Turn Opportunities into Success

With the Right Small Business Grant

Looking for Business Financing?

Apply now for flexible business financing. Biz2Credit offers term loans, revenue-based financing, lines of credit, and commercial real estate loans to qualified businesses.

Set up a Biz2Credit account and apply for business financing

For many entrepreneurs in the US, the search for funding often begins with small business loans. Loans can be fast and flexible, but they come with repayment obligations that weigh on cash flow. That’s where business grants step in as an alternative. These are funds awarded by government agencies, nonprofits, or private organizations that do not require repayment.

Grants are often designed to support small business owners working on projects with social, economic, or technological benefits. They can target specific groups, like minority-owned or women-owned companies, or focus on industries driving innovation and job creation. Unlike loans, the main cost of a grant is time and effort – navigating applications, meeting strict eligibility rules, and reporting on outcomes.

While business grants for small business are competitive, they can provide a critical boost without adding debt. Whether you’re expanding operations, testing a new product, or entering a new market, these funds can make a difference. The key is knowing what’s available, who qualifies, and how to apply effectively.

Understanding Business Grants

Business grants are a form of financial assistance awarded to eligible businesses for specific purposes. Unlike small business loans, grants do not require repayment. They are funded by federal, state, or local governments, as well as private corporations and nonprofit organizations.

The intent is often tied to broader goals, such as economic development, innovation, or community impact. Many grant programs focus on supporting sectors like technology, manufacturing, agriculture, and sustainability. For example, the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs fund research and development that can lead to commercialization and job creation.

There are several types:

- New business grants, designed to help entrepreneurs launch operations

- Startup business grants, targeting early-stage companies with promising business ideas

- Business funding grants for established businesses planning expansion or upgrading equipment

- Grants for new business owners that encourage first-time entrepreneurs to enter competitive industries

Each program has its eligibility criteria, often based on business size, location, industry, and proposed use of funds. But here’s the catch – grants are not “free money” in the casual sense. The application process can be rigorous, requiring detailed business plans, financial projections, and compliance with post-award reporting.

Applicants are evaluated not just on merit, but on their potential to contribute to larger economic or social objectives. Missing a requirement or deadline can quickly disqualify even a strong candidate.

Who Uses Business Grants in the US

Across the US, business grants serve a wide range of entrepreneurs. Many recipients are early-stage founders who might not yet qualify for small business loans due to limited credit history or lack of collateral. Grants for new business owners help bridge that gap, providing working capital without repayment pressure.

Certain startup business grants focus on innovation-heavy sectors. Technology companies, clean energy firms, and biotech startups often use these funds for research and development, product development, or testing new products before market launch. Federal initiatives like SBIR and STTR specifically support projects that drive economic growth through technological breakthroughs.

Social and community-oriented businesses also benefit. Minority-owned, women-owned, and veteran-owned businesses frequently receive targeted business funding grants aimed at promoting inclusion and job creation. In rural areas, rural business development grants help revitalize local economies by supporting small manufacturing, agriculture, or tourism ventures.

Nonprofit organizations sometimes act as intermediaries, awarding smaller grants to eligible businesses through local programs. These initiatives often come with mentorship or technical assistance, creating a broader ecosystem of support.

Purposes of Business Grants

Business grants are rarely open-ended. Most programs are designed with specific outcomes in mind, making it crucial to match your goals with the grant’s purpose. This alignment increases your approval odds.

Here are some of the most common uses:

Established companies, too, use grants strategically – whether for sustainability upgrades, expanding into new markets, or enhancing workforce training. And while these grants can be competitive, the payoff is significant, particularly for businesses seeking to avoid or supplement traditional debt from lenders.

