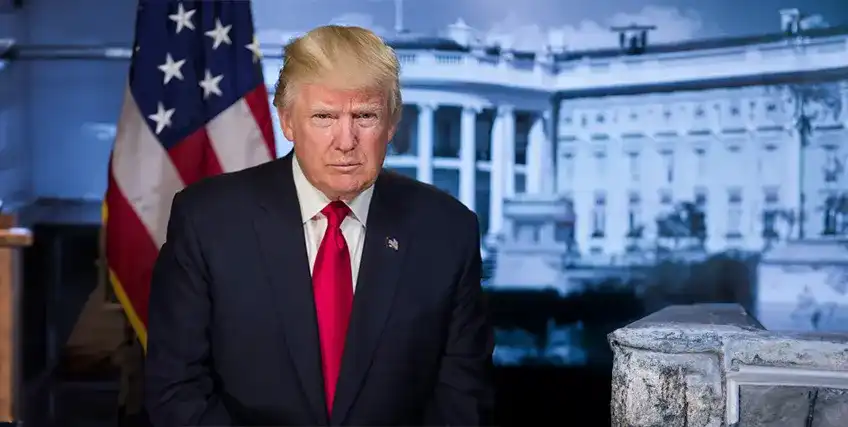

Trump Liberation Day Tariffs Are In Effect, Here’s What You Need To Know

April 04, 2025 | Last Updated on: April 04, 2025

April 04, 2025 | Last Updated on: April 04, 2025

President Donald Trump announced sweeping tariffs on Wednesday, making good on campaign promises. In addition to policies targeted at individual countries, he signed a 10% unilateral tariff on all goods coming into the U.S.

Here’s what you need to know about the recent executive action, and how it may impact your small business.

As of April 5th, all countries will have a 10% tariff added to their duties when importing goods into the United States. The executive order has a long list of countries added with even higher tariffs that will go into effect on April 9th. Notable countries on that list include China (54% tariff) and the E.U. (20% tariff).

Additionally, there will be a 25% tariff on all foreign made autos and the 25% tariff on Canadian and Mexican goods will remain in place.

These tariffs come with a list of conditions and retaliatory tariffs that can be found here.

President Trump exclaimed the singular way for countries to avoid these tariffs: build in America. He listed several companies making significant investments to building inside the U.S., totaling $6 trillion.

His message: This will “Make America Wealthy Again.”

Tariffs like this latest round announced by the Trump administration can impact small businesses by raising costs on imported goods like raw materials and electronics. To mitigate these effects, businesses should explore domestic or alternative international suppliers where tariffs are lower. If you find this option is not available, your best course may be to negotiate better terms with existing suppliers, and adjust product or service pricing strategically.

Staying informed on trade policies is crucial, as new changes could be forthcoming soon. Some businesses may also qualify for tariff exemptions or duty refunds on exports. If you are impacted, be sure to look out for resources to help you understand your options; many financial advisors, accountants and duties brokers can help you navigate these options.

By proactively managing their supply chains and keeping a close eye on their finances, small businesses can navigate tariffs and maintain stability in a shifting economic landscape.

With tariffs impacting costs, now might also be a smart time to explore financing options for your business. Securing funding can help you adapt in ways that help you reduce the effect of tariffs, such as investing in local suppliers, so you can navigate market changes with confidence.

March 21, 2025 | Last Updated on: March 21, 2025

In a widely anticipated move, the Federal Reserve announced today that it will maintain its benchmark interest rate within the current range of 4.25% to 4.50%. This decision mirrors the last decision from the Fed in January, but touches on rising uncertainty for consumers and businesses.

Here’s what you need to know, and what to expect going forward.

Fed Chair Jerome Powell and the Fed’s policy direction remains unphased by the economic and political noise of recent weeks. Powell said earlier this month: "We do not need to be in a hurry and are well-positioned to wait for greater clarity."

During the press conference on Wednesday, Jerome Powell stated inflation remains somewhat elevated above its 2% goal, which remains a top concern for small business owners.

However, the central bank marked down its growth projections for the year as tariffs, government layoffs, moderated consumer spending, and geopolitical tensions create economic uncertainty.

Interest rates will continue to be a significant focus for small business owners as the Fed adjusts to the new administration, along with President Trump publicly advocating for lower rates. Small business owners should know that interest rates are likely to remain stable throughout the year, with one to two rate cuts projected by investors. These cuts are estimated to be 25-basis points each, meaning that rates are projected to drop by 0.50% between now and the end of the year. Some are saying the first rate cut could come as soon as June. However, this could change as economic conditions shift.

Uncertainty remains palpable for small businesses. “Uncertainty is high and rising on Main Street – and for many reasons. Those small business owners expecting better business conditions in the next six months dropped, and the percentage viewing the current period as a good time to expand fell but remains well above where it was in the fall. Inflation remains a major problem, ranked second behind the top problem, labor quality,” said NFIB Chief Economist Bill Dunkelberg. These conditions, along with compressed earnings as shown in our Small Business Earnings Report, present a case where small businesses could benefit from business financing options.

March 06, 2025 | Last Updated on: March 06, 2025

After months of rumors and speeches and weeks of back and forth, Trump tariffs are now in place, effective Tuesday, on Canada and Mexico. Additional tariffs are being put on China as well.

This means imports coming into the US from these countries will have additional duties attached, driving up costs for businesses that rely on such imports. Companies large and small have voiced significant concerns that higher costs for goods will be passed on to consumers through higher prices.

Here are the numbers, and what it could mean for you and your small business.

These tariffs aren’t put in place to fight a trade issue but rather fighting a border security issue. The Trump Administration accuses Mexico and Canada of allowing illicit drugs to flow into the U.S. and are using these tariffs as a negotiating tactic to secure new concessions from these countries.

This is a large jump from the first Trump administration where he signed the USMCA trade agreement to be “the largest, most significant, modern, and balanced trade agreement in history.”

