Financing for Landscaping Businesses: Ways to Fund Growth and Manage Cash Flow

Oct 09, 2025 | Last Updated on: Oct 13, 2025

Landscaping companies in the United States often face constant challenges when it comes to capital. They have a lot of things to take care of such as equipment, trucks, staff, client expectations, and deadlines. These things typically demand careful management along with a steady revenue. But at times, seasonal slowdowns, unexpected repairs, and large projects create cash flow gaps that can put daily operations at risk.

Business owners encounter these pressures while planning business expansion or serving bigger clients. So, how to overcome these obstacles? One solution is to consider options for financing for landscaping businesses. These business loans provide stability and opportunity to landscaping companies to purchase essential equipment, hire staff, and complete major landscaping projects without disrupting operations.

So, in this article we’ll explore some options for financing for landscaping businesses for U.S. business owners. We will also discuss the importance of landscaping loans, how to manage monthly payments and cash flow, factors to consider, and what lenders look for when you apply for different landscaping financing options.

Understanding Landscaping Businesses and Services

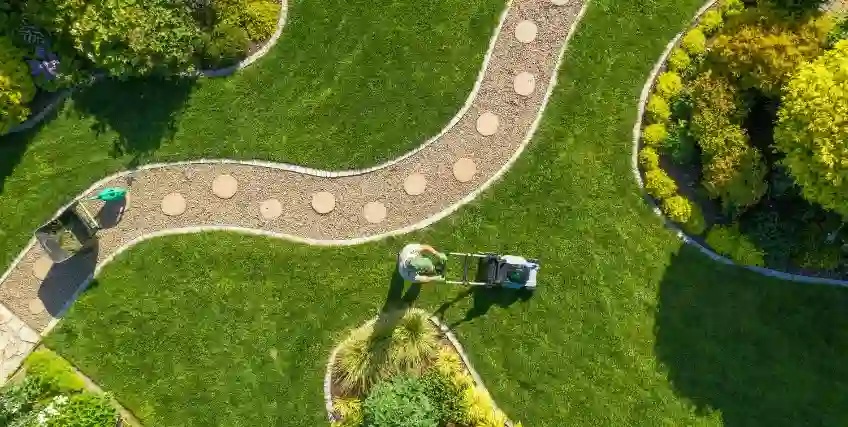

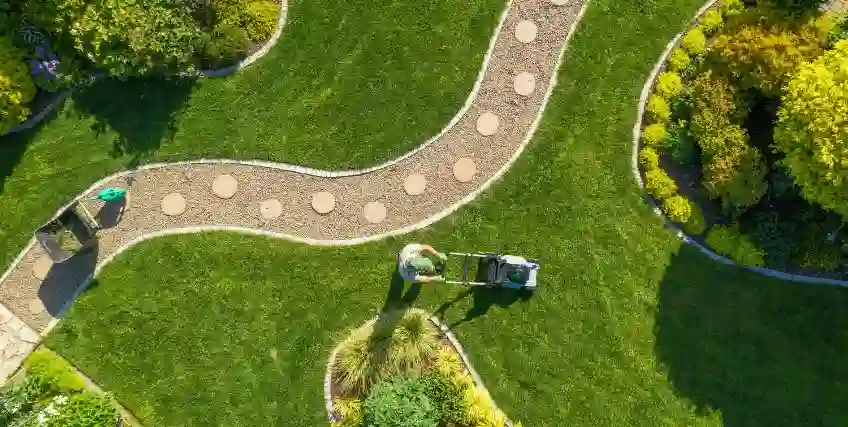

A landscaping business provides professional solutions to enhance outdoor spaces for homes, offices, and commercial properties. These companies transform plain yards into functional living spaces and attractive areas that increase property value and improve client satisfaction.

If you are a landscaping company owner in the U.S., your services may vary depending on your business size and specialization. However, most landscaping companies focus on both aesthetic and functional improvement. Also, many take on home improvement projects, such as deck installations, garden renovations, and patio upgrades, to complement outdoor designs.

