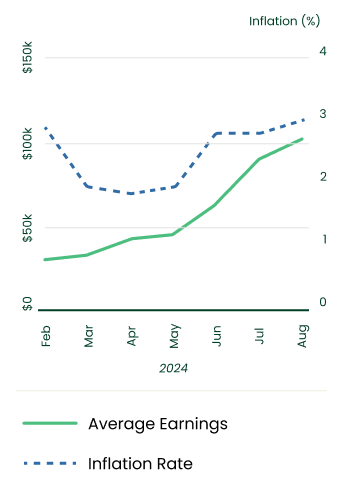

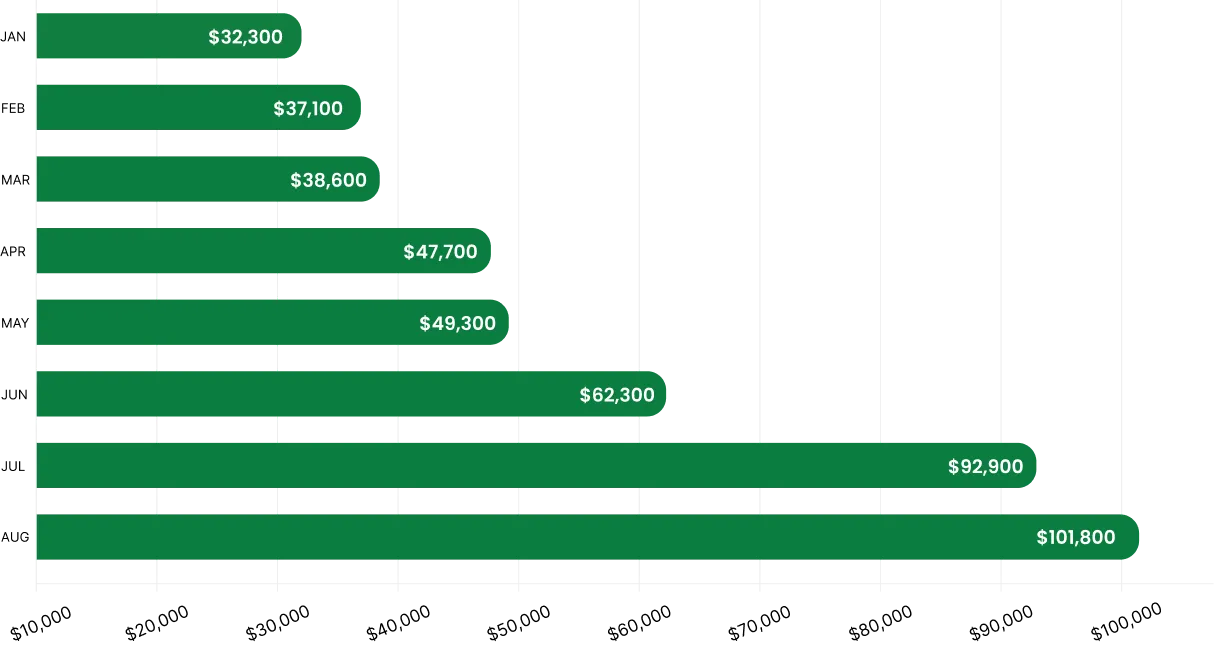

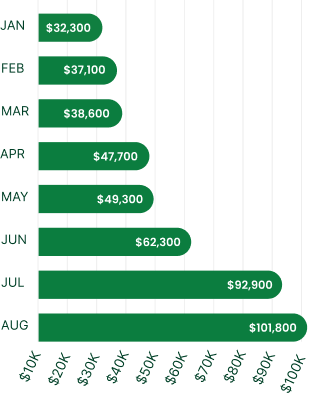

Small businesses are exiting the warm months on a high note, as earnings continue its collective climb throughout the year.

Now, businesses are preparing for the coming holidays, which is expected to be another record breaking year from consumers.

Avg. Small Business Earnings 2025 (Year-to-date)

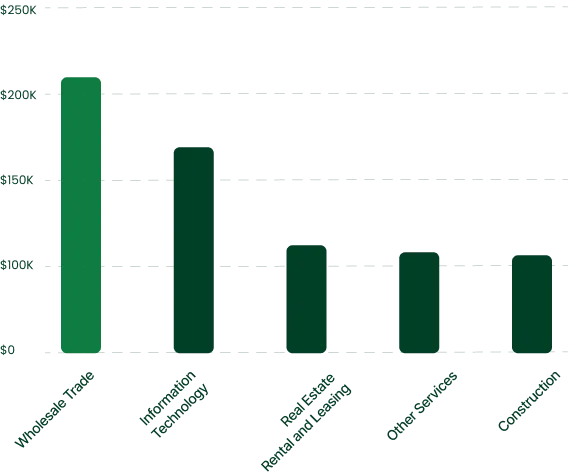

Top 5 Industries by Average Earnings

The U.S. wholesale trade industry is growing steadily in 2025, with strong sales and solid contributions to the economy. Wholesale distributors in particular are seeing healthy momentum, supported by resilient consumer demand.