Less than five years later, that agreement appears to be on rocky ground as the below tariffs go into effect:

| Canada | Mexico | China |

|---|---|---|

|

- 25% tariff on most imports - 10% tariff on energy products |

- 25% tariff on all products | - 10% tariff on all imports added on Feb. 4. An additional 10% added on Mar. 4. |

Additionally, President Trump announced in his speech before Congress on Tuesday that reciprocal tariffs will “kick in” on April 2.

This will impact a variety of everyday products, including automobiles, groceries, consumer electronics, and more. Some products may have updated price points in the coming days, while others could take months to come to fruition.

President Trump boasts about the sweeping tariffs, but they aren’t without immediate consequences. Canada plans to implement 25% tariffs on nearly $100 billion of U.S. imports. Mexico’s president has said the country will announce its own strategy this weekend. Markets saw immediate selloffs as investors are anxious about what’s to come.

U.S. Commerce Secretary Howard Lutnick before the president’s speech to Congress on Tuesday night said tariffs could be renegotiated as soon as Wednesday. It remains unclear how a compromise might be reached and what exactly would be covered by such a deal.

The major concern for most business owners: uncertainty about what this means for them and the future of their business. Here are some suggestions for how business owners can prepare for the impacts of the new US trade policy.

The sentiment among businesses and consumers is largely the same: this isn’t a good thing. Estimates vary, but if tariffs remain in place at these levels consumers could end up spending thousands of dollars more per year for the same goods.

The U.S. Chamber of Commerce represents American small businesses and has been adamant about how tariffs will negatively impact small businesses. In a statement the chamber’s chief policy officer Neil Bradley said, "Tariffs will only raise prices and increase the economic pain being felt by everyday Americans across the country," “We urge reconsideration of this policy and a swift end to these tariffs."

A leather goods storeowner in San Diego told CBS 8 that she has “no choice” but to raise prices. This is one of many small businesses that have decried the tariffs.

However, not all businesses can afford to raise their prices. Many goods and services have already been hit by high levels of inflation over the last three years, and consumers simply won’t continue to pay higher prices for the same goods. This has become a reality for many business owners and is demonstrated in the Biz2Credit Small Business Earnings Report as recent data has shown that earnings have been squeezed by rising costs outpacing revenues.

If you’re the owner of a small business being negatively impacted, there are several things you should consider doing in the wake of this economic turn:

Small businesses have a stronger voice when they band together. Joining industry associations, local chambers of commerce, or trade organizations can amplify concerns and push for policy changes. These groups often lobby lawmakers on behalf of businesses affected by tariffs. For critical industries like food and energy, there is hope of potential carveouts coming from the White House.

Relying on a single supplier—especially one affected by tariffs—can be risky. Expanding your supplier network to include vendors from countries with lower or no tariffs can help mitigate cost increases. Additionally, consider switching from international to domestic suppliers as it now may be less cost prohibitive.

Tariffs often lead to increased costs, but businesses can negotiate with suppliers for better terms, bulk discounts, or longer payment cycles to ease financial pressure. If price increases are unavoidable, consider a gradual adjustment rather than an immediate hike.

The economic impact of the tariffs is difficult to estimate at this point, but consumers and businesses alike will likely feel some economic pain. Additionally, there is debate on whether tariffs will add to stubborn inflation.

As a small business owner during economic uncertainty, remaining agile and keeping options open such as new business funding can potentially make a significant difference in your business’s performance.

February 14, 2025 | Last Updated on: February 14, 2025

2025 is off to a whirlwind start. Optimism soared entering the new year among small business owners. However, this hasn’t yet translated into higher earnings amid rising expenses and stubborn inflation.

Here’s what you need to know, and how you can be financially smart for your own small business during this uncertain time.

In our February 2025 edition of the Biz2Credit Small Business Earnings Report, we analyzed data from over 100,000 small businesses revenue and earnings. This study is a deep dive into how small businesses are performing financially in terms of revenue, expenses, and earnings.

Here’s what we found in our February 2025 version of the Biz2Credit Small Business Earnings Report.

Small businesses continue to be pressured by rising costs, leading to lower earnings. Revenue is up 29% year-over-year, but expenses have pushed earnings down. Compared to January 2024, earnings are down nearly 58%.

The Fed's latest CPI show inflation at 3%, renewing cost pressures on small businesses. While the overall rate has been rising since August 2024, January's data highlights specific pain points. Egg prices, a key input, jumped 15.2% in one month, demonstrating cost volatility.

Beyond eggs, the CPI reveals broader increases in essential goods and services impacting businesses. Rising food and energy costs translate directly into higher operating expenses. CPI subcategories like "food away from home," "rent of shelter," and transportation costs further illustrate the specific pressures.

These rising costs, reflected in the CPI, directly impact SMB profitability. Even with rising revenues, escalating operating costs can erode profit margins, hindering investment and growth. The January CPI data underscores the challenges SMBs face navigating an economy with significant cost pressures.

After the election, there was palpable excitement among the small business community for deregulation and pro-business leaders to be in power. That is now tampered slightly in the wake of President Trump’s sweeping executive actions, tariff spats with essential trading partners like China, and rising inflation.

However, economic analysts see better days ahead. There is still hope for one or more rate cuts later this year, and a strong consumer keeps the economic engine going. According to McKinsey, “consumers are spending more than they were before the pandemic and are spending more each year.”

Lastly, Kelly Loeffler looks to be only days away from taking the helm of the Small Business Administration (SBA). This appointment by President Trump could mean new technology upgrades at the Federal government’s small business agency to improve efficiency, increase access to SBA loans, further emphasis on deregulation for small businesses, and reduce financial fraud.

The January earnings and inflation numbers paint a frustrating picture for small business owners, but there are reasons for optimism. If you operate a small business, be sure to consider how you can set up different revenue streams without increasing your expenses and keep an eye out for funding options to grow or stabilize your business if costs are starting to rise. And if you’re considering financing in 2025, keep an eye on changing interest rates as they may continue to drop when economic conditions improve.

