Landscaping Financing Options: How to Fund Equipment, Payroll, and Business Expansion

Oct 09, 2025 | Last Updated on: Oct 13, 2025

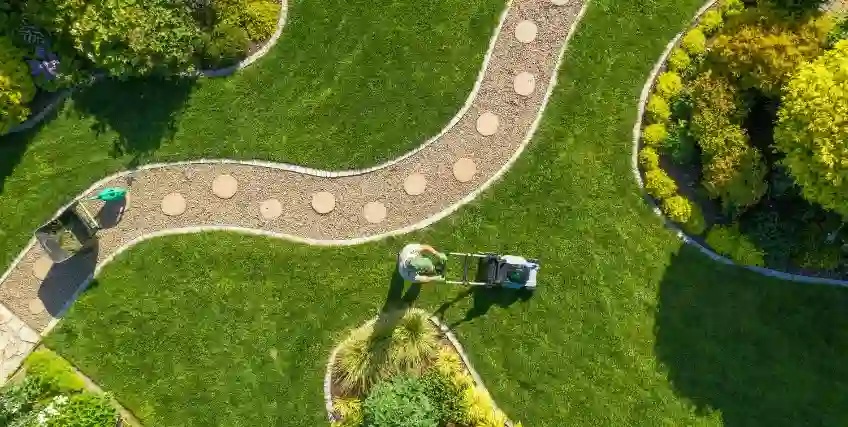

The landscaping business is more than about cutting grass. It’s about improving curb appeal, building outdoor living spaces, and helping homeowners with home improvement projects. Yet, for landscaping business owners, the path to grow their business often comes with hefty costs. These may include getting a new mower, payroll during slow months, or expanding into commercial contracts that can typically strain cash flow.

Business owners in the U.S. can use multiple landscaping financing options as funding becomes the bridge between these challenges and opportunities. With the right business loan for landscapers, they can manage seasonal expenses, secure modern equipment, and take on larger landscaping projects. Instead of delaying growth or straining existing resources, landscaping financing options help create room for stability and expansion.

In this article we’ll look at some of the popular financing options for landscaping businesses, how to secure the right loan types, and why funding matters for landscaping projects for business owners. We’ll also explore the future growth opportunities that business owners can seek for their landscaping businesses.

Why Landscaping Businesses May Need Financing

Business owners who are running their landscaping businesses in the U.S. are well aware that it comes with a lot of financial challenges. Every lush lawn patio, or garden requires upfront investment, and costs can quickly add up. The landscaping business comes with equipment purchases, payroll during slow months, and cash flow gaps that can create serious hurdles.

However, landscaping financing options help business owners bridge this gap, enabling them to manage operations and grow their business. Here’s why landscaping businesses might turn to financing:

- High Equipment Costs: Landscapers need commercial mowers, trucks, trailers, and irrigation systems for their projects which can cost thousands of dollars. Instead of buying multiple machines at once that can tie up working capital, landscaping financing options can help invest in essential tools without straining your budget.

- Seasonal Revenue Fluctuations: Since landscaping demand peaks during spring and summer, winter months can often bring fewer projects. However, businesses still need funds to cover monthly payments, payroll, and operational expenses during slow periods. Hence, business loans for landscapers can be used to cover these seasonal dips.

- Expansion Ambitions: Small business owners who are looking for bigger commercial contracts or adding new services typically require more staff, extra vehicles, and necessary technology. Landscaping financing options can help them to pursue growth opportunities without delaying expansion plans.

- Home Improvement Market Opportunities: With homeowners increasingly investing in home improvement projects and curb appeal, landscapers have a chance to capture new business. Hence, access to financing options can help them take on these lucrative projects confidently.

- Cash Flow Management: Clients sometimes pay after 30–60 days, creating temporary cash shortages. As a result, different landscaping financing options, such as a line of credit or working capital loan, ensure you can cover expenses while waiting for payments.

In short, landscaping financing options act as a bridge between ambition and reality. These funding solutions help business owners cover essential costs, smooth seasonal cash flow, and allow businesses to grow strategically. However, without these solutions, even profitable businesses can risk missing key opportunities.

Types of Landscaping Financing Options

There are different types of landscaping financing options that business owners can choose from. However, each loan type fits different needs, from equipment purchases to payroll or home improvement financing. Let’s take a look:

SBA Loans

SBA loans are backed by the U.S. Small Business Administration and are one of the popular loan options for business owners in the U.S. These loans often come with lower rates and longer repayment loan terms for qualified applicants. SBA loans can be used by landscaping companies for business expansion, purchasing equipment, or working capital. However, this landscaping financing option comes with a lengthy application process and strict eligibility requirements that can take from a few business days or months.

Term Loans

Term loans offer a lump sum loan amount that can be repaid over a set period of time and are offered by local banks, credit unions, or financial institutions. These loans typically come with fixed rates and a fixed repayment schedule. Business owners can use term loans to cover large expenses like vehicles or buy new property. However, just make sure you watch out for origination fees, annual percentage rate, and prepayment penalties when seeking term loans as a landscaping financing option for your business.

Business Lines of Credit

A business line of credit is a flexible funding option that can be used to cover short-term business needs. Business owners can draw funds when they need up to a pre-approved credit limit and pay interest only on the amount used. Borrowers can use a line of credit to cover seasonal costs, cash flow gaps, and other business emergencies. Since some lenders pre-qualify borrowers, these loans can be disbursed quickly in a few business days.

