2023 Inflation Impact Study

May 05, 20252023 Inflation Impact Study

March 05, 20252024 Top Small Business Industries Report

December 05, 20242022 Top Small Business Industries Report

December 05, 2023Annual Latino-Owned Business Study 2024

September 30, 20242023 Inflation Impact Study

May 13, 20242023 Inflation Impact Study

March 06, 2024Annual Latino-Owned Business Study 2023

September 20, 2023Annual Top 25 Cities for Small Business Study 2023

May 03, 20232023 Inflation Impact Study

March 08, 20232023 Inflation Impact Study

January 17, 20232022 Top Small Business Industries Report

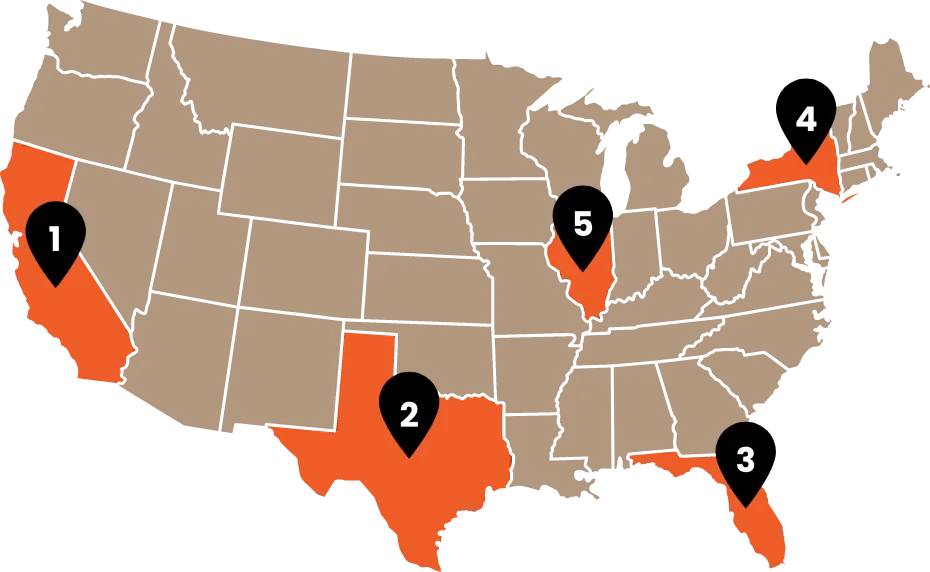

November 15, 2022Top 25 Cities for Small Business 2022

May 03, 2022Biz2Credit Top Small Business Industries Study 2021

November 17, 2021Biz2Credit Analysis of Industry Sectors Finds Restaurant Loan Approval - Biz2Credit

May 06, 2021Latino Small Business Study 2020

October 23, 2020Women-Owned Business Study - 2020

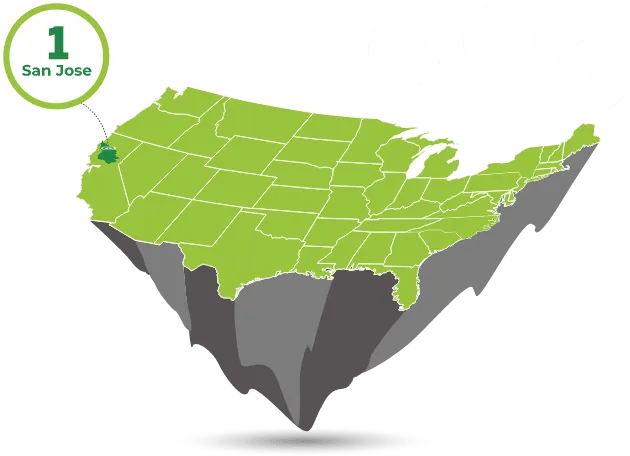

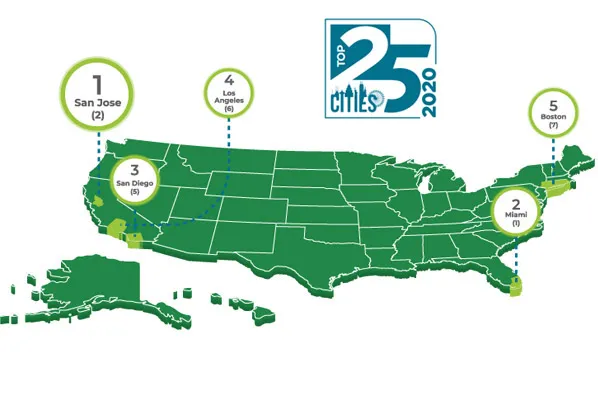

March 13, 2020Analysis Examined Markets with the Highest Annual Revenue, Credit Scores and Other Factors Biz2Credit has identified San Jose as the Best Small Business City for minority entrepreneurs in America, ba

May 12, 2014Infographic May 2014 Back Download Infographic .nrmlHdr .navBar > ul > li.drop > a { background: url(../../../images/html5/drpDownArw.svg) no-repeat

April 10, 2015Term Loans are made by Itria Ventures LLC or Cross River Bank, Member FDIC. This is not a deposit product. California residents: Itria Ventures LLC is licensed by the Department of Financial Protection and Innovation. Loans are made or arranged pursuant to California Financing Law License # 60DBO-35839