Shift from Purchase to Pay-Per-Use & EaaS the New Models in Equipment Financing Loan

September 30, 2025 | Last Updated on: September 30, 2025

The rapid transition from traditional ownership to pay-per-use and Equipment as a Service (EaaS) is redefining how businesses approach the concept of an equipment financing loan.

This paradigm shift isn’t just changing how companies acquire machinery and technology; it’s actively transforming business models, optimizing operations, and setting the stage for long-term competitiveness.

In a landscape shaped by digitalization, cost consciousness, and rapid innovation, understanding these new models is crucial for decision-makers seeking to leverage equipment financing loan for growth and flexibility.

The Dawn of a New Financing Era

For decades, the conventional path to acquiring business equipment has been straightforward: either buy the assets outright or accept an equipment financing loan.

Difficulties associated with asset purchase may include capital being tied up, strained balance sheets, and long-term liabilities such as depreciation and obsolescence.

Such historical paradigms should be replaced by smarter solutions, given the current economy's fluctuating demand, complex supply chains, and the accelerated pace of technological change. Smarter approaches that correlate costs with usage and support operational flexibility should be adopted.

From Ownership to Access: The Pay-Per-Use Revolution

The pay-per-use model, which is at the heart of EaaS, releases organizations from the burden of high upfront costs. Instead of purchasing equipment, organizations now pay periodic competitive rates for use.

The cost barrier of high capital investment is therefore eliminated, mimicking the shift from ownership to access already seen in software, cars, and even home appliances.

By translating capital expenditure (CapEx) into operating expenditure (OpEx), pay-per-use not only maximizes cash flow but also unlocks important off-balance-sheet advantages. No longer do companies bear the entire cost of depreciation, risk, or maintenance.

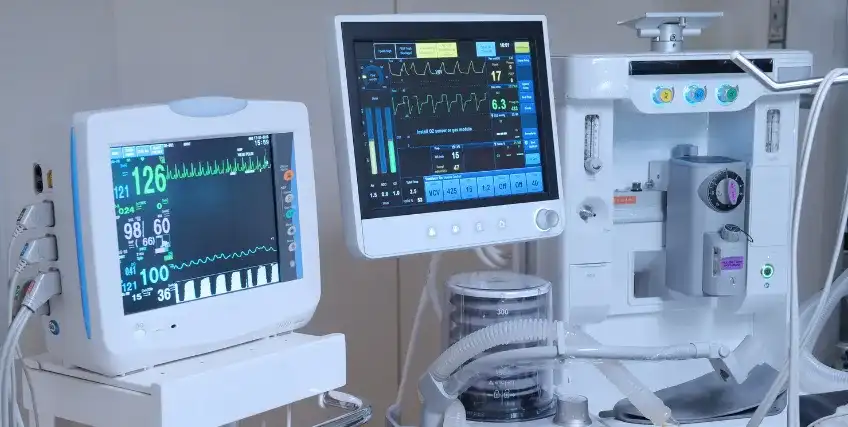

Such a transition is especially relevant in capital-intensive industries, such as manufacturing, construction, healthcare, and logistics, where equipment financing loan usage is sporadic and technology continues to evolve on an ongoing basis.

The Mechanics of Equipment as a Service (EaaS)

EaaS takes the pay-per-use concept to the next level by providing comprehensive solutions, including equipment, maintenance, upgrades, and services, all included in a single service contract.

Instead of the equipment financing loan cost of a machine, businesses have access to the whole value chain, with continuous innovation and carefree use.

Under a standard EaaS model, equipment ownership is typically vested with the service provider, ensuring that maintenance, replacement, and technology refreshments are handled proactively.

Businesses can thus keep up to date without the danger of obsolescence, while service providers create long-term, recurring annual revenue streams and more stable client relationships.

Why Businesses Are Making the Switch

The shift towards EaaS models is driven by several compelling advantages:

- Operational flexibility: Companies can both increase and decrease equipment usage in accordance with demand. Organizations can adjust quickly to any market changes without being locked into previous purchases.

- Risk mitigation: Organizations experience less downtime and uncertainty because maintenance and upgrades of the machine are handled by the provider. Built-in predictive analytics and IoT-enabled monitoring also mitigate the risk for business owners in organizations.

- Cost predictability: Transparent pay-per-use pricing allows organizations to budget with confidence, while avoiding the unknown costs associated with ownership and repairs.

- Access to innovation: Constant updates ensure that organizations consistently utilize the best equipment available, in terms of efficiency and technological advancements, to remain competitive and compliant.

- Sustainable increases: The ability to return or swap equipment within a flexible payment timeframe also allows for increased sustainability and reduced waste in business practices. These advantages are not just hypothetical.

According to fortune business current market data, the global EaaS segment is growing rapidly and is predicted to exceed $1.12 billion by 2032, primarily driven by increased adoption in the manufacturing, healthcare, technology, and transportation sectors.

Equipment Financing Loan: The Bedrock of Modern Asset Strategy

Despite the surge in EaaS, traditional equipment financing loan remains a crucial tool, particularly for businesses that want to own their assets outright or for whom asset customization is critical.

However, the lines are blurring lenders and lessors are now increasingly offering hybrid finance structures, including deferred payment plans, variable-rate contracts, and bundled service solutions, as an evolution of the basic loan product.

For many organizations, the decision between a classic or right equipment financing loan and EaaS comes down to strategic priorities, industry cycles, and risk appetite.

Fintech and Digital Transformation: Powering the Shift

What has spurred this change?

The financial technology (fintech) sector has revolutionized the landscape of equipment financing loans, providing more efficient, intelligent, and affordable access to capital.