1. Equipment and Technology Upgrades

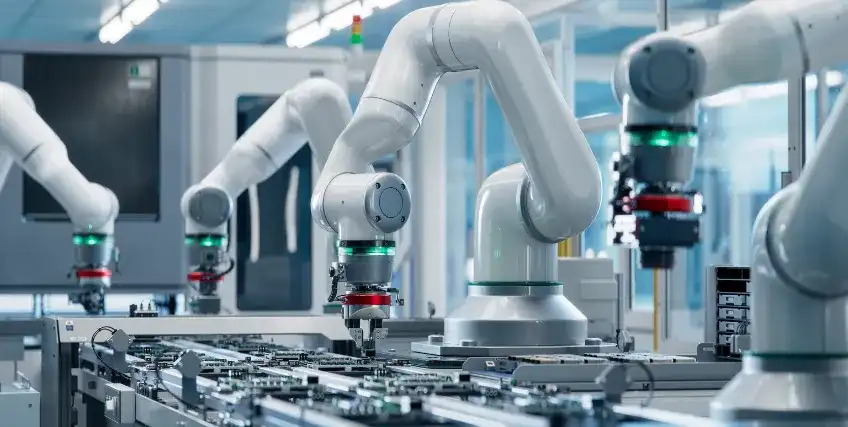

Many business funding grants help companies modernize operations. This could mean buying advanced machinery, upgrading software, or adopting automation tools to boost productivity. Federal and state-level programs often fund these upgrades in industries like manufacturing, construction, and healthcare. By reducing dependence on small business loans, these grants allow companies to invest in long-term efficiency without repayment obligations. Some grants even cover installation and training costs, helping businesses adapt quickly.

2. Hiring and Workforce Development

Some startup business grants support hiring new staff or training current employees. These programs can fund apprenticeships, internships, or certification programs, creating a stronger workforce. For new business grants, this can be the difference between stagnation and business growth. Employers benefit from reduced payroll strain while employees gain valuable skills that enhance company performance.

3. Research and Development

Grants like SBIR and STTR focus on research and development, funding projects with strong commercialization potential. These programs support small business owners who innovate in sectors like biotech, clean energy, and advanced manufacturing. Instead of relying solely on small business loans, recipients get non-repayable funding to test, refine, and bring new technologies to market.

4. Community Impact Projects

Some grants for new business owners target ventures that benefit local communities. This might include opening a community health clinic, launching a food co-op, or creating a public art initiative. These programs often encourage partnerships with nonprofit organizations and local governments, driving economic development and social well-being.

5. Sustainability Initiatives

Environmental grants support businesses aiming to reduce waste, improve energy efficiency, or transition to renewable energy sources. Business grants for small business in this category can cover energy audits, green building upgrades, and eco-friendly manufacturing processes. Companies gain both cost savings and an improved public image.

Benefits of Business Grants for Small Businesses

For many entrepreneurs, securing funding without adding debt is a game-changer. That’s where business grants for small business stand out. They provide a financial boost while leaving cash flow untouched by repayments. Here are some of the top advantages:

1. No Repayment Obligation Compared to Small Business Loans

The clearest advantage of business grants over small business loans is the absence of repayment. This means no interest, no monthly installments, and no added debt burden. Businesses can reinvest earnings into operations, innovation, or expansion without worrying about loan schedules. For startup business grants, this can significantly reduce early-stage financial stress.

2. Boost in Business Credibility

Winning a grant often validates a business idea or project. Funders typically evaluate proposals against strict eligibility criteria, so approval signals reliability and potential. This recognition can help in attracting future grant opportunities, private investors, or even favorable small business loan terms from lenders. It also demonstrates commitment to professional growth and economic development.

3. Access to Larger Funding Amounts

Some business funding grants provide substantial sums that might be difficult to secure through loans without strong collateral. Large-scale grant programs, such as federal SBIR or state-level innovation funds, can support research, expansion, and new product launches. These awards are often targeted toward high-impact sectors like technology, manufacturing, and sustainability.

4. Networking and Mentorship Opportunities

Many grants, especially those from nonprofit or industry-backed organizations, include mentorship, training, and networking components. Recipients gain access to business mentors, industry events, and potential collaborators. For grants for new business owners, this ecosystem support can be as valuable as the funding itself, accelerating growth and business development.

Disadvantages and Challenges of Business Grants

While business grants for small business can be a lifeline, they’re not without drawbacks. The process is often slow, competitive, and bound by strict rules that can challenge even seasoned entrepreneurs. Here are some of the main hurdles:

1. High Competition

Every grant application competes against hundreds, sometimes thousands, of others. Funding pools are limited, making approval rates low. Unlike small business loans, where multiple lenders offer various funding options, grants often have a single awarding body. Applicants must present standout proposals backed by solid data to stand a chance.