February 4, 2025 | Last Updated on: February 5, 2025

President Trump warned throughout his campaign of potential tariffs. Matching the breakneck speed of his first few weeks in office, he approved 25% tariffs on Canada and Mexico to go into effect on February 4th. However, those have been delayed by one month as both countries backed down to negotiation requests. However, China was hit with a 10% additional tariff on top of earlier import duties imposed during Trump’s first administration.

Here’s what this means for you and your small business.

President Trump is not mincing words: this will be financially painful for everyone involved. In a recent post on social media, he said "WILL THERE BE SOME PAIN? YES, MAYBE (AND MAYBE NOT!).” A CNBC Flash Fed survey of 24 economists said GDP would fall and inflation would rise in the wake of tariffs, and this pain will be felt by consumers and small businesses alike.

It’s estimated that the average U.S. household will spend an extra $830 this year, according to an analysis from the nonpartisan nonprofit Tax Foundation. Some say this could add to an already sticky inflation rate. For consumers that are already stretched thin from post-pandemic inflation, this could reduce consumer spending even more, hurting both small and large businesses alike.

For small business owners who import goods from Canada like machinery, metals, energy-related products like oil and gas, you could find yourself paying more for the product you need. Here’s how it works:

When you import goods, you likely work with a customs broker or submit documents to U.S. Customs and Border Protection (CBP). CBP then determines the tariff or fee you owe to bring the products in. At this point, you will see the larger fee tacked on by the Trump administration. This fee could be hard to swallow at first, but you could get funding to absorb it and decide how your business can offset it later.

However, for small businesses that relies heavily on importing goods from these countries, it could be too much to handle. Small businesses that sell groceries, automotive parts, machinery, and wholesale imports and exports will likely feel the economic pinch first.

Amere two weeks into a new presidency, businesses large and small are figuring out what the impacts are of the dozens of executive actions taken. Biz2Credit CEO Rohit Arora says there can potentially be some positives to come from this. “In the best case scenario, [it could] lead to lower deficits,” but followed that there is palpable economic uncertainty.

During a period of potential tariffs raising costs, small business owners can focus on several functions of their organizations to mitigate the burden of tariffs:

The Trump tariffs and the terms associated are changing rapidly, so it’s best to stay in touch with your vendors and watch the news cycle to find the latest update. But as this administration has shown in its early days, being prepared with business funding could give your business the edge it needs to withstand policy changes.

January 31, 2025 | Last Updated on: January 31, 2025

On Wednesday, the Federal Reserve announced it would hold interest rates steady after several cuts — beginning a “wait and see” phase for the central bank.

This comes on the heels of President Trump demanding the Fed drop interest rates further, showing a firm stance of the separation of the Executive branch and the central bank’s policy.

This is the first of eight meetings in 2025, and experts say significant movement in rates is unlikely. Here’s what you need to know.

FOMC unanimously voted in favor of keeping rates where they are, which is 4.25-4.50%.

The labor market remains the optimistic point for the Fed, while inflation remains “somewhat elevated.” The inflation print in December 2024 read 2.9%, further from the central bank’s goal of 2%. They are awaiting new data supporting the effects of their previous rate drops in September, November and December, and how they are impacting economic data.

As of now, it looks like interest rates for business loans and other financing may stay largely static for the remainder of the year. The Fed does not plan to cut rates further at this time. “We feel like we don’t need to be in a hurry to make any adjustments,” Powell said. Current prediction markets estimate one quarter-point cut at some point this year, according to CME Group data.

However, there is palpable uncertainty in the markets as a new Presidential administration comes with sweeping immigration reform and looming tariffs. Powell said, “We don’t know what is going to be a tariff; we don’t know for how long, how much, what countries, and we don’t know about retaliation or how it will transmit through the economy to consumers.”

For now, business loan rates are expected to remain stable. This is advantageous for small business owners that are considering borrowing for their businesses. Instead of trying to time their borrowing activity to another rate drop, many business owners will find it advantageous to secure funding in the short term at today’s current rates.

January 22, 2025 | Last Updated on: January 22, 2025

Small businesses continue to endure financial strain due to cost pressures from inflation, negatively impacting earnings throughout 2024, according to Biz2Credit’s findings in the 2024 Small Business Earnings Report.

Our study found that average small business earnings soared in 2023, but reeled backward in 2024 by 45% as small companies bore the brunt of inflation. Fox Business cited the study, noting that 2025 may be another difficult year as well.

Here’s what you need to know, and how you can be strategic about your small business this year.

In our second version of the Small Business Earnings Report, we analyzed data from over 100,000 small businesses revenue and earnings. This study is a deep dive into how small businesses are performing financially in terms of revenue, expenses, and earnings.

We found several data points that paint a frustrating picture for small business owners.

Despite 2024 being a tight year financially, small business owners are feeling optimistic about days ahead. The National Federation of Independent Business (NFIB) Small Business Optimism Index reached a six-year high amid tampered inflation and potential regulation easing when President-elect Trump takes office. The same index reports the #1 issue for small business owners and continues to be the focus of our study: the impact of inflation.

As small businesses head into 2025, staying financially smart is more important than ever. Looming tariffs, lingering inflation, and other economic factors may continue to put pressure on the 33 million small businesses that power the American economy. Other factors including a tight labor market will continue to challenge small enterprises as well.

If you operate a small business, be sure to consider different revenue streams and funding options to grow or stabilize your business. And if you’re considering potential cashflow needs, keep an eye on changing interest rates in 2025 as they may continue to drop if economic conditions improve.

December 19, 2024 | Last Updated on: December 19, 2024

The Federal Reserve announced it will lower the effective federal funds rate by 0.25% to end the calendar year. This is the third rate cut since September after the Fed raised rates at historic speed to tamper inflation post-pandemic.

This is great news for consumers and small business owners who are looking to borrow money. As interest rates come down, the cost of borrowing goes down as well.

While this marks three rate cuts to round out the year, future rate cuts in 2025 may be harder to come by.

Here’s what this means for you and your business.

Key Points:

After a record-breaking rate hike to stop inflation in recent years, the Federal Reserve ends the year by cutting interest rates by a cumulative 1 percentage point over the last 3 FOMC meetings. This puts the federal funds rate to 4.25-4.50%.