But to fund all these improvements, businesses do require financing for landscaping companies. These loan options can help fund necessary equipment purchases, hire skilled staff, or expand service offerings. Funds can be used for:

- Lawn Care: Lawn care business loans can be used to mow lawns, fertilize grass, and maintain healthy yards.

- Landscape Design: Funds can be used to plan layouts and install plants, shrubs, and trees.

- Hardscaping: Business owners can construct patios, walkways, retaining walls, and decks using financing for landscaping business.

- Irrigation Systems: Business loans can be used to install systems that conserve water and protect plants.

Importance of Financing for Landscaping Businesses

Businesses often need financing for landscaping because of substantial costs that exceed day-to-day revenue. Expenses like equipment purchases, payroll for skilled employees, and marketing efforts demand significant capital. Moreover, seasonal slowdowns or large projects can create temporary cash flow gaps, making it difficult for business owners to maintain operations or seize growth opportunities.

Therefore, options for financing for landscaping businesses provide a reliable solution. These business loans help landscaping companies to support home improvement projects for clients, including outdoor space renovations and garden installations.

Here’s why financing for landscaping businesses is important:

- Equipment Purchases: Small business loans for lawn care can be used to purchase equipment like trucks, mowers, and irrigation systems.

- Labor Costs: Skilled employees and temporary staff add significant expenses. Financing for landscaping ensures consistent payroll and allows for expansion when taking on multiple landscaping projects.

- Marketing and Client Acquisition: Reaching new clients requires investment in advertising, online platforms, and local promotions. Landscaping loans help secure funding to grow your client base and increase revenue.

- Seasonal Cash Flow Management: Off-peak months can reduce income, making it difficult to cover recurring costs. Hence, loan options provide a buffer to maintain operations without disruption.

- Home Improvement and Outdoor Space Projects: Many clients combine landscaping with home improvement projects such as patios, decks, or garden layouts. Financing allows your business to start these projects promptly while offering flexible payment options to clients, sometimes through home equity loans or HELOCs.

Types of Financing Options for Landscaping Businesses

There are different types of options for financing for landscaping businesses. You can take a close look at each of the options and understand which one fits the best for your credit profile and business needs for landscaping services.

SBA Loans

SBA loans are backed by the U.S. Small Business Administration. These loans typically offer lower interest rates along with longer repayment loan terms for qualified applicants. SBA loans can be used as an option for financing landscaping businesses to purchase equipment, expand services, or maintain steady cash flow. However, to qualify for these loans business owners need a strong credit history and a clear business plan.

Term Loans

Term loans are traditional financing options that offer a fixed lump sum loan amount upfront that can be repaid over a set period of time. These loans often come with fixed rates and a fixed repayment structure. Business owners can use term loans for financing landscaping businesses to support long-term growth such as purchasing new landscaping equipment or expanding current services. To qualify for these loans, borrowers typically require good credit.

Equipment Financing

Equipment financing is a funding solution that can be used to purchase business assets like tools, machinery, and tech. Instead of paying upfront for the equipment, borrowers can pay in monthly payments. Additionally, the equipment itself serves as collateral, reducing the risk for lenders and borrowers. This option for financing for landscaping businesses can be used to purchase trucks, irrigation systems, or other large equipment without straining operating cash.

Business Lines of Credit

A business line of credit is a flexible option for financing for landscaping businesses that offers easy access to funds up to a pre-approved limit. Business owners can draw funds as they need and pay interest only on the amount used. . It can be used for short-term expenses, handle fluctuating cash flow without missing payroll or delaying landscaping services.

Therefore, from the above options for financing for landscaping companies, business owners can also refinance their existing loan options. This helps them to secure lower interest rates or adjust loan terms. However, before considering refinancing, be sure to review origination fees and potential prepayment penalties.

