Research reports

2022 Top Small Business Industries Report

December 05, 2023Annual Latino-Owned Business Study 2023

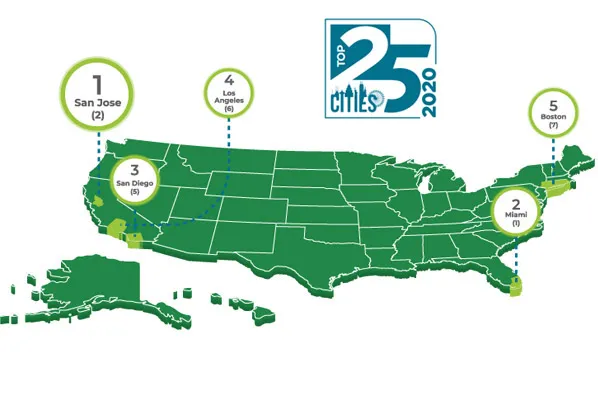

September 20, 2023Annual Top 25 Cities for Small Business Study 2023

May 03, 20232023 Inflation Impact Study

March 08, 20232023 Inflation Impact Study

January 17, 20232022 Top Small Business Industries Report

November 15, 2022Top 25 Cities for Small Business 2022

May 03, 2022Women Owned Business Study 2022

March 08, 2022Biz2Credit Top Small Business Industries Study 2021

November 17, 2021Biz2Credit Analysis of Industry Sectors Finds Restaurant Loan Approval - Biz2Credit

May 06, 2021Small Business Report

December 10, 2020Latino Small Business Study 2020

October 23, 2020Women-Owned Business Study - 2020

March 13, 2020Latino Small Business Study 2019 - Biz2Credit

October 14, 2019Biz2Credit Analysis of Industry Sectors Finds Restaurant Loan Approval - Biz2Credit

August 19, 2019Miami RANKED No. 1 CITY for Small Business in 2019

May 06, 2019As Revenue of Women-Owned Businesses Rose, Credit Scores Dropped in 2018

March 07, 2019Earnings of Latino-Owned Businesses Jumped 26 Percent During Past 12 Months, According to Biz2Credit's Annual Study

September 12, 2018"Small business are true holdouts. Many times, they use checks as a way of controlling cash flow," said Venkatesh Bala, PhD, Chief Risk Officer for Biz2Credit, who conducted the study."

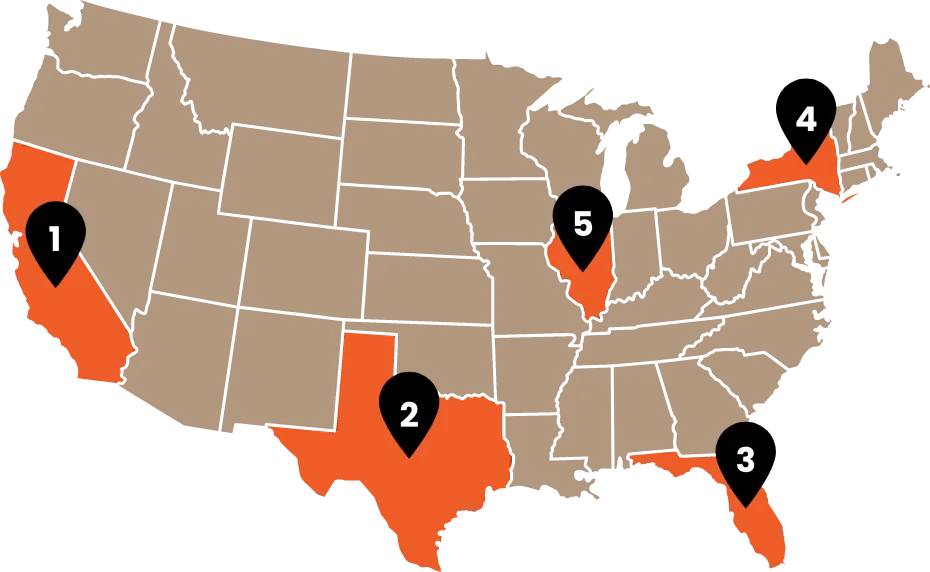

July 22, 2018"Arora believes the growth of New York's tech industry is buoying all the other industries, including fashion, food & beverage, and hospitality. Further, as one of the world's great metropolises, The

April 23, 2018"There are over 57 million American citizens of Hispanic heritage, about 18% of the U.S. population. The number is expected to more than double to 128.8 million in 2060, according to projections from

