Landscaping Business Loans: How to Finance Equipment, Payroll, and Growth

Oct 09, 2025 | Last Updated on: Oct 13, 2025

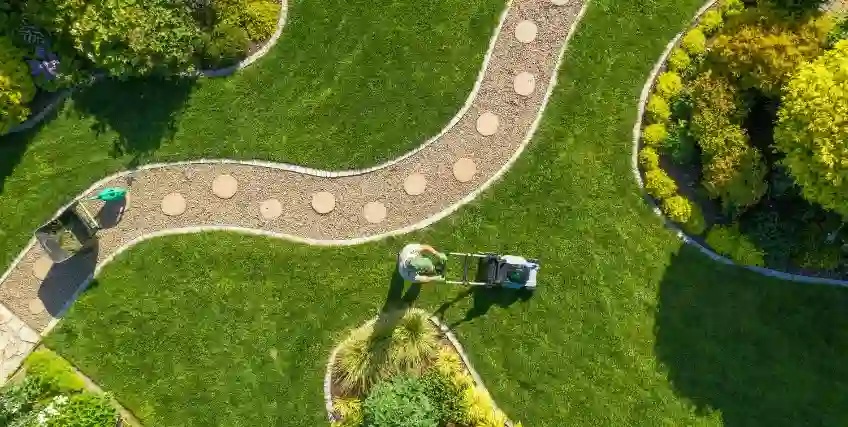

The landscaping industry is highly competitive and seasonal, but itcan be very lucrative. That said, landscaping businesses often require significant capital investments. From heavy-duty landscaping equipment to seasonal payroll, digital marketing, and more, landscaping companies have a range of business needs that demand consistent and flexible cash flow. That’s not always easy to come by in a seasonal business like landscaping.

Entrepreneurs need to understand landscaping business loans as a vehicle for sustained growth and profitability. In this comprehensive guide, we delve into how landscaping businesses can strategically leverage various loan options to finance equipment, manage payroll fluctuations, and fund growth.

In this article:

- Understanding the unique reasons to get a small business loan for landscaping.

- Exploring some of the best landscaping business loans available from traditional lenders, online lenders, and some of the best business funding companies.

- How to improve your loan application to get approved for a higher loan amount with a lower down payment.

How Can You Use Landscaping Business Loans?

Landscaping businesses have many costs, but landscaping business loans can help address a lot of them. Some of the ways you can use a small business loan for landscaping include:

- Seasonal cash flow: Landscaping businesses typically have a seasonal revenue cycle. While business booms in the spring and summer months, the winter off-season often brings a severe cash crunch. Landscaping business loans can provide working capital to bridge the gaps, cover overhead, and retain your staff.

- Equipment: Landscapers require specialized equipment, like trucks, trailers, industrial lawnmowers, and more, to do their best work. That equipment is expensive and depreciates rapidly, so financing can support upgrades and new purchases.

- Marketing: Landscaping can be a competitive business. With landscaping business loans, you can cover costs for marketing campaigns to increase awareness of your business and attract new customers.

- Expansion and growth: Scaling a landscaping operation requires investment in new crews, additional vehicles, and potentially commercial real estate for a staging yard or office. Long-term, high-value landscaping business loans provide flexible funding to cover evolving growth costs.

Types of Landscaping Business Loans

There are several landscaping business loans tailored to address your business’s specific needs. From traditional lenders like banks and credit unions to online lenders, borrowers have access to a range of financing options to support a wide variety of business needs.

Term loans

The classic loan that probably first comes to mind, term loans provide a lump sum of money upfront that you can use as you see fit, and repay with monthly payments over a set term. Term loans offer predictability and flexibility, allowing you to cover many business expenses while helping you plan your budget with a fixed monthly payment.

Traditional lenders tend to offer larger loan amounts and lower interest rates, but have longer funding times and stricter eligibility requirements than online lenders.

SBA loans

The U.S. Small Business Administration (SBA) works with approved lenders to provide partial guarantees on business loans, lowering the risk to lenders. As such, these loans often have lower interest rates and longer repayment terms for qualified applicants than traditional bank loans, making SBA loans the gold standard for established lawn care businesses.

The SBA 7(a) loan is the SBA’s most flexible offering, as funds can be used for nearly any business purpose, from working capital to buying new equipment. Its long-term nature (up to 10 years for equipment and working capital) makes payments highly manageable.

SBA 504 loans can also be useful landscaping business loans for companies that are ready to grow by purchasing land for a maintenance yard or a fleet of new trucks. These loans are specifically designed for purchasing or constructing commercial real estate or acquiring long-term machinery.

SBA loans are flexible, highly desirable landscaping business loan options, but they tend to have very long application and underwriting processes and strict eligibility requirements.

Equipment Financing

Equipment financing is a form of asset-based financing in which the equipment itself serves as collateral for the loan. This means the loan is typically easier to qualify for, even for younger businesses, because the lender has a tangible asset to recover if the business defaults.

