Boost Your Practice

With Cosmetic Surgery Loans

Looking for Business Financing?

Apply now for flexible business financing. Biz2Credit offers term loans, revenue-based financing, lines of credit, and commercial real estate loans to qualified businesses.

Set up a Biz2Credit account and apply for business financing

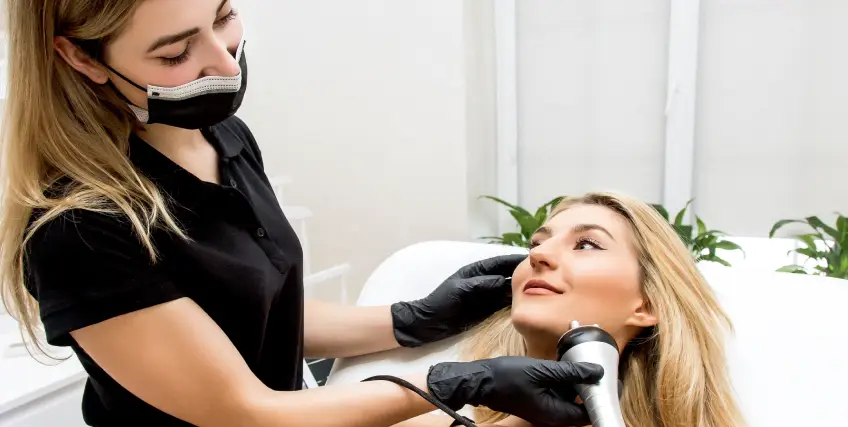

The cosmetic surgery industry in the U.S. has seen steady growth in both surgical and non-surgical procedures. Clinics now offer a broad range of services like breast augmentation, liposuction, facelifts, rhinoplasty, Botox, and full mommy makeover packages. As a result, they are pushed to expand facilities and enhance patient care.

This rising demand brings an urgent need for business capital. Upgrading equipment, hiring skilled plastic surgeons, or expanding into wellness and skin care services all require upfront investment. And not every clinic has the reserves to cover large surgery costs or new hires.

That’s where cosmetic surgery loans come in. They help clinics fund growth while keeping day-to-day operations running. These loans cover everything from facility renovation to post-operative care infrastructure and even marketing for elective procedures.

With access to the right financing options, clinics can maintain quality, meet compliance standards, and serve more patients. Whether it’s installing a new imaging system or launching interest-free payment plans - having financial support can be a game changer for providers looking to grow in a competitive space.

Why Cosmetic Surgery Centers Need Financing

Cosmetic surgery centers today do more than just operate. They offer complex treatment plans, flexible payment options, and high-end services tailored to a growing consumer base. But meeting these expectations takes money. That’s why so many clinics turn to cosmetic surgery loans.

First, there’s equipment. From advanced laser tech and surgical beds to skin care tools and diagnostics, these equipment pieces aren’t cheap. Upgrading tech improves precision and client outcomes, especially in procedures like breast lift, tummy tuck, or facelift. Equipment financing makes these upgrades feasible without draining reserves.

Second, space is critical. Clinics often renovate or expand to accommodate new rooms for non-surgical services or private post-operative recovery areas. A cosmetic loan helps manage renovation costs while maintaining cash flow.

Staffing is another expense. Hiring qualified staff like licensed plastic surgeons, anesthesiologists, and nurses impacts both quality and scale. Salaries, training, and benefits are all costs that can be supported through surgery loans.

Finally, client acquisition is key. Marketing campaigns, social media ads, and SEO work, especially for rhinoplasty, liposuction, or breast implant services, require money. With the right plastic surgery financing, clinics can drive growth without over-leveraging themselves.

Whether you’re covering monthly payments during off-seasons, or need capital for new certifications and compliance updates, cosmetic surgery financing gives clinics flexibility. It lets them scale, stabilize operations, and build a loyal client base, even when credit history or credit score might not be perfect.

Top Uses of Cosmetic Surgery Loans

Clinics don’t just borrow to stay afloat; they borrow to grow. Here’s how cosmetic surgery loans are most commonly used in the industry.

a) Equipment & Technology

Modern procedures depend on high-end tools such as laser systems, injectables, cooling devices, imaging tech, and patient monitoring tools. These aren’t just nice-to-haves. They’re must-haves in procedures like liposuction, tummy tuck, and skin care therapies.

Getting these financed through plastic surgery financing lets clinics keep up with trends while avoiding upfront expenses. It also helps with repairs, software upgrades, or replacements - all essential for keeping the business safe, legal, and effective. For clinics aiming to stay competitive in a fast-moving space, this is one of the smartest ways to use a cosmetic loan.

b) Office Expansion or Renovation

Patients expect clean, private, and welcoming environments, especially when it comes to cosmetic surgery. If your space is outdated or cramped, it could affect patient trust and satisfaction.