This rate is what banks and lenders use to charge borrowers interest, including the annual percentage rate (APR) on mortgages, credit cards, and business term loans.

This decision follows the Consumer Price Index reading last week showing inflation at 2.7%, above the Fed’s goal of 2%. This figure has been ticking upward since September. Additionally, the Fed projects this goal won’t be reached until 2027 as worries of economic policy from the new administration could be inflationary.

Today’s news is fantastic for small business owners looking to get a loan. A drop in interest rates means the cost of borrowing funds is now cheaper, including SBA loans and term loans. And as the cost of capital drops, the demand will follow.

A September Wall Street Journal story featured several businesses left without necessary funding due to high rates. Now, the flood gates appear to be opening for small business operators who are ready and able to make the capital investment.

The new year eagerness is palpable from the small business community after a financial squeeze in 2024. According to the Biz2Credit Small Business Earnings Report, operators have seen their lowest earnings since 2020.

Despite this, after President elect Donald Trump won the election, the NFIB Small Business Optimism Index rose 8 points.

“The election results signal a major shift in economic policy, leading to a surge in optimism among small business owners,” said NFIB Chief Economist Bill Dunkelberg. “Main Street also became more certain about future business conditions following the election, breaking a nearly three-year streak of record high uncertainty. Owners are particularly hopeful for tax and regulation policies that favor strong economic growth as well as relief from inflationary pressures. In addition, small business owners are eager to expand their operations.”

Interest rates will continue to be a large focus for small business owners. 28% of small business owners are planning to spend on improving their businesses in the next six months, up six points from October, according to the NFIB Index. Fed Chair Jerome Powell made clear after this third rate cut in a row that the cental bank will be cautious with future cuts in 2025.

Today’s news is largely an exciting one for America’s 33 million small businesses that have endured significant economic pressures in recent years. But as we turn the page to 2025 with a new administration, a slew of impacting policy proposals, more potential rate cuts, a new head of the SBA, and the continued battle against inflation, there is plenty for small business owners to think about.

Fed Interest Rate Cut, Fed interest rates, Small Business Growth, Small Business Funding

November 12, 2024 | Last Updated on: November 12, 2024

Election day is behind us and following the 2024 election results of Nov. 5, Republican nominee Donald Trump will become America’s 47th president in January 2025.

The president-elect secured 312 electoral college votes, bringing him back to Washington for the first time since he left office in 2021. He achieved this thanks to his electoral wins in several battleground states, including Pennsylvania, Georgia Arizona, and Wisconsin. Trump’s White House win might have wide-reaching consequences for small business owners.

Democratic candidate Vice President Kamala Harris, meanwhile, secured 226 electoral college votes as her ‘blue wall’ electoral strategy failed to prevent the Republican wave across the Rust Belt and Sun Belt states.

Now, Harris’ push to continue helping minority-owned small businesses – a signature selling point to business owners of the Democratic Biden-Harris administration - is left in the dust by her election loss.

Here’s what you need to know about how the 2024 election results could impact small business owners.

3 Key Takeaways: How Trump Win Will Impact SMBs

Trump and Harris outlined their economic agendas quite differently during the campaign. While Democratic candidate Vice President Harris had a detailed economic platform, including in-depth recommendations on small business policy, Trump leaned on the record of his prior administration to communicate his vision for small business owners.

The Republican’s signature economic proposals may give an idea of how this election, which many have referred to as a ‘vibes’ election - will impact small business owners.

For instance, Trump’s plan to impose tariffs, which are taxes on imported goods, could become an additional financial burden for SMBs who sell imported goods or who rely on international manufacturing. On the other hand, some of the tax cuts the Republican president-elect wants to enact might be beneficial for business owners, including preserving a low corporate tax rate that could lead to greater retained earnings.

The results from election night came as inflation and high interest rates have hurt many American small business owners over the last several years. At the same time, many of them also feel optimistic about 2025. A recent U.S. Chamber of Commerce report noted that “the economy/inflation is the single most important issue that small businesses would like the new U.S. Congress and presidential administration to address in 2025.”

Meanwhile, the report noted that 73% of small business owners “expect next year’s revenue to increase—identical to last quarter and the highest number recorded since the Index began in 2017.” So although inflation remains a concern, business owner sentiment had been improving leading up to Election Day.

Ultimately, the economy and inflation became determining factors in voters’ decisions. Harris could not overcome these issues as a de facto incumbent, and Trump attacked her political platform with these two problems throughout the campaign. Now it is Trump who will be given the voters’ mandate to try to preserve the gains made on both inflation and high rates.

Trump and Harris outlined very different economic agendas. During her campaign, Harris said that small businesses are “the backbone of our communities”. Her Democratic platform and proposals for SMBs provided many details. Some of these policies were geared toward continuing to help underserved communities and minority-owned businesses. Harris also offered to boost the startup expense deduction to $50,000 from $5,000.

In addition, under the Biden-Harris administration, small business applications reached a record high, with 19 million new applications filed as of August 2024.

Trump, meanwhile provided fewer details on his Republican platform. Yet, some of his economic proposals might have a direct impact on how SMBs will conduct business going forward.

Here are some of Trump’s proposals and how they could affect owners.

Tariffs have been a cornerstone of Trump’s economic agenda. These could become one of the election result’s most significant potential impacts on SMBs. During the campaign, he has called for tariffs to range from 20% to up to 60% for Chinese goods.

What it means for small business owners: Many SMBs use imported products or components. The degree to which this could affect a business will depend on how much it relies on imports. In turn, this added tax could become a substantial financial burden for some of them.

There is another potential impact for SMBs. Tariffs might result in higher consumer prices, as these production costs will be passed on to them. In turn, this could lead to decreased sales activity for SMBs.

Bryan Riley, director of the National Taxpayers Union Free Trade Initiative, said that these could be especially harmful to small businesses that may not have the resources to weather higher prices, as happened under Trump’s first term.