Landscaping equipment financing can help you acquire new, revenue-generating equipment immediately without digging too deeply into your working capital. Repayment terms are often aligned with the expected lifespan of the machinery, so you’ll pay it off over its useful life. This type of landscaping business loan can be critical for maintaining a competitive edge in your market.

Business lines of credit

Landscaping services deal with cash crunches throughout the seasons, but a business line of credit can be a major lifeline. A line of credit can be one of the most effective landscaping business loans for managing the unpredictable nature of seasonal income.

With a line of credit, you’re approved for a maximum credit limit, but you only pay interest on the amount you withdraw. Once you repay what you’ve borrowed, you’ll have access to the full credit amount again. You can use draws to cover working capital, purchasing supplies and materials, covering emergency expenses, and more. Given how unpredictable the landscaping business can be, a line of credit offers flexible financing that’s much easier to qualify for than traditional business loans.

Tips to Qualify for Landscaping Business Loans

Every lender has different qualification requirements for varying loan products. However, to qualify for the best landscaping business loans, you’ll usually have to meet several requirements:

- Credit score: Lenders typically review both the business owner’s personal credit score (FICO) and the business credit score. A higher credit score will improve your approval chances and term offers.

- Time in business: Traditional banks and SBA lenders usually prefer businesses with at least two years of operating history and consistent annual revenue. Online lenders are often more willing to work with startups and newer businesses.

- Revenue: Lenders need to see that you have the ability to repay the loan. You should be prepared to show comprehensive financial statements, including profit and loss statements, balance sheets, business tax returns, and bank statements that detail your revenues and cash flow.

How to Improve Your Approval Chances for Landscaping Business Loans

Preparation is everything when applying for landscaping business loans. These tips can help ensure you put your best foot forward:

- Have a detailed business plan: Lenders want to know that you have a clear vision and you know what you’re doing. A professional, well-researched plan shows your capacity for growth and ability to repay the loan. You should include detailed financial projections that account for seasonality and competition.

- Get organized: Before applying, have at least two years (if applicable) of clean, easy-to-read financial statements and tax returns ready. Being unprepared or disorganized can prolong the process, or even show lenders you’re a less trustworthy applicant.

- Work on your credit: Before you apply for a loan, take the time to work on your credit score. Pay down outstanding debts and check your credit report for any errors. Small improvements in your credit score could lead to major long-term interest savings.

- Consider collateral: Understand what assets you can offer as collateral (equipment, vehicles, real estate, or accounts receivable), as having collateral can significantly influence the rates and amounts available for many landscaping business loans.

Final Thoughts

The right landscaping business loan depends on your situation and specific needs. By thoroughly evaluating options, understanding eligibility requirements, and preparing meticulous documentation, a landscaping business owner can successfully secure the necessary landscaping business loans to weather seasonal changes, upgrade their fleet, and ultimately cultivate long-term growth.

FAQs About Landscaping Business Loans

What is the primary difference between a business line of credit and a term loan for a landscaping business?

A term loan provides a single lump sum of money, repaid over a fixed schedule with interest. A business line of credit is a credit amount you can draw from, pay down, and draw from again, and is ideal for flexible, ongoing needs like covering seasonal payroll or unexpected operating expenses. Both can be very valuable to your business, but each may serve a different purpose.

Can I get a landscaping business loan if I am a startup with no credit history?

It can be difficult to get a traditional bank or SBA loan without any operating history. However, some specialized landscaping business loans, such as equipment financing (which uses new equipment as collateral) or a microloan from online lenders, may be easier to come by. If you have a strong personal credit score and a detailed business plan, it can improve your approval odds.

How long do SBA loans take to approve and fund for a landscaping business?

There’s no guaranteed timeline for SBA loan approval. That said, they tend to have the longest timeline of small business loan products. The approval process can take anywhere from a few weeks to several months, depending on the loan type and the lender.

Will I need to provide collateral for a landscaping business loan?

For large, long-term loans like the SBA 7(a) or 504, collateral and a down payment are often required. Equipment financing uses the purchased asset as collateral.

What are the top 10 business loans to manage seasonal cash flow with a loan?

The right financial resource for you depends on your particular situation. If your primary concern is seasonal cash flow management, however, a business line of credit can offer the most flexibility without being burdened by a fixed monthly payment during slow periods of the year.

Frequent searches leading to this page

Related Articles

Financing for Landscaping Businesses: Ways to Fund Growth and Manage Cash Flow

October 13, 2025

Landscaping Business Loans: How to Finance Equipment, Payroll, and Growth

October 13, 2025

Landscaping Financing Options: How to Fund Equipment, Payroll, and Business Expansion

October 13, 2025

Term Loans are made by Itria Ventures LLC or Cross River Bank, Member FDIC. This is not a deposit product. California residents: Itria Ventures LLC is licensed by the Department of Financial Protection and Innovation. Loans are made or arranged pursuant to California Financing Law License # 60DBO-35839