Cosmetic surgery financing supports expansions, new treatment rooms, aesthetic redesigns, and even the buildout of dedicated post-operative spaces. Renovating to comply with updated regulations or adding wellness offerings like non-surgical treatments can make a real difference. Clinics also use loans to furnish spaces with ergonomic chairs, lighting systems, and noise-reduction tools.

c) Marketing and Client Acquisition

Most cosmetic procedures are electives, i.e. patients choose them when they trust a clinic’s brand. That’s why high-quality marketing is vital.

Whether you’re pushing facelift offers through digital ads or targeting social media audiences with breast augmentation promos, marketing costs money. A cosmetic surgery loan gives clinics the budget they need for PPC ads, SEO content, influencer partnerships, or even CRM software. It can help you attract and retain clients while measuring real ROI. Plus, it ensures marketing spend doesn’t eat into operating capital.

d) Hiring Skilled Professionals

You can’t run a successful clinic without licensed, experienced professionals. That includes board-certified plastic surgeons, anesthesiologists, scrub techs, and front-office staff.

Surgery loans cover hiring costs, onboarding, training, and even benefits. If you’re adding services like Botox, breast lift, or mommy makeover, you’ll need specialized talent to match. Using business financing to build a stronger team helps clinics grow their service offerings and scale their operations.

e) Managing Cash Flow for Seasonal Slumps

Cosmetic clinics often see fluctuations in patient volume based on seasons, holidays, or local events. While some months bring a surge in breast implant or rhinoplasty procedures, others might slow down.

Instead of worrying about rent, salaries, or supplier payments during lean periods, clinics use cosmetic loans to bridge gaps. Some opt for revenue-based financing to repay based on cash inflow, helping them avoid strain when demand dips. This makes it easier to manage operations without panicking.

Popular Financing Options for Cosmetic Surgery Centers

Not all clinics need the same type of funding. These are the most popular cosmetic surgery financing solutions in the market today.

a) Term Loans

Terms loans come with fixed loan terms, set interest rates, and structured monthly payments. They’re ideal for large one-time expenses like buying new laser tech or launching a new service line. Most clinics repay over 1–5 years, depending on their credit score and revenue.

b) Equipment Financing

Instead of paying full price for devices upfront, clinics can finance tools like imaging machines, suction systems, and surgical chairs. The equipment itself acts as collateral. This helps providers manage budgets and still access the best tools for elective procedures and non-surgical services.

c) Business Line of Credit

This revolving credit lets clinics borrow only what they need and repay over time. It’s handy for covering recurring costs like inventory, staffing, or last-minute repairs. Great for short-term needs or unpredictable months.

d) Revenue-Based Financing

Instead of fixed payments, you repay a percentage of estimated future receivables. In short, you pay a portion of your monthly income. This is useful if your revenue fluctuates due to seasonal demand, procedure type, or client volume. With revenue-based financing, funding approval depends more on monthly sales than credit report or score.

What Lenders Look for Before Approving Loans

Before you apply for plastic surgery financing, it helps to know what lenders evaluate. These are the top factors they consider when reviewing your application.

a) Credit History and Credit Score

A strong credit score shows you’re responsible with repayments. Most lenders look at your business and personal credit history, including payment patterns, credit utilization, and delinquencies. A clean credit report gives you access to better loan terms, lowest rates, and higher approval odds. Even if your score isn’t perfect, many lenders still offer cosmetic surgery loans if other financials are strong.

b) Business Revenue

Consistent monthly or annual income is a major plus. Lenders want to know if your practice can handle monthly payments without stress. Clinics offering multiple cosmetic procedures like facelifts, tummy tucks, or liposuction, often have stable revenue. Documentation such as bank statements, tax returns, and P&L reports are usually required to verify your numbers.

c) Time in Business

How long you’ve been in business matters. Lenders often favor clinics with at least 1–2 years in business. It signals you’re past the risky startup phase. Clinics with a track record in high-demand areas like plastic surgery, skin care, or wellness tend to get quicker approval, better interest rates, and more flexible financing options.

d) Loan Purpose

Clearly explaining why you need the loan builds lender trust. Whether it’s buying new plastic surgery equipment, covering post-operative care upgrades, or renovating your facility, lenders want to see if you have a plan. Specificity around loan amount, usage, and impact on operations helps strengthen your application.

How to Apply for Cosmetic Surgery Loans

The application process doesn’t have to be complicated. Here’s a simple breakdown of what most cosmetic surgery centers need to do:

Start by identifying your financing goal. From buying a new imaging device to managing payroll to launching a new non-surgical procedure, you need to be clear when it comes to understanding your goal. Calculate the loan amount you’ll need and the period of time you plan to repay it over.

