Top Loan Options for New and Growing Optometry Clinics

December 11, 2025 | Last Updated on: December 11, 2025

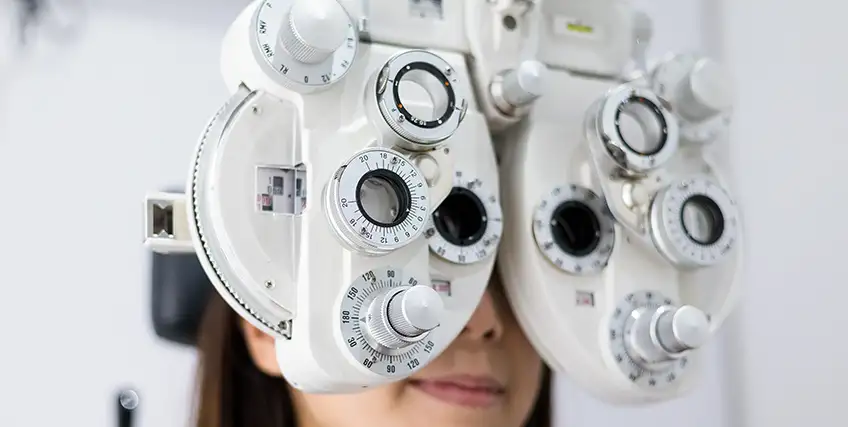

Like other medical professions, running an optometry practice requires significant and specialized investment. Optometry offices require precise tools to perform eye exams, diagnose potential issues, and provide treatment options for patients. Not every office has the steady optometry practice revenue to make big investments in their present and future. That’s why optometry business loans can be so valuable.

Securing capital can support expansion, equipment upgrades, and everyday operational costs. They can support stability for business owners who want to provide a top-tier healthcare experience for patients. However, securing optometry practice financing isn’t always easy. Lenders may view optometrist offices as risky borrowers, especially new practice owners. Here, we explore how you can use optometry business loans and how to maximize your chances of getting approved.

In this article:

- How to finance an optometry practice using optometry business loans

- Types of loans that can benefit your practice, from optometry equipment financing to SBA loans.

- How to improve your chances of qualifying for financing.

Why Do You Need Optometry Business Loans?

Simply put, access to business loans can unlock opportunities. Whether you have a brand new practice or you’ve been in business for a while, financing can modernize your clinic and ensure you have the latest imaging technology, sophisticated customer management tools, and the space you need to provide the best service possible. Some optometrists want to be able to provide specialized treatments or improve their marketing efforts to drum up more regular patient revenue. There are many business reasons why optometry business loans are so valuable.

Securing financing for medical practices can be difficult, however. Every loan is subject to credit approval, and lenders want to see a practice’s credit history, revenue trends, outstanding debts, and licensing before deciding on loan terms. Since optometry practices often have high costs, more limited reach than day-to-day healthcare centers like urgent cares, and higher risk of litigation from unhappy patients, the loan process can be a bit more rigorous. Nonetheless, that doesn’t mean you can’t find optometry practice financing solutions to support your practice management.

How Can You Use Optometry Business Loans?

Whether you’re just getting started or you’ve been in business for a while, there are important considerations when starting a private practice. You’ll have startup costs, location costs, equipment costs, licensing costs, insurance costs, and much more. Securing working capital can help support both your operational costs and bolster your cash flow to prepare for more significant growth investments.

Some of the ways you could use optometry business loans include:

- Upgrading equipment and technology: Modern diagnostic tools are essential in optometry practices today, but specialized medical equipment is extremely expensive. Optometry equipment financing allows you to offset the upfront costs to purchase autorefractors, optical coherence tomography (OCT) machines, and advanced imaging systems without depleting cash reserves. Likewise, optometry equipment leasing may give you even more flexibility.

- Expansion or renovation: A well-designed practice can improve the patient's experience and streamline your workflow. Optometry business loans can support investments in new facilities, competitor practice acquisition, or renovations to improve your existing ones.

- Hiring and training: Experienced opticians, technicians, and administrative staff will improve the quality of your service, but it comes at a cost. With optometry business loans, you can get the upfront cash you need to pay the salaries of people who will grow the bottom line for your business. You could also use money to invest in training programs to keep the team updated on the latest eye care advancements and technology.

- Improve marketing: Effective marketing brings in new patients and can help retain existing ones. Almost any type of loan can help cover expenses for digital advertising, website development, social media campaigns, and local community outreach efforts.

- Manage inventory and supplies: Any optometry practice will have a rapidly depleting supply of eyewear, lenses, contacts, and medical tools. Optometry business loans can help keep inventories stocked without cash flow disruptions.