October 25, 2017"Businesses in New York significantly outpaced companies based in other cities in annual revenues," said Arora, whose firm is based in Manhattan. "Tourism, food & hospitality, real estate and construc

April 25, 2017A new study of Hispanic-owned businesses found that the number of loan applications by Hispanic entrepreneurs made through online lending marketplace Biz2Credit.com grew by 68.7% in the past 12 months

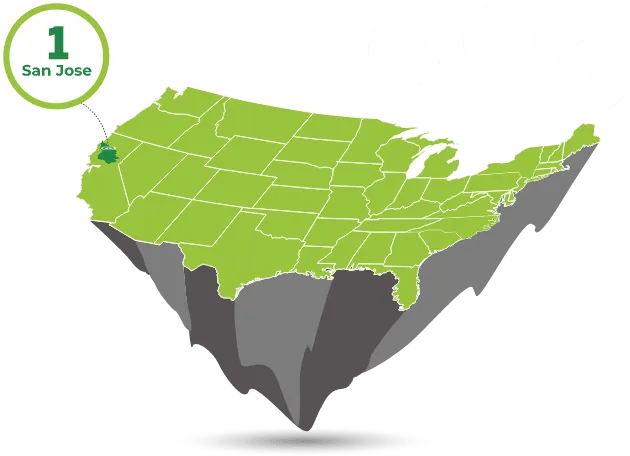

October 19, 2016Analysis Examined Markets with the Highest Annual Revenue, Credit Scores and Other Factors Biz2Credit has identified San Jose as the Best Small Business City in America, based on a weighted average

May 02, 2016Nearly eight out of ten minority entrepreneurs are confident that their companies will grow in the next 12 months and more than six in ten are optimist about the overall economy's growth, according to

April 14, 2016Study of 35,000 Companies Finds Average Revenues of Women-Owned Businesses Increased 12% in a Year-to-Year Comparison Average annual revenues and loan approval percentages of women-owned companies in

February 17, 2016Biz2Credit Annual Study Gauges Progress on Business Operations and Areas of Growth The most recent Biz2Credit study showed that Latino small business loan applications grew 18 percent, however, Latin

September 10, 2015Analysis Examined Markets with the Highest Annual Revenue, Credit Scores and Other Factors Biz2Credit, the leading online platform for small business finance, has identified Riverside, CA, as the Bes

May 05, 2015Analysis Examined Markets with the Highest Annual Revenue, Credit Scores and Other Factors Biz2Credit, the leading online platform for small business finance, has identified San Diego, CA, as the 'Be

May 05, 2015Analysis Examined Markets with the Highest Annual Revenue, Credit Scores and Other Factors Biz2Credit, the leading online platform for small business finance, has identified the Riverside-San Bernard

May 05, 2015Annual Revenues, Profits, and Credit Scores of Women-Owned Businesses Improved in 2014, According to Biz2Credit Study Study of 15,000 Companies Finds Average Revenues of Women-Owned Businesses Increa

February 27, 2015Analysis Examined Income, Expenses and Age of Business A new study released by Biz2Credit.com finds that Asian-owned businesses have higher average annual revenues, credit scores and expenses than o

October 27, 2014Analysis Examined Average Annual Revenue, Credit Scores and Operating Expenses Latino entrepreneurs faced challenges in securing financing and are more likely to borrow money from high interest, non-

September 15, 2014Bank Funding of Small Businesses Dried Up During and After Recession, According to the Study Biz2Credit, the leading online credit marketplace, today released the results of a study of bank failures

August 20, 2014Analysis Examined Markets with the Highest Annual Revenue, Credit Scores and Other Factors Biz2Credit, the leading online credit marketplace, today released the results of a study of bank failures so

May 12, 2014Analysis Examined Markets with the Highest Annual Revenue, Credit Scores and Other Factors Biz2Credit has identified San Jose as the Best Small Business City for minority entrepreneurs in America, ba

May 12, 2014Analysis Examined Markets with the Highest Annual Revenue, Credit Scores and Other Factors Biz2Credit has identified San Jose as the Best Small Business City in America, based on a weighted average t

May 12, 2014Retail, Transportation, Construction, Wholesale, Accommodation/Food Services and Arts/Entertainment/Recreation Feel Biggest Impact of the Cold Weather in January and February Small businesses in reta

March 18, 2014Study of 10,000 Companies Finds Earnings of Women-Owned Businesses Increased 54% in a Year-to-Year Comparison Earnings and business credit scores of women-owned companies soared in 2013, according to