Next, gather your financial records. This includes profit and loss statements, recent tax filings, and your business credit report. Lenders will use these to assess your cash flow and repayment ability. Having this data ready can help you prequalify faster and avoid delays.

Make sure to check your credit history and resolve any issues before applying. Even small actions like paying off credit cards can boost your credit score and qualify you for lowest rates or interest-free options.

Once that’s done, compare offers. Look into different financing plans, ask about origination fees, and understand the repayment terms. Don’t just focus on the rate but watch for prepayment penalties, extra charges, and hidden costs that could strain your clinic’s financial situation.

You’ll typically be asked to submit your business license, ownership documents, and details on how you’ll use the funds. Many lenders offer decisions within a few business days, especially for smaller cosmetic loans.

Tips to Get the Lowest Rates on Cosmetic Surgery Loans

Getting approved is only half the battle. Here’s how your cosmetic surgery center can qualify for the lowest rates and most favorable loan terms.

a) Maintain Strong Financial Records

Lenders want to see that your clinic runs efficiently. Organize your balance sheets, income statements, and tax filings. Clear and consistent financials give them confidence in your ability to repay. This is especially important for clinics offering diverse cosmetic procedures like Botox, breast implant surgery, etc., where monthly income may vary. Accurate records can directly influence your eligibility for plastic surgery financing with better rates.

b) Improve Credit Score Before Applying

Before you apply for plastic surgery financing, check both your personal and business credit score. Correct any errors in your credit report, pay off overdue bills, and reduce credit utilization. Even small improvements can impact the interest rate you're offered. A better score can also lead to faster funding decisions and access to higher loan amounts, all of which are crucial for clinics planning to expand or add high-demand services like mommy makeovers.

c) Shop Around and Compare Offers

Don’t jump on the first offer. Compare multiple lenders for cosmetic surgery loans and review their financing plans, payment options, and terms. Look at things like origination fees, prepayment penalties, and whether the provider offers special financing or interest-free periods. Some lenders may even allow you to pre-qualify without affecting your credit. A little comparison shopping now can save your clinic thousands over the life of the loan.

Trusted by Thousands of Small Business Owners in America.**

Simply because we get what you go through to build a business you believe in.

**Disclaimer: All stories are real, as told by real business owners. Customers do not receive monetary compensation for telling their stories.

From One Entrepreneur to Another: We Get You

We understand what's behind building a business you believe in.

All stories are real, as told by real business owners. Customers do not receive monetary compensation for telling their stories.

Articles on Loans for Cosmetic Surgery Centers

Tips to Get a Loan for Cosmetic Surgery Center: A Step-by-Step Guide

Cosmetic and plastic surgery procedures are accessible to not just celebrities anymore. They are within easy reach of common people.

Business Loans for Cosmetic Surgery Centers: Financing Options to Grow Your Practice

In the competitive business landscape of aesthetic medicine, staying ahead requires continuously investing in your practice. Whether

Cosmetics Equipment Financing for Franchise Owners: What You Need to Know

A plethora of initial expenditures accompanies the opening or growth of a cosmetics franchise, none greater than the investment in

How to Get a Loan to Start a Cosmetic Surgery Center

From breast lifts to botox, Americans are spending big amounts on beauty. These days cosmetic surgery is no longer niche

Frequently Asked Questions

1. Can I get cosmetic loans with a lower credit score?

It is possible to secure cosmetic loans with a low credit score, but it may impact your interest rates or limit your financing options. Some lenders offer cosmetic loans based more on revenue than your credit history. It’s still smart to improve your score before applying.

2. What types of equipment can I finance?

You can finance lasers, body contouring machines, injectables equipment, surgical tables, sterilization units, and more. If it’s used for plastic surgery or skin care procedures, there’s likely a loan option for it.

3. Do loans cover non-surgical treatments like Botox or skincare?

If the treatment generates revenue for your clinic, you can likely finance it. Many clinics use loans to launch non-surgical lines or upgrade rooms for wellness and skin care services.

4. Can I apply if I offer only elective procedures?

Most cosmetic surgery financing is geared toward clinics that perform elective procedures like rhinoplasty, breast reduction, or facelift. Revenue consistency matters more than the nature of the procedure.

5. Can I finance both surgical and non-surgical upgrades together?

Whether it’s new lasers for non-surgical treatments or surgical beds for plastic surgery, you can bundle multiple expenses into a single cosmetic loan, but it depends on lender terms.

Frequent searches leading to this page

Term Loans are made by Itria Ventures LLC or Cross River Bank, Member FDIC. This is not a deposit product. California residents: Itria Ventures LLC is licensed by the Department of Financial Protection and Innovation. Loans are made or arranged pursuant to California Financing Law License # 60DBO-35839