Types of Optometry Business Loans

Optometry practice financing solutions are designed to meet different business needs so you can grow your business, improve patient care, and stay ahead of your competitors. Depending on your practice’s financial health and your personal credit history, you may qualify for different types of start-up loans or optometry business loans to meet your specific business needs. Several loan options can support your goals.

- Term loans: The conventional loans provide an upfront lump sum of money that you can use for just about any business need. You’ll repay the loan amount with monthly payments based on an interest rate.

- SBA loans: Loans backed by the U.S. Small Business Administration are among the most competitive and difficult to qualify for. However, they often offer the best interest rates and longest repayment periods and can be used for a wide range of business purposes. The SBA 7(a) program is one of the nation’s most popular.

- Equipment loans: Most optometry offices will have new equipment needs over time. Optometry equipment financing is a practical solution to help you acquire cutting-edge equipment without making a large upfront payment. Instead, the equipment itself is used as collateral for the loan, allowing you to make smaller payments to get top-notch equipment.

- Business lines of credit: A cross between a business credit card and a term loan, lines of credit give you access to a full loan amount, but only assess interest when you withdraw from the credit. Since most are revolving, you can make withdrawals to pay salaries, purchase inventory, or meet other business needs, and when you repay what you borrowed, you’ll have access to the full amount again.

- Commercial real estate loans: Whether you’re just getting started or you’re ready to expand, a commercial real estate loan can provide the financial support needed to purchase, renovate, or expand a property. These loans typically offer long-term funding with structured repayment plans, allowing you to establish a new clinic, expand an existing location, or upgrade facilities without putting a major dent in your cash reserves.

- Building and growing an optometry practice requires significant capital. Both conventional and alternative business financing options can support your needs, whether it’s hiring additional staff, covering operational expenses, acquiring new equipment, or improving your marketing.

How to Get an Optometry Business Loan

Getting an optometry business loan is similar to any other business loan. Whether you’re applying with a traditional lender or an online lender, you’ll need to know your credit score, have a firm grasp of your business financials, and prepare a business plan. When you’re ready to begin, the process may look like this:

- Determine your funding needs: Understanding how you’ll use the loan proceeds is an important first step because it will inform the loan amount you need and the type of loan you pursue. For instance, if you just need a new piece of equipment, an equipment loan may make more sense than a term loan.

- Compare lenders: Many lenders offer optometry business loans, but some may be reticent to work with medical professionals. When you’re comparing lenders, assess the eligibility requirements to qualify for different types of funding, as well as your own quality as an applicant. Make sure to contact lenders to ensure they’re willing to work with high-risk industries like medicine.

- Gather documentation: When you’ve found the right lender, gather your business information, medical licensing information, tax returns, financial statements, and bank statements. Different lenders may have varying documentation requirements, so be sure to clarify exactly what you need before applying for an optometry business loan.

- Apply: You can typically submit a loan application online, but some lenders may require you to come into a branch in person or apply over the phone.

Final Thoughts

An optometry business loan can give your practice a significant boost. Whether you want to hire a new optometrist, upgrade to the most cutting-edge equipment, or simply get a little more flexibility to cover day-to-day expenses, loans can help. Depending on your specific needs, there are a range of loan options and lenders you might consider.

FAQs About Optometry Business Loans

How much does an optometry practice make?

The American Optometry Association (AOA) reports that optometry practices may achieve a net profit margin of 30-40%, and the average net income for private optometry practices is $168,193 per year.

How can I finance the purchase of an existing optometry practice?

There are several financing options you may pursue, including commercial real estate loans, SBA loans, term loans, or even an alternative solution like revenue-based financing.

What are the key considerations when starting a private optometry practice?

When you’re just getting started, consider the startup costs, location costs, how you’d like to pay for equipment, as well as more industry-specific costs like licensing and insurance. Securing working capital from the start will help you manage these significant startup costs and ensure smooth operations when you’re just starting out.

Should you buy or lease optometry equipment?

There are pros and cons to each. Leasing is similar to renting, allowing you to use a piece of equipment for a specific period of time in exchange for monthly payments. At the end of the term, you can either give the equipment back and lease something new or purchase it outright. Buying ensures you will have the equipment for a longer period of time and can be more cost-effective in the long-run, but in a field like optometry, you may risk the equipment becoming obsolete fast.

Are optometry business loans medical practice financing?

Medical practice financing provides essential financial support to healthcare professionals, including optometrists. As such, optometry business loans are a form of medical practice financing, designed to help optometrists establish, expand, or enhance their practices.