March 01, 2014Study of Nearly 14,000 companies finds women-owned businesses have higher operating costs, slimmer margins, lower credit scores and a tougher time securing financing Despite strides by female entre

March 27, 2013Analysis Identifies Markets with the Highest Annual Revenue, Number of Employees, Ages of Businesses and Credit Scores Among Small Business Owners NEW YORK, NY, April 29, 2013 - Biz2Credit.com has id

April 29, 2013Infographic March 2017 Back Download Infographic Annual Revenues, Profits of Women-Owned Businesses Leaped in 2016, According to Biz2Credit Study Study of 2

July 06, 2017Infographic February 2014 Back Download Infographic Biz2Credit Analysis of Women-Owned Companies Finds Earnings, Credit Scores, and Small Business Loan .nrm

June 07, 2017Infographic February 2018 Back Download Infographic .nrmlHdr .navBar > ul > li.drop > a { background: url(../../../images/html5/drpDownArw.svg) no-repea

June 07, 2017Infographic May 2014 Back Download Infographic .nrmlHdr .navBar > ul > li.drop > a { background: url(../../../images/html5/drpDownArw.svg) no-repeat

April 10, 2015Infographic April 2017 Back Download Infographic .nrmlHdr .navBar > ul > li.drop > a { background: url(../../../images/html5/drpDownArw.svg) no-repe

July 06, 2017Infographic May 2015 Back Download Infographic .nrmlHdr .navBar > ul > li.drop > a { background: url(../../../images/html5/drpDownArw.svg) no-repeat

June 07, 2017Infographic September 2015 Back Download Infographic .nrmlHdr .navBar > ul > li.drop > a { background: url(../../../images/html5/drpDownArw.svg) no-

June 07, 2017A new study of Hispanic-owned businesses found that the number of loan applications.

March 04, 2019Infographic JULY 2018 Back Download Infographic .RespImage { max-width: 100%; height: auto; margin-left: -10px; width: 100%; } @media scr

July 10, 2018Infographic April 2016 Back Download Infographic .nrmlHdr .navBar > ul > li.drop > a { background: url(../../../images/html5/drpDownArw.svg) no-

April 14, 2016Infographic May 2016 Back Download Infographic .nrmlHdr .navBar > ul > li.drop > a { background: url(../../../images/html5/drpDownArw.svg) no-re

April 25, 2016Infographic October 2014 Back Download Infographic .nrmlHdr .navBar > ul > li.drop > a { background: url(../../../images/html5/drpDownArw.svg) no-

October 27, 2014Infographic APRIL 2018 Back Download Infographic 2018-best-small-business-cities-in-america-infographic .nrmlHdr .navBar > ul > li.drop > a { backgrou

April 24, 2018Infographic June 2017 Back Download Infographic .nrmlHdr .navBar > ul > li.drop > a { background: url(../../../images/html5/drpDownArw.svg) no-repea

June 07, 2017Infographic July, 2017 Back Download Infographic

July 06, 2017Infographic February 2016 Back Download Infographic .nrmlHdr .navBar > ul > li.drop > a { background: url(../../../images/html5/drpDownArw.svg)

February 18, 2016Infographic February 2015 Back Download Infographic .nrmlHdr .navBar > ul > li.drop > a { background: url(../../../images/html5/drpDownArw.svg) no-r

March 10, 2015Infographic May 2015 Back Download Infographic .nrmlHdr .navBar > ul > li.drop > a { background: url(../../../images/html5/drpDownArw.svg) no-repeat

April 10, 2015Infographic May 2015 Back Download Infographic .nrmlHdr .navBar > ul > li.drop > a { background: url(../../../images/html5/drpDownArw.svg) no-repeat

April 10, 2015Infographic May 2014 Back Download Infographic .nrmlHdr .navBar > ul > li.drop > a { background: url(../../../images/html5/drpDownArw.svg) no-repeat

May 12, 2014Infographic May 2014 Back Download Infographic .nrmlHdr .navBar > ul > li.drop > a { background: url(../../../images/html5/drpDownArw.svg) no-repeat

May 12, 2014COVID-19 Resource Hub Careers Biz2X

August 20, 2014Infographic September 2014 Back Download Infographic .nrmlHdr .navBar > ul > li.drop > a { background: url(../../../images/html5/drpDownArw.svg) n

September 15, 2014Infographic October 2017 Back Download Infographic .nrmlHdr .navBar > ul > li.drop > a { background: url(../../../images/html5/drpDownArw.svg) no-re

October 25, 2017