Working Capital Loans

Working capital loans are funding options that offer a small loan amount. These loans can be used to cover short-term needs like payroll, supplies, or fuel. Additionally, these are one of the best options for covering seasonal cash shortages. Since the loans are useful for urgent needs, they often come with higher interest rates.

Equipment Loans

Equipment loans are financing options that can be used to purchase business assets like landscaping machines, trucks, and tools. Instead of paying upfront for the equipment, business owners can pay in easy monthly payments. Moreover, the equipment itself serves as collateral making it a secured loan and reducing risk for both lenders and borrowers.

How to Choose the Right Financing Option

It is important to understand that not every landscaping financing option fits every business need. Hence, you need to choose the right loan process, depending on your business goals and financial profile.

Here’s how to choose the right landscaping financing option:

- Match need to loan type: For equipment, loan for equipment can be used. For payroll, you may use a line of credit or working capital loans. However, what is best for an individual will vary.

- Check interest rates: Aim for the lowest rate possible. Compare annual percentage rates from banks, credit unions, and online lenders.

- Loan term flexibility: Shorter terms mean higher monthly payments but lower total interest. Longer terms ease cash flow but may increase costs.

- Creditworthiness: Good credit or excellent credit often unlocks low rates. Borrowers with weaker credit history may face higher landscaping loan rates.

- Prepayment penalties: Watch out for hidden costs if you plan to repay early.

Tips to Strengthen Your Loan Application

Getting approved for landscaping loans depends on how lenders view your creditworthiness. To improve your chances when seeking landscaping financing options, you need to:

- Maintain good credit: A high credit score shows lenders you manage debt responsibly.

- Prepare documents: Gather tax returns, financial statements, and proof of income.

- Show stability: Highlight consistent revenue and business contracts.

- Refinance old debt: Use debt consolidation to clean up obligations and strengthen your credit history.

- Pre-qualify: Many lenders allow you to pre-qualify without affecting your credit score. This shows estimated loan terms before you apply.

Future Growth Opportunities for Landscaping Businesses

Landscaping demand continues to grow. Hence, landscaping financing options open doors for expansion.

- Eco-friendly services: Homeowners want sustainable home improvement projects, including drought-resistant plants and water-saving systems.

- DIY trends: Homeowners are combining DIY with professional landscaping projects, leading to more hybrid service models.

- Commercial contracts: With steady funding, landscapers can bid on larger municipal or corporate contracts.

- Technology: Smart irrigation and digital design tools require investment but improve efficiency.

Final Words

Financing options for landscaping give business owners the tools to grow and thrive. From SBA loans and equipment loans to flexible lines of credit, landscapers have multiple landscaping financing options to meet different business needs. These solutions cover the costs of trucks, mowers, irrigation systems, and other essential equipment while also helping manage monthly payments, seasonal payroll, and expansion projects.

However, success begins with preparation. A strong credit history, good credit, and a well-documented application process increase approval chances. Understanding your loan term, interest rates, loan amount, and any prepayment penalties ensures you choose the best financing option. Also, comparing loan offers from a local bank, credit union, or online lenders helps secure the lowest rate available.

Therefore, explore your landscape financing options today. Compare landscaping loan rates, pre-qualify with multiple lenders, and secure the funding you need to expand, invest in equipment, and take your business to the next level. Don’t let cash flow limitations slow your growth.

FAQs About Landscaping Financing Options

What landscaping financing options are available for landscaping businesses?

Landscaping businesses have multiple financing options depending on their needs. These include SBA loans, equipment loans, working capital loans, lines of credit, and commercial real estate loans. However, each option serves different purposes, some are ideal for buying trucks or machinery, while others help cover payroll or expansion costs.

How do I determine the right loan amount for my landscaping business?

The loan amount should match your specific needs without overextending your business. You can start by listing the expenses you plan to cover like equipment, seasonal payroll, or expansion costs. Then, factor in additional costs such as interest rates, origination fees, and potential prepayment penalties. Hence, this approach ensures your monthly payments are manageable and your cash flow remains healthy.

Can I get a landscaping loan with less-than-perfect credit?

Some lenders offer secured loans or working capital loans even if your credit score isn’t ideal. However, borrowers with good credit or excellent credit often qualify for the lowest rates and more flexible loan terms. So, maintaining a strong credit history and preparing your application process carefully can improve your chances of approval.

How long does it take to get approved for landscaping financing?

The timeline varies depending on the loan type and lender. SBA loans and commercial real estate loans can take several business days to a few weeks due to detailed review. On the other hand, lines of credit and equipment loans may provide decisions quickly. Therefore, it’s better to prepare all necessary documents and pre-qualify to speed up the process.

Are there any hidden costs I should be aware of?

Before considering any landscaping financing option, always check for origination fees, prepayment penalties, and variable interest rates. Some loans may have additional administrative fees or annual charges. Also, comparing loan offers from a local bank, credit union, or online lenders helps you identify the lowest rate and avoid unexpected costs.

Frequent searches leading to this page

Related Articles

Financing for Landscaping Businesses: Ways to Fund Growth and Manage Cash Flow

October 13, 2025

Landscaping Business Loans: How to Finance Equipment, Payroll, and Growth

October 13, 2025

Landscaping Financing Options: How to Fund Equipment, Payroll, and Business Expansion

October 13, 2025

Term Loans are made by Itria Ventures LLC or Cross River Bank, Member FDIC. This is not a deposit product. California residents: Itria Ventures LLC is licensed by the Department of Financial Protection and Innovation. Loans are made or arranged pursuant to California Financing Law License # 60DBO-35839