Today’s digital lenders are utilizing AI (artificial intelligence), real-time data, and automation to assess risk, expedite loan approvals, and offer a range of payment options tailored to meet diverse business needs.

Technology is also what enables EaaS at all levels, from IoT (Internet of Things) devices that track utilization, AI (artificial intelligence) software that predicts maintenance issues, to billing platforms that automate reporting and invoicing for usage-based contracts.

Digital integration within EaaS is not just nice to have; it is necessary; it provides efficiency and transparency for both providers and customers in an ever-evolving marketplace.

Equipment Financing for Startups: Leveling the Playing Field

New equipment financing loan for businesses typically faces significant barriers to entry, including minimal collateral, a limited history of creditworthiness, and a need for the most up-to-date equipment.

Startup equipment financing solutions, offered through innovative loan and EaaS arrangements, enable new small businesses to acquire the necessary equipment financing loan without compromising their capital or jeopardizing their growth trajectory.

Current leading lenders and EaaS providers offer startups flexible qualification criteria, extended payment terms, and subscription-based access to a wide range of products, including factory automation robots, high-end medical imaging scanners, and smart kitchen appliances.

The democratization of access to these capabilities on this basis removes much of the competitive advantage deep-pocketed incumbents have had in the past.

IT Equipment Leasing: Flexibility for a Cloud-First World

In the technology industry, renting IT devices is now the norm. Rather than investing precious capital in servers, laptops, networking gear, or software-managed services, companies rent their IT stack, reducing the total cost of ownership, easing administration, and keeping employees agile.

Renting also simplifies onboarding, global expansion, and remote work, as companies can scale or de-scale device fleets in real-time.

The benefits of leasing IT hardware are obvious: predictable monthly payments, hassle-free maintenance, and a smooth hardware lifecycle that keeps organizations up to date without the perpetual burden of upgrades and end-of-life disposal.

Technology Equipment Financing: Keeping Pace with Innovation

The current trends intersect at the rapidly evolving landscape of technology equipment financing loan.

Banks, fintech, and niche lenders offer customized solutions at the segment level, allowing organizations to package hardware, software, managed services, and associated upgrades into financing or leasing arrangements, often with a favorable tax treatment structure.

Modern technology equipment financing loan is less about acquiring a “machine” and more about having continual access to the tools, support, and innovation needed to maintain competitiveness.

Overcoming Challenges and the Road Ahead

Even as adoption of pay-per-use and EaaS accelerates, it is not without problems. Prospective adopters must scrutinize carefully:

- Terms and conditions of contracts, as well as cost control measures, are to avoid unexpected costs or burdensome terms.

- Reliability and reputation of EaaS providers, considering the potential effect on mission-critical business processes with uptime operation.

- Protection and privacy of data in use measurement and remote monitoring, especially as IoT devices proliferate.

- Syncing EaaS terminology with higher-level business financing and tech strategies, with the promise that flexibility and scalability are, in fact, delivered in reality.

Future innovation in the equipment finance loan process will continue to be driven by digitalization, evolving risk models, and increasingly close collaboration between firms and suppliers. With AI, IoT, and analytics giving these products and services life, those firms that develop a new way of working will be able to not only react quickly but also seize emerging growth opportunities.

Conclusion: The Future Belongs to the Agile

The migration from equipment purchase to pay-per-use and EaaS is more than an equipment financing loan trend; it is a strategic business imperative grounded in flexibility, efficiency, and empowerment. Whether through an adaptive equipment financing loan or a bespoke EaaS agreement, organizations now have access to powerful, customizable solutions designed to meet their unique needs in an unpredictable world.

By reimagining how they acquire and leverage essential assets, forward-looking companies are transforming uncertainty into opportunity and short-term obstacles into long-term growth. The leaders of tomorrow will be those who make access, agility, and innovation the cornerstones of their equipment strategy and who recognize that in the digital era, it’s not just what equipment is owned, but how it is used, financed, and serviced, that defines competitive success.

FAQs About Equipment Financing Loan

What is an equipment financing loan?

Equipment financing is considered a type of small business loan that provides funding for the acquisition of necessary long-term assets, such as machinery, vehicles, or computers. As an alternative to making a lump-sum payment upfront, businesses make loan payments over time. The equipment being financed typically serves as collateral in the event of a missed payment, granting the lender the right to seize the collateral. This financing can help preserve working capital and can be easier to qualify for, even for businesses with subpar credit.

What is the loan to value for equipment finance?

When it comes to business equipment loans, lenders will create a borrowing base that uses the value of the equipment. The value is calculated using a loan-to-value (LTV) ratio.

What is the average interest rate for an equipment loan?

The actual rate will depend on creditworthiness and credit score; in general, the better the credit profile, the lower the rate and the more advantageous the terms.

What is the basic equipment loan agreement?

A basic equipment financing agreement allows a lender to fund business equipment loans for a specific term. The borrower agrees to make loan payments and promises to use the equipment as agreed, which includes returning the equipment in good condition once the term is completed.

How long is the average equipment loan?

Equipment financing for borrowers varies. However, most loan terms range depending on the asset's useful life, lender guidelines, and the borrower’s financial profile. Some professional services or SBA 504 small business loans can go as long as 25 years for specialized or heavy equipment.

Frequent searches leading to this page

Term Loans are made by Itria Ventures LLC or Cross River Bank, Member FDIC. This is not a deposit product. California residents: Itria Ventures LLC is licensed by the Department of Financial Protection and Innovation. Loans are made or arranged pursuant to California Financing Law License # 60DBO-35839