Riley added that the uncertainty surrounding tariff threats makes it difficult for small businesses to plan for the future.

“Mom-and-pop retailers will face lower sales as their prices increase, and manufacturers that have to pay more for imported inputs may have to scale back as a result,” said Riley.

Finally, many experts noted that tariffs could have an inflationary impact since they directly increase the cost of imported goods or materials. This could put further pressure on owners if inflation does indeed resume under a tariff-heavy policy.

Trump also wants to make permanent the changes enacted in the Trump Tax Cuts and Job Acts (TCJA) in 2017 - a major piece of legislation under his previous Republican administration. These changes are set to expire in 2025. One of these was cutting the corporate tax rate to 21% from 35%. The expiration of these tax cuts could bring in more fiscal revenue, but would also leave companies with lower after-tax profits, increasing the burden on small businesses already struggling with high costs and low profit margins.

The Republican president-elect went even further during the campaign, proposing to lower this rate to 15%. Whether Trump wants to make the tax cuts permanent, or lower business taxes even further, he will need an act of Congress to do it. But if he can get that passed, it could be a huge help for business owners, as it would free up capital to expand their business or pay off high-cost debt, for example.

Trump is a big proponent of deregulation, which could help cut costs and boost growth for business owners.

Dr. Peter C. Earle, senior economist with the American Institute for Economic Research noted that the type of deregulation that characterized the first Trump administration is likely to continue. It may even accelerate under his next term of office.

“By dismantling the web of red tape and redundancies at various levels, small- and medium-sized businesses are likely to become more profitable, expand their workforces, and all during a period wherein interest rates are likely to be falling – lowering debt service costs,” explained Earle.

According to Trump, fewer regulations foster economic growth for SMBs. Some of the deregulations that could help small businesses include the deregulation of financial services that will make access to capital easier.

The race for Congress and its outcome could also shape many of these policies. Ballots were still being counted days after the presidential result in several congressional districts. The Republican party won control of the Senate. However, days following the election results, several House races that would determine the outcome of control of the House were still uncalled, notably in key states such as Nevada, Arizona, Pennsylvania, and California.

What it means for SMBs: A Republican sweep of Congress would enable the new President to enact some of his policies that require new legislation even faster, such as tax cuts. This could be beneficial for small business owners, depending on the final shape that these policies take.

Axios reported that the President-elect intends to retain several pro-business cabinet members for his new administration. In a sign of how this might shape up, Axios noted that “Trump's transition also is business-friendly.”

“The co-chairs [of the Trump transition team] are Howard Lutnick, chairman and CEO of Cantor Fitzgerald, and Linda McMahon, who headed the Small Business Administration during Trump's first term,” according to Axios.

What’s more, Tesla and SpaceX CEO Elon Musk might also play a significant role in the new Republican administration notably as part of a so-called efficiency commission.

This task force could also be beneficial for SMBs, as it intends to streamline government services and cut through red tape. For instance, less bureaucracy could result in faster processes for businesses to get up and running or expand.

Another potential way this task force could benefit SMBs is by lessening legal and administrative costs.

It is still too soon to determine all of the changes in policy that a new Trump presidency will bring and how these electoral results will impact small business owners. In addition, it is difficult to estimate how fast his administration will implement the new economic policies he campaigned on, or how Republicans and Democrats in Congress will respond.

Regardless, Trump’s return to the White House is sure to have a lasting effect on American small businesses, some positive and some negative. Favorable tax policy, deregulation and a business-friendly climate could all boost business owners’ bottom lines, but a return of inflation fueled by tariffs or global economic uncertainty would potentially set struggling businesses back.

The best way to prepare for any economic shift is to keep up to date with changes and regulations, such as tax implications or potential inflationary actions, and adjust your business plan accordingly.

business loan, business funding, minority business owner, female owned small business, help for small business owners

November 8, 2024 | Last Updated on: November 8, 2024

During its November 2024 meeting, the Federal Reserve lowered interest rates by 25 basis points. With this reduction, the Federal Funds Rate now sits in a range of 4.50% to 4.75%. Lower interest rates reduce the cost of borrowing to encourage consumers to spend and small businesses to invest. Learn more about the latest Fed moves and how this may impact your business.

Key Takeaways

After concluding its two-day meeting on Thursday, the Federal Reserve announced a 25 basis point (25 bps) reduction in its Federal Funds Rate to 4.50% to 4.75%. Each basis point is equal to 1/100 of a percent, which means that a 25 basis point reduction is equal to 0.25%.

Today's reduction comes on the heels of the 50 bps reduction at the last Federal Reserve meeting in September 2024.

When COVID hit the world's economy in 2020, the Federal Reserve slashed interest rates quickly to cushion the virus's impact on consumers and business owners. While the Fed reduced interest rates three times in the second half of 2019 as the economy slowed, the global pandemic accelerated interest rate reductions. Subsequently, the Fed left interest rates near 0% percent for nearly two years as the economy struggled to heal.

As inflation increased to highs not seen since the 1980s, the Federal Reserve ratcheted up interest rates to curb spending and stop inflation before it got out of control. Over the span of 18 months, the Fed boosted interest rates from near zero to more than 5%.

These efforts brought inflation under control, and the current reading of 2.1% is just above its target of 2%. However, the cumulative effect of higher-than-normal inflation over the past four years impacted consumer spending and business investment in a significant manner.

The next Fed meeting will be held on December 17-18, 2024. Typically, it can take six months or longer before the effects of interest rate changes filter through the economy. So, the impact of this month's rate cut won't be easily measured.

However, there are indicators you can track to forecast future rate changes. Economists take regular surveys to predict where the economy and interest rates are headed. Additionally, traders bet on future changes in interest rates, and they're predicting a 70% chance of another 25 bps cut in December.

While small businesses do not borrow at the Federal Funds Rate, it is used by most banks and lenders to set interest rates.

The baseline interest rate for banks is the Prime Rate, which is 300 basis points (or 3%) above the Federal Funds Rate. Variable rate loans, lines of credit, and credit cards typically charge the Prime Rate plus a modifier for the types of loan, the borrower's credit, and other factors.