2. Strict Eligibility Criteria

Many grant programs are narrowly defined. They may target only certain industries, demographics, or regions. For example, new business grants might be available only to rural business owners or technology startups. Missing even one requirement—like a location condition—can result in immediate disqualification.

3. Extensive Compliance and Reporting

Once awarded, grants come with detailed reporting requirements. Businesses may need to submit progress reports, expense breakdowns, or proof of job creation. This administrative burden can be resource-heavy, especially for smaller teams that lack a dedicated grant manager. In contrast, small business loans typically have simpler repayment tracking.

4. Long Disbursement Timelines

Even after approval, it can take months for funds to arrive. Delays can slow down startup funding or halt business development plans. For time-sensitive projects, businesses may still need to secure working capital from other funding options in the interim.

Types of Business Grants in the US

Not all business grants are created equal. The US funding ecosystem offers a range of programs, each with unique goals, eligibility rules, and application processes. Knowing the types can help you target the right opportunities instead of chasing mismatched funding.

1. Federal Grants

Federal grant programs are often the most competitive but can provide the largest awards. Initiatives like SBIR and STTR fund high-potential research and development projects, especially in tech and science sectors. Businesses that qualify can access substantial amounts without turning to small business loans for innovation funding. Applications are typically found on https://www.grants.gov/.

2. State and Local Grants

State economic development agencies and city governments offer business grants for small business to encourage local growth. These programs may support rural business expansion, urban revitalization, or specific industries like agriculture or manufacturing. They can be less competitive than federal programs and often have quicker processing times.

3. Industry-Specific Programs

Some grants are tied to specific industries such as clean energy, advanced manufacturing, or healthcare. These new business grants aim to boost sector competitiveness and meet national or state-level priorities. Applicants must often show measurable impacts like job creation or improved public services.

4. Private and Nonprofit Grants

Corporations and nonprofit foundations also fund startup business grants for ventures aligned with their mission or community goals. These often come bundled with mentorship or access to accelerator programs, offering more than just money. They can be a strategic complement to traditional funding like small business loans.

How to Apply for a Business Grant

Applying for a business grant isn’t something you do overnight. The process requires planning, precision, and an understanding of each program’s eligibility criteria. Unlike small business loans, where lenders often focus on creditworthiness and repayment capacity, grant providers assess how well your proposal aligns with their mission.

The first step is research. Start by visiting official websites like Grants.gov and the SBA’s funding page to explore current grant opportunities. Make a shortlist based on your business size, location, and industry.

Next, prepare a compelling business plan. This document should outline your goals, funding needs, and expected outcomes, such as job creation, economic growth, or product development. The more clearly you connect your project to the grant’s objectives, the stronger your application.

Gather required documents in advance, like tax returns, incorporation papers, financial statements, and, if needed, letters of support. Pay attention to formatting and submission guidelines; even small mistakes can get your grant application rejected.

Finally, submit before the deadline and follow up. Some programs may require interviews or additional documentation before approval. If successful, be prepared to meet reporting requirements and use funds exactly as stated in your proposal.

Taking these steps seriously not only improves your odds for grants but also prepares you for other funding options like startup business grants or small business loans down the road.

Comparing Grants and Small Business Loans

Both business grants and small business loans play important roles in funding growth, but they work very differently. Grants provide money without repayment, which makes them attractive for small business owners aiming to avoid debt. However, they’re competitive, time-consuming, and often limited to specific purposes.

Small business loans, on the other hand, offer faster access to funds and far more flexibility in how you use them. Whether you need working capital, inventory, or to cover unexpected expenses, loans can be tailored to meet a wider range of needs. The trade-off is repayment, often with interest, which affects cash flow.

A startup business grant might be ideal for research projects, product development, or community initiatives that align with government or nonprofit priorities. But if you need immediate funding to seize a market opportunity, a loan may be more practical.

Some businesses use a hybrid approach, such as securing a grant for a specific initiative while using a loan for general operating costs. This can help balance the advantages of both funding types.

Ultimately, the choice depends on your business stage, funding urgency, and ability to meet eligibility criteria. Reviewing both options side-by-side helps in building a sustainable business financing strategy.