Managing Monthly Payments and Cash Flow

Maintaining healthy cash flow ensures the landscaping business can sustain operations and grow. Strategies include:

- Forecast expenses and revenue: Plan for seasonal slowdowns.

- Track loan installments: Keep records of monthly payments and balances.

- Prioritize loans with high interest rates: Reduce long-term costs.

- Maintain an emergency fund: Covers unexpected repair or operational needs.

By using varied financing for landscaping, including loans, credit lines, and home improvement funding, businesses can maintain stability and support growth.

Applying for Landscaping Loans: The Process

A clear loan process simplifies financing:

- Assess your needs: Determine the required loan amount for equipment, labor, or landscaping projects.

- Review credit profile: Evaluate credit history, credit score, and eligibility.

- Research lenders: Compare banks, credit unions, and online lenders for the best interest rates and loan terms.

- Prepare documentation: Gather tax returns, financial statements, and business plans.

- Submit application: Follow the application process carefully.

- Compare offers: Evaluate loan options, monthly payments, and any prepayment penalties.

- Accept financing for landscaping companies: Choose the best type of loan and begin using funds effectively.

The Bottom Line

Access to the right options for financing for landscaping companies allows your business to cover expenses, acquire new equipment, and expand services. You just need to consider loan terms, interest rates, and monthly payments before selecting a lender.

Businesses with good credit can often access secured loans, lines of credit, or term loans at lower interest rates, while borrowers with lower credit scores may need alternative options, such as personal loans or credit cards.

However, smart use of landscaping loans, small business loans for lawn care, and lawn care business loans ensures that your business thrives while maintaining healthy personal finance and cash flow.

Business owners should research reputable lenders and financing for landscaping options that match their business needs.

FAQs About Financing for Landscaping Businesses

How do I determine the best loan for my landscaping company?

The most suitable loan depends on your business needs and credit profile. You can evaluate factors such as interest rates, loan terms, monthly payments, and potential prepayment penalties. A term loan or SBA loan works well for major equipment purchases or expansion. While a line of credit helps cover seasonal slowdowns and may suit smaller projects or temporary cash flow needs.

How does my credit score affect loan eligibility for a landscaping business?

Lenders consider credit history and credit profile when approving financing for landscaping companies. Borrowers with good credit usually receive lower interest rates, larger loan amounts, and longer loan terms. Whereas businesses or owners with lower credit scores may face higher interest rates or require secured loans such as equipment financing or SBA-backed loans.

Are equipment purchases covered under landscaping loans?

Many landscaping loans, term loans, and SBA loans allow businesses to purchase trucks, mowers, and other tools. Equipment financing also provides a dedicated option, where the equipment itself serves as collateral. Hence, financing ensures companies acquire essential tools while keeping monthly payments predictable.

Can I combine different types of financing for my landscaping business?

Many landscaping businesses combine loans to balance cash flow and investment needs. For example, a company might use an SBA loan to fund equipment and a line of credit to manage seasonal expenses. Therefore, using multiple financing sources can maintain operational stability and support growth without overextending resources.

How can I manage monthly payments effectively for landscaping loans?

To maintain financial stability, track monthly payments and plan budgets carefully. You can prioritize loans with high interest rates to reduce long-term costs. Also, combining a line of credit with a fixed-rate loan can balance flexibility and predictability. Therefore, proper management allows businesses to fund new landscaping projects, cover labor, and expand services without cash flow disruptions.

Frequent searches leading to this page

Related Articles

Financing for Landscaping Businesses: Ways to Fund Growth and Manage Cash Flow

October 13, 2025

Landscaping Business Loans: How to Finance Equipment, Payroll, and Growth

October 13, 2025

Landscaping Financing Options: How to Fund Equipment, Payroll, and Business Expansion

October 13, 2025

Term Loans are made by Itria Ventures LLC or Cross River Bank, Member FDIC. This is not a deposit product. California residents: Itria Ventures LLC is licensed by the Department of Financial Protection and Innovation. Loans are made or arranged pursuant to California Financing Law License # 60DBO-35839