A reduction in interest rates by the Federal Reserve may impact your business in different ways. Here are a few that you should be aware of.

When the Fed lowers interest rates, the cost of borrowing can decrease. However, the impact will depend on what type of financing you're using and how its interest rates are set.

Review your financing needs to determine what type of borrowing will help you reach your goals. Exploring options from different lenders is an excellent way to find the best financing options, interest rates, and terms for your business.

While interest rate cuts benefit borrowers, they have the opposite effect on savers. Businesses that have excess cash sitting in a savings account or money market account will earn less. Banks tend to slash interest rates on savings rates

If you save money in a certificate of deposit (CD), your APR will not change. The rate for your CD is set for the term you selected. However, when the CD matures, you'll likely face lower renewal rates than when you opened your account.

Research your savings options to find banks offering more appealing rates. Online high-yield savings accounts are simple to open. Additionally, you may be able to take advantage of promotional-rate CDs that banks offer to meet their funding needs.

The Fed's metrics show that the 2.1% inflation reading in September 2024 was near its target rate of 2%. While price increases have slowed, that won't bring prices down to where they were pre-COVID.

As a business owner, many of your costs increased without an easy way to bring them back down. Labor costs have increased significantly as many minimum-wage jobs now earn $15 to $20 an hour. Supply chain issues may still affect different industries, which can also drive up costs and squeeze margins.

Renegotiating contracts, buying in bulk, and automating processes can help reduce costs and maintain margins without increasing prices on your customers.

fed rate hike, federal interest rate, fed interest rate, current fed interest rate

The modern healthcare system is growing markedly, with an expectation to reach $819 billion in 2027, according to McKinsey. And it’s not just patients spending more money, it’s also the way that healthcare businesses run, secure and expand their operations that is causing dramatic spending.

Healthcare providers and businesses are under increasing pressure to improve outcomes while reducing costs, complying with new data privacy laws, and staying ahead of cyber threats. These new hurdles are on top of the already high-demand business in health care to run a successful and profitable operation.

Here’s what all of this means for you and your business in the coming new year.

Automation is revolutionizing the modern healthcare industry by streamlining operations, improving efficiency, and reducing costs. Tasks such as appointment scheduling, patient intake, billing, and insurance claim processing are increasingly being handled by automated systems, freeing up staff to focus on higher-value work. In fact, a recent survey from the American Medical Association indicates nearly two-thirds of doctors see advantages of using it in their practice.

However, it doesn’t come without hesitation. The same study from the AMA found physicians are most concerned about the impact to the patient-physician relationship (39%) and patient privacy (41%). Some are waiting for further clinical research to prove that it can improve their practice.

Modern healthcare is moving away from the fee-for-service (FFS) model, which rewards providers for the quantity of services they deliver, toward value-based care (VBC). This model has been proven to be better for both patients and providers. Here are a few reasons why:

In summary, value-based care improves patient outcomes, reduces costs, and enhances the overall efficiency and sustainability of healthcare systems. While the transition to VBC brings challenges, it holds the potential to make healthcare more sustainable and equitable.

The integration of blockchain technology in modern healthcare is coming to head as a possibility to address critical data security challenges. Healthcare organizations handle vast amounts of sensitive patient data, including medical histories and insurance information, making them prime targets for cyberattacks.

Here’s how it could work for your healthcare business:

Blockchain enables encrypted, immutable records that can only be accessed with proper authorization, reducing the risk of data breaches and unauthorized access. With data distributed across multiple nodes, it makes the system more resilient to cyberattacks. This system also aids with HIPAA compliance by providing auditable trails of all transactions, ensuring accountability and improving overall data integrity.

To move a business in health care to a blockchain system, it should begin by assessing its current data management systems and identifying areas where blockchain can provide the most benefit, such as patient data security, supply chain management, or clinical trials. From there, partner with a blockchain tech partner with expertise in healthcare compliance to ensure the data is stored safely and remains accessible.

This can be a large project for a modern healthcare business, but with the right implementation, it can improve care coordination and give better security measures to sensitive information.

As we look ahead to 2025, automation and blockchain are poised to play pivotal roles in reshaping the healthcare landscape. Routine tasks—such as patient scheduling, claims processing, and data entry—are becoming more efficient, allowing healthcare providers to focus more on patient care. Similarly, AI-powered tools are enhancing diagnostics and personalized treatment plans, improving outcomes while reducing costs.

These technologies offer healthcare providers the opportunity to reimagine their operations and care models.

healthcare industry trends, healthcare venture capital trends, healthcare marketing trends, health care trend

October 17, 2024 | Last Updated on: October 17, 2024

Businesses and residents of multiple states have been negatively impacted in recent weeks, causing billions of dollars in damages and losses for communities across the South and East coast. Rebuilding efforts have started, but the reality is much bleaker for many small businesses. Disaster loans have recently dried up from the SBA, and Congress will not be back in session for a few more weeks.

Unfortunately, this could lead to further businesses not making it through the aftermath of the storm. Historically, a large swath of businesses that experience a large natural disaster never come back from it, according to FEMA. But there are things you can do to mitigate and prepare if or when the next natural disaster occurs.

Here’s what you need to know.

The aftermath of a storm can be difficult to navigate for anyone. For business operators, it can mean an extended period of time without any incoming business, which can mean the end for many small businesses.

As the beginning stages of the recovery process begin, take these steps into account:

1. Document everything, and file a claim with your insurer

Just like any insurance claim, your insurer will need documentation of the losses to your building. Additionally, check into what your coverage amounts are to see what will be likely covered or not.

2. If you need assistance, apply immediately for a disaster loan

If your community has been impacted, you won’t be the only one applying for a disaster loan from either the federal government for lenders. It’s best to submit your application for financial help as quickly as possible, even if you’re unsure if you need it. This is because lenders can take a significant amount of time to process, approve, and disburse funds to those who need it.

And if you’re approved and don’t need the disaster loan funds, you can always decline the loan with no penalty.