For the rest of 2025, wholesale trade is expected to maintain moderate growth, especially in areas like pharmaceuticals, electronics, and food distribution, even as global headwinds may limit gains.

Takeaways

Circumstances continue to slowly improve for American small businesses as optimism continues its climb upward amid likely rate cuts by the Federal Reserve. However, labor quality continues to be a stinging issue for owners looking to hire. Despite an uptick in unemployment, 32% of small business owners report being unable to fill job openings.

The remaining months of 2025 will be highlighted by the remaining three Federal Reserve meetings, consumer spending during the holiday season, and continue tariff negotiations from the White House.

Methodology

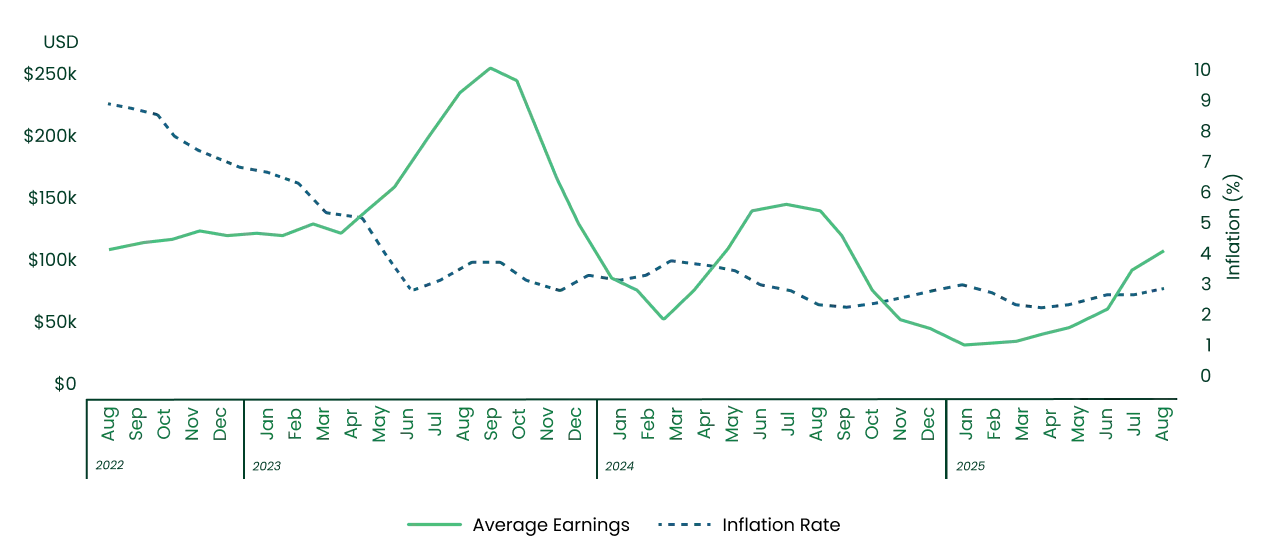

Biz2Credit pulled over 100,000 complete financing applications submitted between January 2022 and August 2025. This report examines a number of variables including annual revenue, operating expenses, age of business, credit score, approval rate, and funding rate.

Other Reports

Top 25 Cities for Small Business Annual Report

Biz2Credit's Top 25 Cities for Small Business Study is an annual review of the financial performance of small businesses in the United States. The study reviews tens of thousands of credit inquiries and applications from small to mid-sized businesses across the country for the full prior year (2024). Results from the study deliver insight on the performance of small businesses over the past 12 months.

Annual Women-Owned Business Study 2025

Building strong business credit is essential for the growth and stability of any small business. Good business credit can help secure better...

Annual Latino-Owned Business Study 2024

Biz2Credit, a leading online funding provider to small businesses, analyzed the financial performance of over 121,000 companies, including more than 18,000 Latino-owned firms, that submitted funding requests through the company's online funding platform. The report covered small businesses across the country, from start-ups to established companies, from July 1, 2023 to June 30, 2024.

Term Loans are made by Itria Ventures LLC or Cross River Bank, Member FDIC. This is not a deposit product. California residents: Itria Ventures LLC is licensed by the Department of Financial Protection and Innovation. Loans are made or arranged pursuant to California Financing Law License # 60DBO-35839