Resources for Finding Business Grants

Finding the right business grants starts with knowing where to look. The most reliable source is Grants.gov, which lists federal grant opportunities across industries. It’s updated regularly and includes detailed eligibility criteria for each program.

The SBA also maintains a list of federal, state, and local options. Their network of Small Business Development Centers (SBDCs) offers guidance on grant applications and even workshops on combining grants with small business loans for broader funding coverage.

Other valuable resources include local chambers of commerce, nonprofit organizations, and industry associations. Many states also have dedicated economic development websites highlighting new business grants and sector-specific programs.

Using a mix of national and local resources increases your chances of finding a match that supports your business growth goals.

Common Mistakes to Avoid in Grant Applications

Even strong proposals can fail if they overlook basic requirements. Knowing the most common pitfalls can help you avoid unnecessary rejections and save time in the process.

1. Ignoring Deadlines and Instructions

Many grant applications are discarded simply because they miss deadlines or don’t follow the stated format. Unlike small business loans, where you can often reapply quickly, most grant programs have fixed windows that close for the year. Always read guidelines thoroughly, prepare in advance, and leave buffer time for submission.

2. Incomplete Documentation

Missing tax records, outdated business plans, or unsigned forms can disqualify you instantly. Startup business grants often require extra proof, such as incorporation papers or eligibility criteria statements. Create a checklist before applying to ensure all documents are accurate and up to date.

3. Overlooking Smaller Grant Opportunities

Many entrepreneurs chase big federal grants while ignoring local or industry-specific ones. Grants for new business owners at the state or municipal level often have fewer applicants, improving your odds. These can complement small business loans or other funding options.

4. Neglecting Post-Award Compliance

Winning a grant is only the first step. Failing to meet reporting or spending requirements can jeopardize future funding. Business grants for small business often require progress updates, receipts, or impact data like job creation. Treat compliance with the same importance as the application itself.

Trusted by Thousands of Small Business Owners in America.**

Simply because we get what you go through to build a business you believe in.

**Disclaimer: All stories are real, as told by real business owners. Customers do not receive monetary compensation for telling their stories.

From One Entrepreneur to Another: We Get You

We understand what's behind building a business you believe in.

All stories are real, as told by real business owners. Customers do not receive monetary compensation for telling their stories.

Articles on Business Grants

Tips to Qualify for Tech Startup Grants Without Diluting Equity

The world of startup surely feels exciting for entrepreneurs, but it can also feel overwhelming.

Small Business Grant Opportunities: What You Need To Know

Almost all small business owners would welcome the chance to get free money, so it’s important that owners keep an eye

Grants for Startups: Tips to Secure Startup Funding to Launch Your Business

If you’re a budding entrepreneur, your business idea can excite you and present many challenges at the same time. You may wonder how you...

Small Business Grant vs. Loan: Which Funding Option Is Right for You

We all know to run a small business, especially in the U.S. takes energy, vision, and money. You can face daily expenses and unexpected costs while...

What Is a Small Business Grant? A Complete Guide for Entrepreneurs

In entrepreneurship, funding is often the biggest barrier to turning a great idea into a profitable one. Many small business owners look to...

Frequently Asked Questions About Small Business Grants in the US

1. What is the difference between business grants and small business loans?

Business grants are funds that don’t require repayment, while small business loans must be repaid with interest. Grants often have strict eligibility rules, whereas loans can be more flexible.

2. Can startup business grants be used for any expense?

Not always. Startup business grants usually specify approved uses, such as research and development, hiring, or equipment. Spending outside these terms may violate the funding agreement.

3. Are business funding grants taxable?

Yes, in many cases. The IRS may treat business funding grants as taxable income. It’s wise to consult a tax professional before using the funds.

4. How do I find grants for new business owners?

Check official websites like Grants.gov or your state’s economic development page. Many grants for new business owners are also offered by local chambers of commerce and nonprofits.

5. Can I apply for multiple grants at once?

Yes, you can apply for several grant programs as long as you meet each set of eligibility criteria. This can improve your overall funding chances.

Frequent searches leading to this page

Term Loans are made by Itria Ventures LLC or Cross River Bank, Member FDIC. This is not a deposit product. California residents: Itria Ventures LLC is licensed by the Department of Financial Protection and Innovation. Loans are made or arranged pursuant to California Financing Law License # 60DBO-35839