3. Create a recovery timeline for you and your employees

There’s a ton of uncertainty after a storm, and your employees will look to you as the leader to bring some level of assuredness.

As you begin recovery, do your best to create, deliver, and communicate a timeline of next steps. This could be steps like cleaning up any mess left behind, reconstruction, and reopening your location. This will give your team goals to work towards in a time of frustration and defeat.

As climate change is upon us, it’s only a matter of time before the next natural disaster hits. If you want to prepare for the next potential storm, here are a few tips to consider:

1. Prepare your physical assets with upgrades

If you have a physical storefront or location that is in need of upgrades, the SBA has a loan program that could potentially help you. The Small Business Administration offers mitigation loans to help businesses upgrade their buildings against potential natural disasters. This includes purchases like sealing a roof deck against flood damage, installing a fire-rated roof, building hail protection from hailstorms, and more.

You can find out more about what upgrades will qualify here.

2. Prepare financially

When disaster hits, your insurance and other lending options can be available, but it may not cover everything. It’s up to you to have money put away for an emergency.

Additionally, look into your insurance policies to see what events are covered and how much coverage you have. If you’re under-insured, you may consider raising your coverage amounts to protect your business assets.

3. Evaluate your business plan ahead of the next disaster

The best businesses pivot when things drastically change. Maybe there is a way for your business to lean into another revenue stream while one is down because of a disaster.

Disaster will strike when you least expect it, and operators need to have a plan in place to get back up and running as quickly as possible. A small business disaster loan can help, but there is also plenty you can do ahead of the next storm to minimize the damage.

disaster loan assistance, loan disaster assistance, injury loan, disaster loans for individuals

October 18, 2024 | Last Updated on: October 22, 2024

The last few weeks of storms have pounded states across the Atlantic including Florida, Georgia and the Carolinas, leaving millions scrambling for resources like SBA disaster loans and other funding.

To add fuel to the fire, the Small Business Association (SBA) announced that funds for vital disaster loan programs have run dry, and Congress remains in recess until Nov. 12. Despite this, it’s still encouraged to submit an SBA disaster loan application. Once funding is approved, loans will begin approval once more.

For small business owners who have been impacted by recent storms, we’re here to help you get the necessary resources to get your business back up and running.

Here’s what you need to know.

If your business qualifies for a SBA disaster loan, you could potentially get up to $2 million in loans to “replace damaged equipment or inventory and cover economic injury from business disruption,” according to SBA Administrator Isabel Casillas Guzman.

These loans are meant to be a supplement alongside any insurance coverage as well as FEMA funding, which was allotted $860 million in funding by the Biden administration.

Here are several loans you may be able to qualify for:

If you prefer to apply in-person, there are application sites in several affected states:

|

Florida |

Business Recovery Center (BRC) Manatee County Rocky Bluff Library 6750 US-301 Ellenton, FL 34222 Hours: Monday – Saturday, 9 a.m. to 6 p.m. Closed: Sunday

Business Recovery Center (BRC) Sarasota County Sarasota Christian Church 2923 Ashton Rd Sarasota, FL 34231 Hours: Monday – Saturday, 9 a.m. to 5 p.m. Closed: Sunday |

|

Georgia |

Business Recover Center (BRC) Eastern Heights Baptist Church, 23805 US Hwy 80 E, Statesboro, GA 30461 Regular hours: Monday – Friday, 8 a.m. to 5 p.m., Saturday, 10 a.m. to 4 p.m., closed on Sunday

Business Recover Center (BRC) County: Savannah Entrepreneurial Center, 801 E Gwinnett St, Savannah, GA 31404 Regular hours: Monday – Friday, 8 a.m. to 5 p.m., Saturday, 10 a.m. to 4 p.m., closed on Sunday |

|

North Carolina |

Disaster Loan Outreach Center (DLOC) Mecklenburg County U.S. Small Business Administration District Office 6302 Fairview Road Suite 300 Charlotte, NC 28210 Hours: Monday – Friday, 8 a.m. to 5 p.m. Closed: Saturday and Sunday

Business Recovery Center (BRC) Buncombe County Asheville Chamber of Commerce 36 Montford Avenue Asheville, NC 28801 Hours: Monday – Friday, 9 a.m. to 6 p.m. Saturday, 9 a.m. to 3 p.m. Closed: Sunday

Business Recovery Center (BRC) Watauga County Appalachian Enterprise Center 130 Poplar Grove Connector Boone, NC 28607 Hours: Monday – Friday, 8 a.m. to 6 p.m. Saturday, 9 a.m. to 3 p.m. Closed: Sunday |

Here’s how you can apply for FEMA assistance:

Depending on your business’s location, you may be able to also qualify for funding from your respective state. Here are small business resources for these impacted states:

Resources are launching each day to help small business across the East Coast and Southeast get back on their feet, and we will do our best to update this as new funding becomes available.

disaster loan assistance, loan disaster assistance, injury loan, disaster loans for individuals

October 17, 2024 | Last Updated on: October 17, 2024

Former President Donald Trump has been scarce on sharing his vision for small businesses during his 2024 campaign. In a recent podcast appearance with Dave Ramsey, he pointed to letting small business owners create jobs by “letting them do what they have to do, but we still have to give them a playing field,” and then quickly pivoted to discussing China and his emphasis on trade tariffs.

Despite scant details, more small business owners feel that a second Trump presidency would net them a better outcome. In the CNBC SurveyMonkey Small Business Confidence Index Q3 2024, half of small business owners think Donald Trump will have a positive impact on their business, compared with only 32% for his opponent.

Here’s what you need to know about how a Donald Trump 2024 presidency could affect your small business.

The Biden administration has been hammered with lawsuits from business groups claiming government overreach into the private sector. From reclassifying independent contractors to banning noncompete clauses, there has been a slew of government intervention in the private sector.

What this means for SMBs: A Trump administration will mean a suspension or reversal of many of the Biden administration’s labor regulations. This could benefit industries that rely on contract workers like those in private events, warehousing, and transportation. Additionally, businesses that use noncompete agreements like creative designs, portfolio managers, and those with exclusive client relationships would be able to retain their exclusive relationships if and when employees leave.

Trump was the first US presidential candidate in this race to propose the idea of no taxes on tips. Harris followed closely behind, adopting one of the few common policy goals between the two candidates.

Pundits have dubbed this as a way for both candidates to appeal to those in the service sector, particularly in Nevada, a swing state. This potential policy has drawn mixed reactions across the board, especially for restaurant operators.

A recent Eater article highlights one of many potential issues that could come from this policy: “This plan will create resentment between the front and back of the house in my workplace,” says Ned Baldwin, owner of Houseman in Hudson Square. “In this plan, cooks will pay taxes on their income but the servers, largely, will not. The plan seems arbitrary and unfair to the restaurant.” Additionally, Trump has touted potentially ending taxes on overtime wages. This imbalance could possibly force operators to pay non-tipped employees even more.

What this means for SMBs: For business operators with workers who earn tips, this could bring a significant dynamic change inside your business. For businesses with hourly workers, this could potentially raise employee costs across all sectors as more hourly workers push for overtime wages.

One of former President Trump’s largest election stances has been to put pressure against companies outsourcing labor and goods away from the U.S. He wants to reverse that trend, and disincentivize imported goods with significant tariffs through a “manufacturing renaissance.”

At a recent rally, he said he envisions “a mass exodus of manufacturing from China to Pennsylvania, from Korea to North Carolina, from Germany to right here in Georgia.”

What this means for SMBs: If your small business is in the manufacturing or labor sector, this could be a significant benefit to your operations. However, if you import goods that would be subject to this significant tariff, it would be a substantial increase in costs.

Consumers are reaching record levels of credit card debt, and interest payments have soared into the hundreds of billions. And as the Federal Reserve has hiked interest rates, rates on credit cards have risen in tandem.

In response, former President Trump proposed capping credit card issuers to charging 10% APR on their products. This is a long fall from the current average APR of 21.76%, according to the Federal Reserve Bank of St. Louis.

What this means for SMBs: If this were to make it through Congress and pass (which experts highly doubt), this could cause access to credit to dry up. This means that business credit cards for small business owners could become more difficult to be approved for, and consumers may not be able to get credit as easily for their own purchases.

Some of the former President’s ideas could have a significant impact on your business operations if he is elected president in 2024. You can read more about his various proposals here.

We’re here to give you the facts of the US presidential candidates and their respective small business policies to make the best voting decision for you and your business.

usa election result 2024, usa election result, election usa 2024, election usa

October 17, 2024 | Last Updated on: October 17, 2024

Vice President Kamala Harris has been hard at work promoting her fiscal ideas for small business owners throughout her short-lived presidential campaign in 2024. And even before securing the Democratic nomination, the current second-in-command has been vocal about her advocacy for small business throughout her vice presidency.

In the weeks leading up to the election, she has announced several proposals aimed to help more entrepreneurs get their operations off the ground, and how she plans on adjusting the tax code to be favorable for small businesses.

Here’s what you need to know as a small business owner if Harris wins the presidency in 2024.

The Kamala Harris campaign website has a section dedicated to the small business community, and what she aims to do with her Opportunity Economy agenda. It includes ambitious goals like:

What this means for SMBs: This could potentially represent not only more competitors in your industry, but more people setting out on an entrepreneurial journey, reducing the available workforce to fill open job listings. Small businesses face headwinds finding qualified workers, with 90% of business operators trying to hire reporting few or no qualified applicants for the positions they were trying to fill, according to the NFIB.

What this means for SMBs: This could give aspiring entrepreneurs the boost they need to get started. The average business startup costs about $40,000, according to Shopify. However, critics say this doesn’t solve the root issue of early business failure: cash flow. Many early businesses don’t turn a profit in their infancy, and if a business folds before becoming profitable, the deduction won’t be able to be used. But for those that do make it to profitability, it can be a great way to reduce their tax burden.

What this means for SMBs: If you’re already in business, you likely know the headaches of filing business taxes, Harris’ plan could minimize your tax headaches with a standard deduction. This isn’t a new concept as Hillary Clinton proposed this idea during her 2016 presidential campaign. It’s estimated that a small business spends 82 hours and $2,900 per year on tax compliance, according to the Taxpayer Advocate Service.

What this means for SMBs: In a July 2024 report, the SSBCI reported it approved 3,600 businesses for capital funding. 80% of those approved were businesses with less than 10 employees. Harris aims to continue pushing more funding into these programs to ensure small business owners continue getting the funding they may not otherwise be approved for.

You can read more about her small business policy breakdown here (see page 46).

If Harris is the winner in the presidential campaign in 2024, business owners could potentially see significant tax changes. For example, the 2017 Tax Cuts and Jobs Act signed during the Trump administration would likely expire without extension at the end of 2025. The TCJA gives business owners the ability to deduct 20% of their costs before their income “passes through” to their individual returns. This has significantly benefitted small business owners, but Democrats have slammed the TCJA as merely a way for business owners to pay less taxes.

Additionally, Vice President Harris has proposed raising the corporate tax rate from the current 21% enacted by the TCJA to 28%. This is a walk back of her 35% proposal during her brief presidential campaign in the last general election. The Harris campaign says this is “a fiscally responsible way to put money back in the pockets of working people.”

If you’re someone looking to start a business, the Harris campaign looks to be bringing some great incentives. However, for someone that is currently operating a profitable business, you could see a higher tax bill if Harris is the 47th President of the United States.

Some of Vice President Harris’s proposals could have a significant impact on your business operations if she is elected president in 2024. You can read more about the policies she is running with here.

We’re here to give you the facts of the US presidential candidates and their respective small business policies to make the best voting decision for you and your business.

Term Loans are made by Itria Ventures LLC or Cross River Bank, Member FDIC. This is not a deposit product. California residents: Itria Ventures LLC is licensed by the Department of Financial Protection and Innovation. Loans are made or arranged pursuant to California Financing Law License # 60DBO-35839